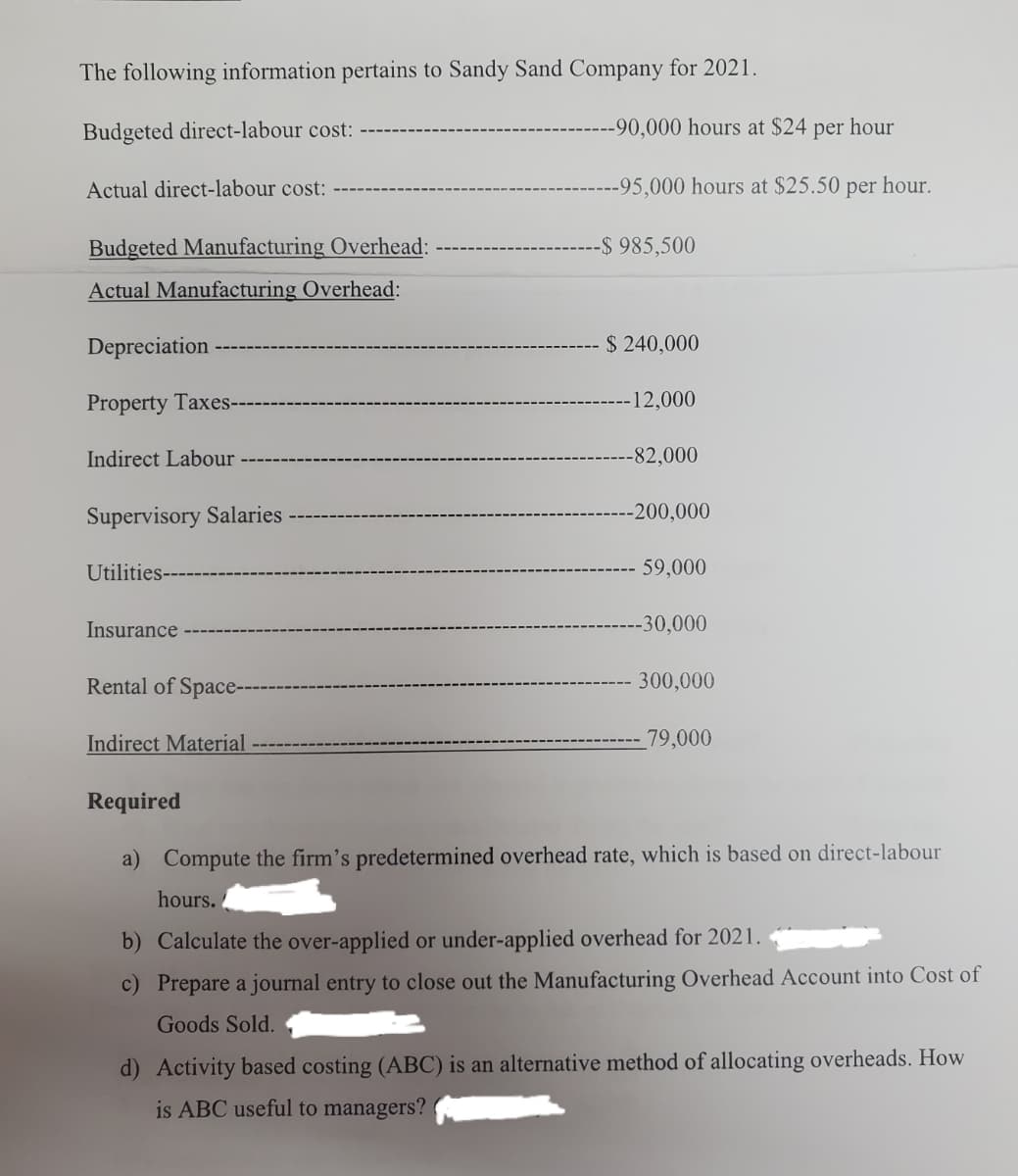

The following information pertains to Sandy Sand Company for 2021. Budgeted direct-labour cost: -90,000 hours at $24 per hour Actual direct-labour cost: -95,000 hours at $25.50 per hour. Budgeted Manufacturing Overhead: -$ 985,500 Actual Manufacturing Overhead: Depreciation $ 240,000 Property Taxes-- 12,000 Indirect Labour -82,000 Supervisory Salaries -200,000 Utilities---- 59,000 Insurance -30,000 Rental of Space- 300,000 Indirect Material 79,000 Required a) Compute the firm's predetermined overhead rate, which is based on direct-labour hours. b) Calculate the over-applied or under-applied overhead for 2021. c) Prepare a journal entry to close out the Manufacturing Overhead Account into Cost of Goods Sold. d) Activity based costing (ABC) is an alternative method of allocating overheads. How is ABC useful to managers?

The following information pertains to Sandy Sand Company for 2021. Budgeted direct-labour cost: -90,000 hours at $24 per hour Actual direct-labour cost: -95,000 hours at $25.50 per hour. Budgeted Manufacturing Overhead: -$ 985,500 Actual Manufacturing Overhead: Depreciation $ 240,000 Property Taxes-- 12,000 Indirect Labour -82,000 Supervisory Salaries -200,000 Utilities---- 59,000 Insurance -30,000 Rental of Space- 300,000 Indirect Material 79,000 Required a) Compute the firm's predetermined overhead rate, which is based on direct-labour hours. b) Calculate the over-applied or under-applied overhead for 2021. c) Prepare a journal entry to close out the Manufacturing Overhead Account into Cost of Goods Sold. d) Activity based costing (ABC) is an alternative method of allocating overheads. How is ABC useful to managers?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 22E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

Transcribed Image Text:The following information pertains to Sandy Sand Company for 2021.

Budgeted direct-labour cost:

-90,000 hours at $24 per hour

Actual direct-labour cost:

-95,000 hours at $25.50 per hour.

Budgeted Manufacturing Overhead:

-$ 985,500

Actual Manufacturing Overhead:

Depreciation

$ 240,000

Property Taxes--

-12,000

Indirect Labour

-82,000

Supervisory Salaries

-200,000

Utilities----

59,000

Insurance

-30,000

Rental of Space-

300,000

Indirect Material

79,000

Required

a) Compute the firm's predetermined overhead rate, which is based on direct-labour

hours.

b) Calculate the over-applied or under-applied overhead for 2021.

c) Prepare a journal entry to close out the Manufacturing Overhead Account into Cost of

Goods Sold.

d) Activity based costing (ABC) is an alternative method of allocating overheads. How

is ABC useful to managers?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning