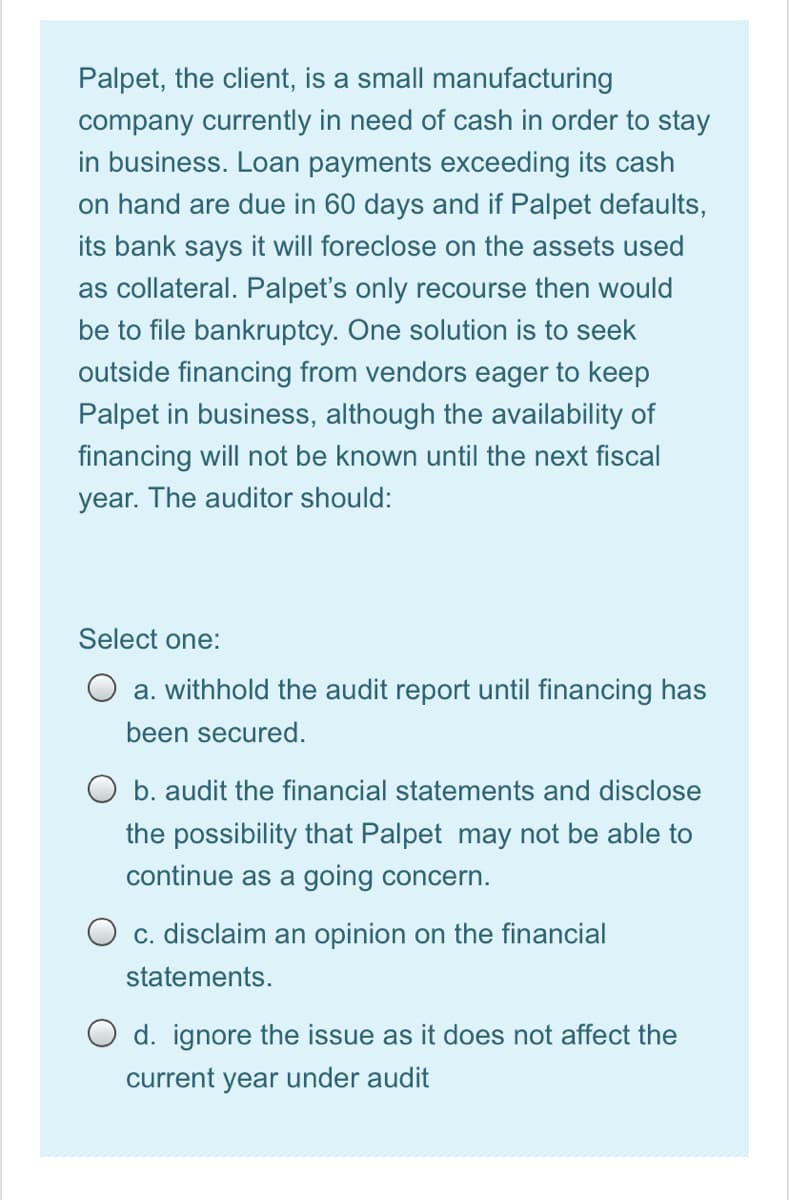

Palpet, the client, is a small manufacturing company currently in need of cash in order to stay in business. Loan payments exceeding its cash on hand are due in 60 days and if Palpet defaults, its bank says it will foreclose on the assets used as collateral. Palpet's only recourse then would be to file bankruptcy. One solution is to seek outside financing from vendors eager to keep Palpet in business, although the availability of financing will not be known until the next fiscal year. The auditor should: Select one: O a. withhold the audit report until financing has been secured. O b. audit the financial statements and disclose the possibility that Palpet may not be able to continue as a going concern. O c. disclaim an opinion on the financial statements. O d. ignore the issue as it does not affect the current year under audit

Palpet, the client, is a small manufacturing company currently in need of cash in order to stay in business. Loan payments exceeding its cash on hand are due in 60 days and if Palpet defaults, its bank says it will foreclose on the assets used as collateral. Palpet's only recourse then would be to file bankruptcy. One solution is to seek outside financing from vendors eager to keep Palpet in business, although the availability of financing will not be known until the next fiscal year. The auditor should: Select one: O a. withhold the audit report until financing has been secured. O b. audit the financial statements and disclose the possibility that Palpet may not be able to continue as a going concern. O c. disclaim an opinion on the financial statements. O d. ignore the issue as it does not affect the current year under audit

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 16P

Related questions

Question

.

Transcribed Image Text:Palpet, the client, is a small manufacturing

company currently in need of cash in order to stay

in business. Loan payments exceeding its cash

on hand are due in 60 days and if Palpet defaults,

its bank says it will foreclose on the assets used

as collateral. Palpet's only recourse then would

be to file bankruptcy. One solution is to seek

outside financing from vendors eager to keep

Palpet in business, although the availability of

financing will not be known until the next fiscal

year. The auditor should:

Select one:

O a. withhold the audit report until financing has

been secured.

O b. audit the financial statements and disclose

the possibility that Palpet may not be able to

continue as a going concern.

O c. disclaim an opinion on the financial

statements.

O d. ignore the issue as it does not affect the

current year under audit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning