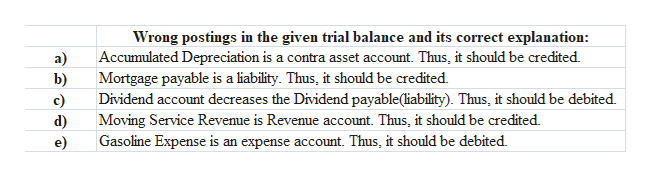

Parrish 4-1 Pg. 95 Correcting Trial Balance George has prepared the following trial balance for Now What Coporation. Unfortunately, George has a problem because the debits and credits are not equal. Identify the problems and calculate the correct trial balance totals. Cash $470550 DR Accounts Receivable $41800 DR Land $170000 DR Building $360000 DR Trucks $232000 DR Accumulated Depreciation $100000 DR Accounts Payable $50750 CR Dividends Payable $8000 CR Mortgage Payable $298000 DR Common Stock $800000 CR Dividends $8000 CR Moving Service Revenue $78000 DR Salaries Expense $30650 DR Gasoline Expense $17500 CR Repairs Expense $1250 DR Interest Expense $3000 DR totals $1785250 CR totals $884250

Parrish 4-1 Pg. 95 Correcting Trial Balance George has prepared the following trial balance for Now What Coporation. Unfortunately, George has a problem because the debits and credits are not equal. Identify the problems and calculate the correct trial balance totals. Cash $470550 DR Accounts Receivable $41800 DR Land $170000 DR Building $360000 DR Trucks $232000 DR Accumulated Depreciation $100000 DR Accounts Payable $50750 CR Dividends Payable $8000 CR Mortgage Payable $298000 DR Common Stock $800000 CR Dividends $8000 CR Moving Service Revenue $78000 DR Salaries Expense $30650 DR Gasoline Expense $17500 CR Repairs Expense $1250 DR Interest Expense $3000 DR totals $1785250 CR totals $884250

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 8TP: Analyze Trusty Companys trial balance and the additional information provided to determine the...

Related questions

Question

Parrish 4-1 Pg. 95 Correcting

George has prepared the following trial balance for Now What Coporation. Unfortunately, George has a problem because the debits and credits are not equal. Identify the problems and calculate the correct trial balance totals.

Cash $470550 DR

Accounts Receivable $41800 DR

Land $170000 DR

Building $360000 DR

Trucks $232000 DR

Accounts Payable $50750 CR

Dividends Payable $8000 CR

Mortgage Payable $298000 DR

Common Stock $800000 CR

Dividends $8000 CR

Moving Service Revenue $78000 DR

Salaries Expense $30650 DR

Gasoline Expense $17500 CR

Repairs Expense $1250 DR

Interest Expense $3000

DR totals $1785250 CR totals $884250

Expert Solution

Step 1

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,