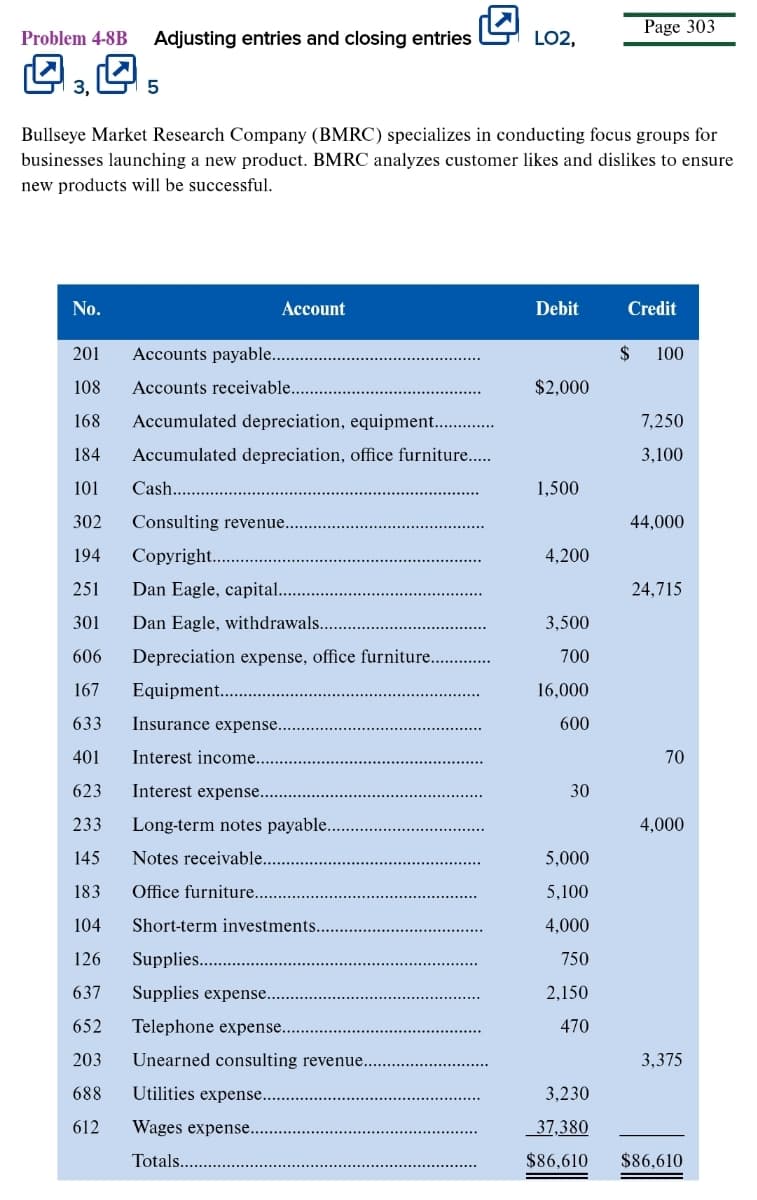

Page 303 Problem 4-8B Adjusting entries and closing entries LO2, 5 Bullseye Market Research Company (BMRC) specializes in conducting focus groups for businesses launching a new product. BMRC analyzes customer likes and dislikes to ensure new products will be successful. No. Account Debit Credit 201 Accounts payable. 2$ 100 108 Accounts receivable.. $2,000 168 Accumulated depreciation, equipment... 7,250 184 Accumulated depreciation, office furniture.. 3,100 101 Cash... 1,500 302 Consulting revenue. 44,000 194 Copyright.. 4,200 251 Dan Eagle, capital.. 24,715 301 Dan Eagle, withdrawals.. 3,500 606 Depreciation expense, office furniture.. 700 167 Equipment... 16,000 633 Insurance expense.. 600 401 Interest income. 70 623 Interest expense. 30 233 Long-term notes payable. 4,000 145 Notes receivable. 5,000 183 Office furniture... 5,100 104 Short-term investments.. 4,000 126 Supplies. 750 637 Supplies expense.. 2,150 652 Telephone expense.. 470 203 Unearned consulting revenue. 3,375 688 Utilities expense. 3,230 612 Wages expense.. 37,380 Totals... $86,610 $86,610

Page 303 Problem 4-8B Adjusting entries and closing entries LO2, 5 Bullseye Market Research Company (BMRC) specializes in conducting focus groups for businesses launching a new product. BMRC analyzes customer likes and dislikes to ensure new products will be successful. No. Account Debit Credit 201 Accounts payable. 2$ 100 108 Accounts receivable.. $2,000 168 Accumulated depreciation, equipment... 7,250 184 Accumulated depreciation, office furniture.. 3,100 101 Cash... 1,500 302 Consulting revenue. 44,000 194 Copyright.. 4,200 251 Dan Eagle, capital.. 24,715 301 Dan Eagle, withdrawals.. 3,500 606 Depreciation expense, office furniture.. 700 167 Equipment... 16,000 633 Insurance expense.. 600 401 Interest income. 70 623 Interest expense. 30 233 Long-term notes payable. 4,000 145 Notes receivable. 5,000 183 Office furniture... 5,100 104 Short-term investments.. 4,000 126 Supplies. 750 637 Supplies expense.. 2,150 652 Telephone expense.. 470 203 Unearned consulting revenue. 3,375 688 Utilities expense. 3,230 612 Wages expense.. 37,380 Totals... $86,610 $86,610

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 68.3C

Related questions

Question

Answer 4-8B and 4-9B

Transcribed Image Text:Page 303

Problem 4-8B

Adjusting entries and closing entries

LO2,

3, L

5

Bullseye Market Research Company (BMRC) specializes in conducting focus groups for

businesses launching a new product. BMRC analyzes customer likes and dislikes to ensure

new products will be successful.

No.

Аccount

Debit

Credit

201

Accounts payable..

$

100

108

Accounts receivable...

$2,000

168

Accumulated depreciation, equipment...

7,250

184

Accumulated depreciation, office furniture...

3,100

101

Cash....

1,500

302

Consulting revenue.

44,000

194

Copyright..

4,200

251

Dan Eagle, capital..

24,715

301

Dan Eagle, withdrawals..

3,500

606

Depreciation expense, office furniture....

700

167

Equipment..

16,000

633

Insurance expense..

600

401

Interest income...

70

623

Interest expense..

30

233

Long-term notes payable..

4,000

145

Notes receivable..

5,000

183

Office furniture....

5,100

104

Short-term investments...

4,000

126

Supplies..

750

637

Supplies expense...

2,150

652

Telephone expense...

470

203

Unearned consulting revenue.

3,375

688

Utilities expense..

3,230

612

Wages expense...

37,380

Totals...

$86,610

$86,610

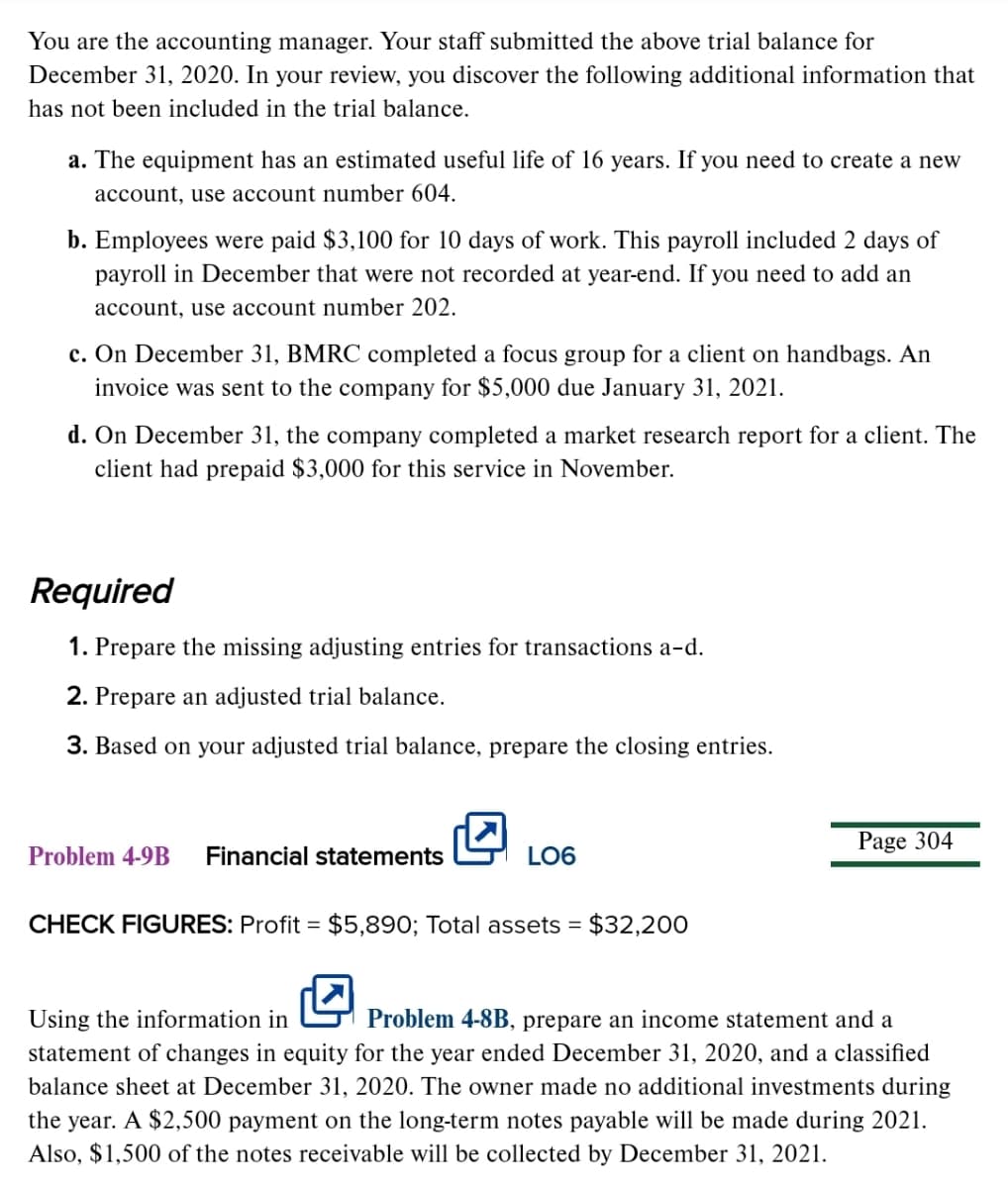

Transcribed Image Text:You are the accounting manager. Your staff submitted the above trial balance for

December 31, 2020. In your review, you discover the following additional information that

has not been included in the trial balance.

a. The equipment has an estimated useful life of 16 years. If you need to create a new

account, use account number 604.

b. Employees were paid $3,100 for 10 days of work. This payroll included 2 days of

payroll in December that were not recorded at year-end. If you need to add an

account, use account number 202.

c. On December 31, BMRC completed a focus group for a client on handbags. An

invoice was sent to the company for $5,000 due January 31, 2021.

d. On December 31, the company completed a market research report for a client. The

client had prepaid $3,000 for this service in November.

Required

1. Prepare the missing adjusting entries for transactions a-d.

2. Prepare an adjusted trial balance.

3. Based on your adjusted trial balance, prepare the closing entries.

Page 304

Problem 4-9B

Financial statements

LO6

CHECK FIGURES: Profit = $5,890; Total assets = $32,20O

Using the information in

Problem 4-8B, prepare an income statement and a

statement of changes in equity for the year ended December 31, 2020, and a classified

balance sheet at December 31, 2020. The owner made no additional investments during

the year. A $2,500 payment on the long-term notes payable will be made during 2021.

Also, $1,500 of the notes receivable will be collected by December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning