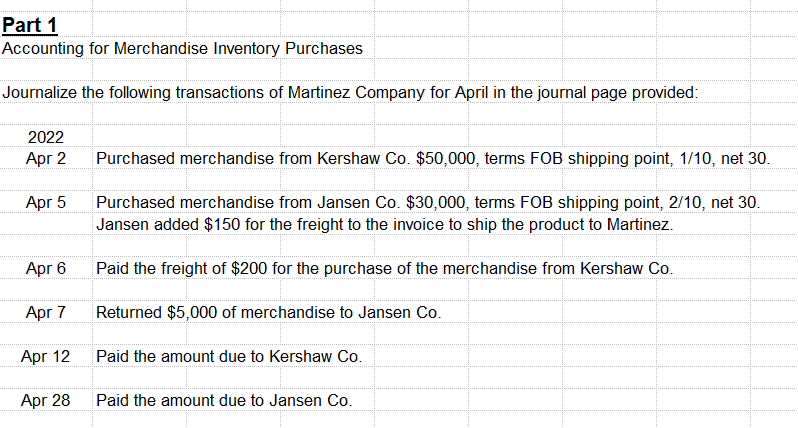

Part 1 Accounting for Merchandise Inventory Purchases ournalize the following transactions of Martinez Company for April in the journal page provided: 2022 Apr 2 Apr 5 Apr 6 Apr 7 Apr 12 Apr 28 Purchased merchandise from Kershaw Co. $50,000, terms FOB shipping point, 1/10, net 30. Purchased merchandise from Jansen Co. $30,000, terms FOB shipping point, 2/10, net 30. Jansen added $150 for the freight to the invoice to ship the product to Martinez. Paid the freight of $200 for the purchase of the merchandise from Kershaw Co. Returned $5,000 of merchandise to Jansen Co. Paid the amount due to Kershaw Co. Paid the amount due to Jansen Co.

Part 1 Accounting for Merchandise Inventory Purchases ournalize the following transactions of Martinez Company for April in the journal page provided: 2022 Apr 2 Apr 5 Apr 6 Apr 7 Apr 12 Apr 28 Purchased merchandise from Kershaw Co. $50,000, terms FOB shipping point, 1/10, net 30. Purchased merchandise from Jansen Co. $30,000, terms FOB shipping point, 2/10, net 30. Jansen added $150 for the freight to the invoice to ship the product to Martinez. Paid the freight of $200 for the purchase of the merchandise from Kershaw Co. Returned $5,000 of merchandise to Jansen Co. Paid the amount due to Kershaw Co. Paid the amount due to Jansen Co.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.1APR: Purchase-related transactions using perpetual inventory system The following selected transactions...

Related questions

Topic Video

Question

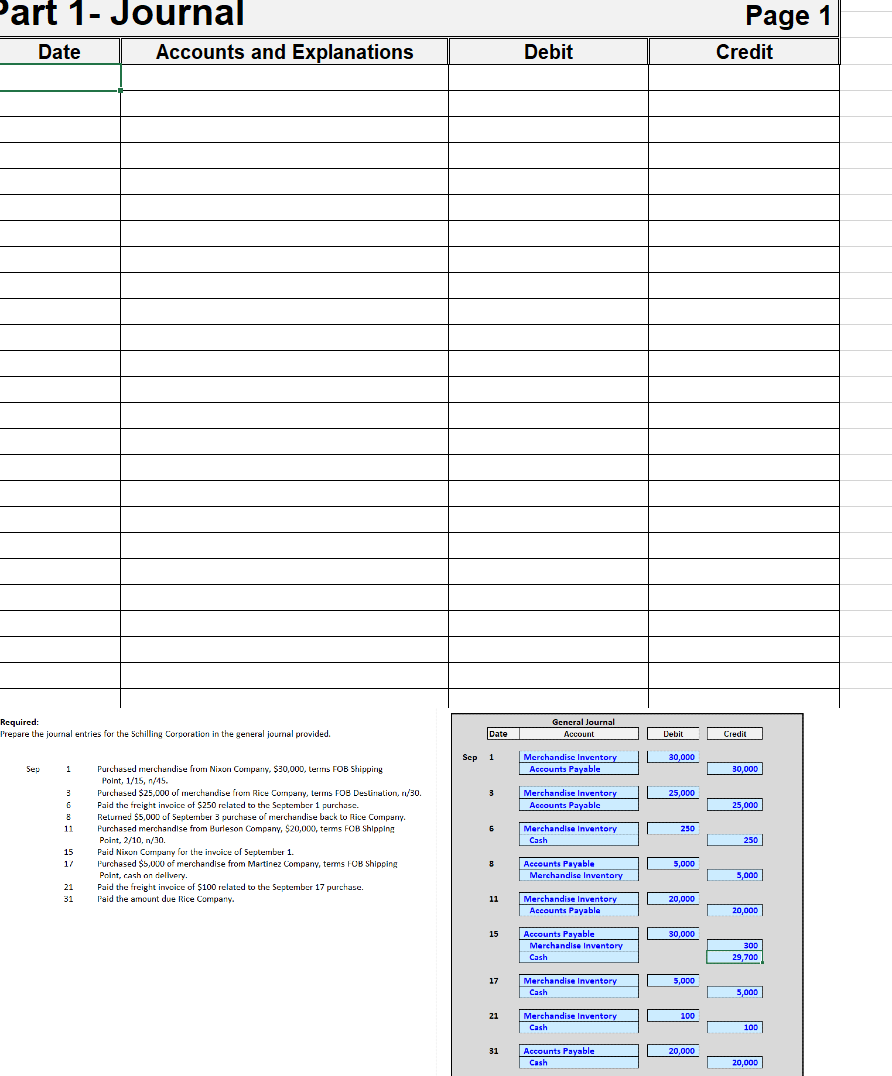

Accounting below given image is only example

Solve using the same format as the provided journal below. I will also post an example of this type of problem done previously.

Transcribed Image Text:Part 1

Accounting for Merchandise Inventory Purchases

Journalize the following transactions of Martinez Company for April in the journal page provided:

2022

Apr 2

Apr 5

Apr 6

Apr 7

Apr 12

Apr 28

Purchased merchandise from Kershaw Co. $50,000, terms FOB shipping point, 1/10, net 30.

Purchased merchandise from Jansen Co. $30,000, terms FOB shipping point, 2/10, net 30.

Jansen added $150 for the freight to the invoice to ship the product to Martinez.

Paid the freight of $200 for the purchase of the merchandise from Kershaw Co.

Returned $5,000 of merchandise to Jansen Co.

Paid the amount due to Kershaw Co.

Paid the amount due to Jansen Co.

Transcribed Image Text:Part 1- Journal

Date

Required:

Prepare the journal entries for the Schilling Corporation in the general journal provided.

Sep

1

3

6

11

15

1/

Accounts and Explanations

21

31

Purchased merchandise from Nixon Company, $30,000, terms FOB Shipping

Point, 1/15, n/45.

Purchased $25,000 of merchandise from Rice Company, terms FOB Destination, n/30.

Paid the freight invoice of $250 related to the September 1 purchase.

Returned $5,000 of September 3 purchase of merchandise back to Rice Company.

Purchased merchandise from Burleson Company, $20,000, terms FOB Shipping

Point, 2/10, n/30.

Paid Nixon Company for the invoice of September 1.

Purchased $5,000 of merchandise from Martinez Company, terms FOB Shipping

Point, cash on delivery.

Paid the freight invoice of $100 related to the September 17 purchase.

Paid the amount due Rice Company.

Sep

Date

1

3

6

8

11

15

17

21

31

Debit

General Journal

Account

Merchandise Inventory

Accounts Payable

Merchandise Inventory

Accounts Payable

Merchandise Inventory

Cash

Accounts Payable

Merchandise Inventory

Merchandise Inventory

Accounts Payable

Accounts Payable

Merchandise Inventory

Cash

Merchandise Inventory

Cash

Merchandise Inventory

Cash

Accounts Payable

Cash

Debit

30,000

25,000

250

5,000

20,000

30,000

5,000

100

20,000

Page 1

Credit

Credit

30,000

25,000

250

5,000

20,000

300

29,700

5,000

100

20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning