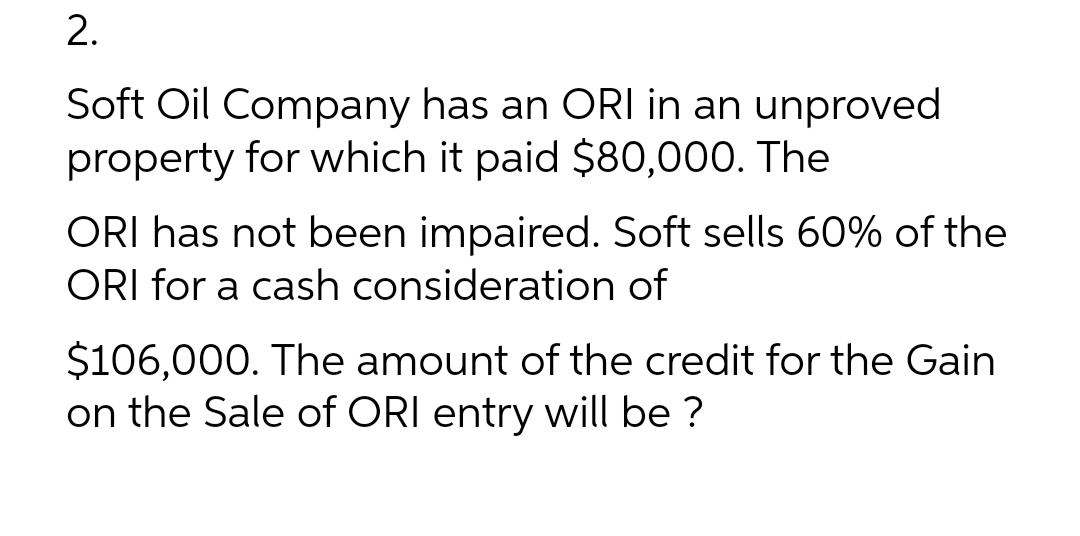

2. Soft Oil Company has an ORI in an unproved property for which it paid $80,000. The ORI has not been impaired. Soft sells 60% of the ORI for a cash consideration of $106,000. The amount of the credit for the Gain on the sale of ORI entry will be ?

Q: Lucas is a shareholder of Gospel Corporation with 10,000 ordinary shares held purchased in 2021 at…

A: Board Member: A board member is a person who sits on the board of directors of a firm, which acts as…

Q: Assume the following information (the quantity of materials purchased = the quantity used):…

A: Variances are difference between actual cost and standard cost. If actual cost is higher than…

Q: Relevant costs for decision making Cipla Uganda pharmaceutical company, buys a chemical for…

A: The company makes multiple products that can be further processed and sold, generally, the company’s…

Q: Assume a company’s direct labor budget for July estimates 10,000 labor-hours to meet the month’s…

A: Manufacturing overheads means all type of indirect costs and expenses which are incurred for…

Q: Compute for the benefit ratio of the following projects. Project cost Gross income Operating cost…

A: Introduction: The benefit-cost ratio (BCR) is a financial or qualitative indicator that depicts the…

Q: The following additional information for Mr KYM was available: Stock at 30 June 2007 was valued Rs…

A: Trading and Profit and Loss account shows all type of incomes and expenses in the business and at…

Q: The following information for the advertising expense account was provided by Steady Stationery Shop…

A: The journal entries are prepared to record the day-to-day transactions on the regular basis. The…

Q: Sandpiper Corporation paid P120,000 for annual property taxes on January 15, 2006, and P20,000 for…

A: Capital expenditure is the expenses incurred for getting benefits from them for a long span of time.…

Q: P11.49A (LO 4. 5) Return on investment is often expressed as follows: ROI Controllable margin…

A: ROI :— Profit Margin * Assets Turnover Return on investment or return on costs is a ratio between…

Q: Revenu Quebec can impose a penalty of up to $30,000 on any employer who fails to file their…

A: A remittance slip refers to the slip that shows the salary paid to the employees by the employer. As…

Q: A Company purchased a piece of machinery for $60,000 on January 1, 2019 and has been depreciating…

A: Lets understand the basics. Change in depreciation method is known as a change in accounting policy.…

Q: Sept. Dec. 30 31 31 9.2%. Received interest on the Trust bond. Received interest on the Hanna and…

A: Bonds are a financing tool. This is a loan. Company issue bonds to get money and people invest money…

Q: thilaire Corporation is working on its direct labor budget for the next two months. Each unit of…

A: Answer : Total Direct Labor Cost = Direct Labor cost per hour * Total direct labor hours paid

Q: The Kirkland Department of Culver Company began the month of December with work in process inventory…

A: It is assumed that weighted average method is used to calculate equivalent unit production. Under…

Q: Assume the following: The actual price per pound is $2.25. The standard quantity of pounds allowed…

A: The variance is the difference between the actual data and standard output of the production.…

Q: Direct Labor Costs During May, Darling Company accumulated 530 hours of direct labor costs on Job…

A: Direct Labour Costs :— It is the total cost incurred by company for wages of employees which is…

Q: What professional conduct is outlined by the American Institute of Certified Public Accountants…

A: The American Institute of Certified Public Accounts (AICPA) The American Institute of Certified…

Q: Kurama Company incurred P2,350,000 of overhead costs during 2019. However, only P1,950,000 was…

A: Adjusted Cost of goods sold :— It is the cost of goods sold plus under applied overhead minus…

Q: For the current year ending April 30, MJW Company expects fixed costs of $87,500; a unit variable…

A: Break Even Point - Break Even point is the point where the company recovered its cost. It is the not…

Q: Mr. Lopez opened a mini grocery store with business name Lopez Fiesta Mart. Operations began on…

A: JOURNAL ENTRY :— journal entry is the process of Recording financial transactions. A journal entry…

Q: With respect to qualified retirement plans, nondiscrimination rules prohibit employers from giving…

A: Non discriminatory rules prohibit a Company to give preferential treatment to some of its key…

Q: Low Heel Trading's financial year ends on 30 June. The owner of the business, Nancy, provided the…

A: The journal entries are prepared to record the day-to-day transactions of the business on regular…

Q: ACCOUNT Date Description 4 7 8 12 15 19 Initial Investment Purchase of Service Vehicle Payment of…

A: Statement of cash flows is the important part of financial statements which shows the movement of…

Q: Golden Corporation contemplates to market a new product. Estimated fixed costs is P1,000,000. The…

A: Introduction: A fixed cost is something that does not change with the amount of goods or services…

Q: Current Attempt in Progress Carla Vista, Inc. leased equipment from Tower Company under a 4-year…

A:

Q: The following petty cash transactions were made by the Freeman Corporation during the month…

A: Introduction: A transaction is any financial business event that affects the financial statements of…

Q: Beginning Work in Process: Ending Work in Process: Beginning Finished Goods Inventory: Ending…

A: Cost of goods manufactured: Cost of goods manufactured means total manufacturing costs; including…

Q: Assets Cash Accounts receivable Inventory Prepaid expenses FV-OCI investments MARTINEZ INC.…

A: Cash flow statement is a financial statement which is prepared by the entity for checking the cash…

Q: Question 1) At the start of its 2021 fiscal year (January 1, 2021), Liberia Incorporated noted that…

A: Basic EPS=Net income-Preferred dividendsWeighted average number of common shares Dividend payout…

Q: on ance P2-6C. Cookie Mejias, owner of Mejias Company, would like to know how each of the following…

A:

Q: Luther Corporation Consolidated Income Statement Year ended December 31 (in $ millions) 2012 610.1…

A: Price — Earning Ratio (P/E) :— It is the ratio of market price per share and earnings per share.…

Q: estion 5 Abba, Inc is considering the purchase of some new equipment that costs $240700. The new…

A: Cash inflows means the amount of cash received by an entity during a period. It includes only cash…

Q: A company wants to pay a bonus to an employee so that the net pay is $10,000. The federal income tax…

A: Federal income tax, State income tax and FICA tax are to be deducted from the bonus paid. We…

Q: Required: 1. Identify reasons for entries (a) through (d). 2. Assume that the underapplied or…

A: 1) Identify reasons a Actual manufacturing overhead for the year b Applied manufacturing…

Q: 1. 2. 3. 4. 5. 6. 7. Swifty's cash register showed the following totals at the end of the day on…

A: Given that, Total pre tax sales = $56,000 GST = $2,800 PST = $3,920 Sales tax remitted to…

Q: Lockrite Security Company manufacturers home alarms. Currently, it is manufacturing one of its…

A: calculation of above requirement weather company should make or buy are as follows

Q: Question 3 of 10 Consider the following income statement data for Oriole Inc.: Sales revenue Less:…

A: Common size analysis is one of the financial statement analysis in which each item is shown as…

Q: Original payment of $3057 due today is settled by two equal payments due in 2 and 8 months. Assuming…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: 1 million bond issue is outstanding. assume deposits earn 8 percent per annum. calculate the amount…

A: Given in the question: Amount 1000000 Interest Rate 8% Time (in Years) 20…

Q: a. Discuss the various operational budgets prepared for: (i) a service organisation (ii) a trading…

A: Before going for the various operational budget we need to understand the meaning of Operational…

Q: True or False 7. Corporations that avail of OSD are allowed to deduct the cost of sales or cost of…

A: Introduction: Rather than tracking all expenses to determine net income. Taxpayers can directly…

Q: iven below to answer the following questions: Prepare the Cash Budget for January, February and…

A: A cash budget refers to the form of the budget which reflects the sum value of expected cash inflows…

Q: True or False Prior years' financial statements are not restated when the prospective approach is…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Nash SA uses a calendar year for financial reporting. The company is authorized to Issue 8,850,000…

A: calculation of weighted average ordinary share used in computing earnings per share for 2022 on the…

Q: What is the recorded cost of the patent? Total Capitalized cost=

A: As per IAS 16 any cost directly associated with the product to bring to its intended use and desired…

Q: Beginning inventory, purchases, and sales for Item XJ-56 are as follows: May 1 Beginning…

A: Introduction: Ending inventory is the worth of products still available for purchase and held by a…

Q: Give the statement of cash flows

A: Cash Flow Statement is a part of Financial Statement in which all Cash Inflows and Outflows made by…

Q: In January of 1980 DTM purchased a building for $15,000,000 and at that time estimated that the…

A: According to the given question, we are required to prepare the expenditure-related journal entries…

Q: Pastner Brands is a calendar-year firm with operations in several countries. As part of its…

A: Compensation Cost :— It is the multiplication of number of share vested and fair value per option.…

Q: . Prepare a schedule of cost of goods manufactured. b. Was the overhead underapplied or…

A:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Southwestern Wear Inc. has the following balance sheet: The trustees costs total 281,250, and the firm has no accrued taxes or wages. The debentures are subordinated only to the notes payable. If the firm goes bankrupt and liquidates, how much will each class of investors receive if a total of 2.5 million is received from sale of the assets?Garcia Co. owns equipment that costs $150,000, with accumulated depreciation of $65,000. Garcia sells the equipment for cash. Record the journal entry for the sale of the equipment if Garcia were to sell the equipment for the following amounts: A. $90,000 cash B. $85,000 cash C. $80,000 cashSurfin Corporation sold product "S" to Red Corporation for P1,000,000 plus 12% VAT. Subsequently, Red Corporation sold the product to Lights Corporation for P1,344,000 (VAT-inclusive). How much is the VAT payable of Red Corporation?

- Eleven years ago, Lynn, Incorporated purchased a warehouse for $315,000. This year,the corporation sold the warehouse to Firm D for $80,000 cash and D’s assumption ofa $225,000 mortgage. Through date of sale, Lynn deducted $92,300 straight-linedepreciation on the warehouse.Requiredc. How would your answers change if Lynn was a noncorporate business?Kwell Co. owes Kuto Bank P4,000,000 plus accrued interest of P360,000. The unamortized discounton the loan is P80,000. The debt is a 10-year, 12% loan. During 20x1, Kwell’s business deteriorateddue to loss of demand for its services. On December 31, 20x1, Kuto Bank agrees to accept oldequipment and cancel the entire debt. The equipment has a cost of P12,000,000, accumulateddepreciation of P8,800,000 and fair value of P3,600,000. How much is the gain (loss) on theextinguishment of the debt?Eleven years ago, Lynn, Incorporated purchased a warehouse for $315,000. This year,the corporation sold the warehouse to Firm D for $80,000 cash and D’s assumption ofa $225,000 mortgage. Through date of sale, Lynn deducted $92,300 straight-linedepreciation on the warehouse.Required:b. What is the character of this gain?c. How would your answers change if Lynn was a noncorporate business?

- ABC Company sells to XYZ, 5 used factory equipment, each of which was acquired at P20,000, 3 years ago. The carrying value of each equipment is P5,000. The selling price of each equipment is P3,000. Upon executing the sale, ABC received P5,000 down payment and a 10% 1 year promissory note for the balance. Compute the amount of loss ABC has suffered from the sale of the equipment.In return for equipment with a fair worth of 150,000, Travis Co. chose to form a corporation and issue 5000 shares of ordinary stocks with a par value of P20 that trade at P25 on the stock market. Similar equipment was purchased by Travis Co. for $60,000 and is used similarly. The equipment has no salvage value and is depreciated over a 5-year period using the straight-line approach. How much does the first year's depreciation cost?1. On December 31, 2018, the company posted an eding capital of 30 million. the following yer, the copany realized a net income after tax of 70 milion, but the owner withdrew 20 million frm the capital for persnal investments. by the end of 2019, how much is the ending capital of the company? 2. The following information can be found in Sanduc Merchandising Corporation's financial statement in 2019: cost of sales of 2,450,000; accumulated depreciation of 75,000; operating expenses of 1,050,000; corporate income tax of 32% sales of 4,800,000; 3-year bank loan of 1,000,000 that pays an interest rate of 8.5 per year. determine the net profit before tax of Sanduco

- The fair value of Wallis, Inc.’s depreciable assets exceeds their book value by $50 million. The assets have an average remaining useful life of 15 years and are being depreciated by the straight-line method. Park Industries buys 30% of Wallis’s common shares. When Park adjusts its investment revenue and the investment by the equity method, how will the situation described affect those two accounts?BBB,Inc sells its unprofitable division A at a gain of $20,000. Before the sale, division A had a net loss of $50,000 for the period. Which of the following is true? The$20,000. Before the sale, Division U had a net loss of $50,000 for the period. Which of the following is true O The $20,000 gain on sale will be disclosed in the notes to the financial statements only, with the 550 operations. The $50,000 net loss will be a part of continuing operations and the $20,000 gain on sale will be a part of discontinued operations. The $20,000 gain on sale will be a part of continuing operations and the $50,000 net loss wil be a part of discontinued operations. Both the net loss of $50,000 as well as the gain on sale of $20,000 will be included as a part of discontinued operations.EEE has been very successful in operating his business for the last five years. His financial statements showed total assets of P380,000 and liabilities of P50,000. He invited FFF to join him by investing an amount enough to give him a 30% interest in the firm. Profit and loss agreement provides 80:20 to EEE and FFF, respectively. Before the formation, the parties agreed to make the following adjustments in the books of EEE:· Allowance for doubtful accounts amounting to P10,000 be established.· The merchandise should be adjusted to include goods out on consignment amounting to P25,000.· Accrued utilities of P2,500 be recognized.How much is the amount to be invested by FFF?