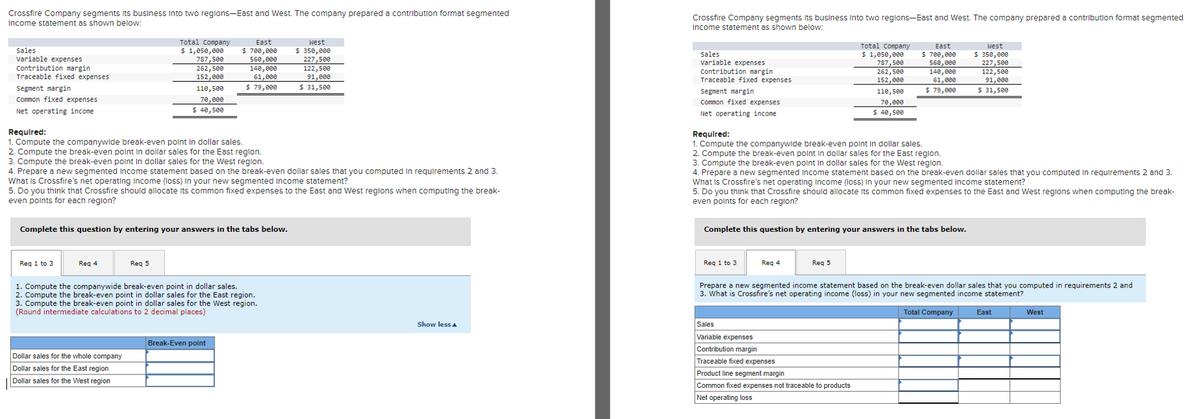

Crossfire Company segments its business into two regions-East and West. The company prepared a contribution format segmented Income statement as shown below: Sales variable expenses contribution margin Traceable fixed expenses Segment margin Common fixed expenses Net operating income Req 1 to 3 Total Company $ 1,050,000 787,500 262,500 152,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. Req 4 110,500 70,000 $ 40,500 4. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. What is Crossfire's net operating income (loss) in your new segmented income statement? 5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break- even points for each region? Complete this question by entering your answers in the tabs below. Req 5 Dollar sales for the whole company Dollar sales for the East region Dollar sales for the West region East $ 700,000 560,000 140,000 61,000 $ 79,000 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. (Round intermediate calculations to 2 decimal places) Break-Even point West $ 350,000 227,500 122,500 91,000 $ 31,500 Show less A

Crossfire Company segments its business into two regions-East and West. The company prepared a contribution format segmented Income statement as shown below: Sales variable expenses contribution margin Traceable fixed expenses Segment margin Common fixed expenses Net operating income Req 1 to 3 Total Company $ 1,050,000 787,500 262,500 152,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. Req 4 110,500 70,000 $ 40,500 4. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. What is Crossfire's net operating income (loss) in your new segmented income statement? 5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break- even points for each region? Complete this question by entering your answers in the tabs below. Req 5 Dollar sales for the whole company Dollar sales for the East region Dollar sales for the West region East $ 700,000 560,000 140,000 61,000 $ 79,000 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. (Round intermediate calculations to 2 decimal places) Break-Even point West $ 350,000 227,500 122,500 91,000 $ 31,500 Show less A

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 7E: Columbia Products Inc. has two divisions, Salem and Seaside. For the month ended March 31, Salem had...

Related questions

Question

Please answer all subparts because i cant post last two subpart separately because of these are linked with above parts please thanku

Transcribed Image Text:Crossfire Company segments its business Into two regions-East and West. The company prepared a contribution format segmented

Income statement as shown below:

sales

Variable expenses

Contribution margin

Traceable fixed expenses

Segment margin

Common fixed expenses

Net operating income

Required:

1. Compute the companywide break-even point in dollar sales.

2. Compute the break-even point in dollar sales for the East region.

Req 1 to 3

Total Company

$ 1,050,000

787,500

262,500

152,000

110,500

70,000

$ 40,500

Req 4

Complete this question by entering your answers in the tabs below.

East

$ 700,000

560,000

3. Compute the break-even point in dollar sales for the West region.

4. Prepare a new segmented Income statement based on the break-even dollar sales that you computed In requirements 2 and 3.

What is Crossfire's net operating Income (loss) in your new segmented Income statement?

5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break-

even points for each region?

Req 5

Dollar sales for the whole company

Dollar sales for the East region

Dollar sales for the West region

140,000

61,000

$ 79,000

1. Compute the companywide break-even point in dollar sales.

2. Compute the break-even point in dollar sales for the East region.

3. Compute the break-even point in dollar sales for the West region.

(Round intermediate calculations to 2 decimal places)

Break-Even point

West

$ 350,000

227,500

122,500

91,000

$ 31,500

Show less A

Crossfire Company segments its business Into two regions-East and West. The company prepared a contribution format segmented

Income statement as shown below:

Sales

Variable expenses

Contribution margin

Traceable fixed expenses

Segment margin

Common fixed expenses

Net operating income

Req 1 to 3

Required:

1. Compute the companywide break-even point in dollar sales.

2. Compute the break-even point in dollar sales for the East region.

3. Compute the break-even point in dollar sales for the West region.

4. Prepare a new segmented Income statement based on the break-even dollar sales that you computed in requirements 2 and 3.

What is Crossfire's net operating Income (loss) in your new segmented Income statement?

5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break-

even points for each region?

Complete this question by entering your answers in the tabs below.

Reg 4

Total Company

$ 1,050,000

787,500

262,500

152,000

110,500

70,000

$ 40,500

Req 5

East

$ 700,000

560,000

140,000

61,000

$ 79,000

Sales

Variable expenses

Contribution margin

Traceable fixed expenses

Product line segment margin

Common fixed expenses not traceable to products

Net operating loss

West

$ 350,000

227,500

122,500

91,000

$ 31,500

Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and

3. What is Crossfire's net operating income (loss) in your new segmented income statement?

Total Company

East

West

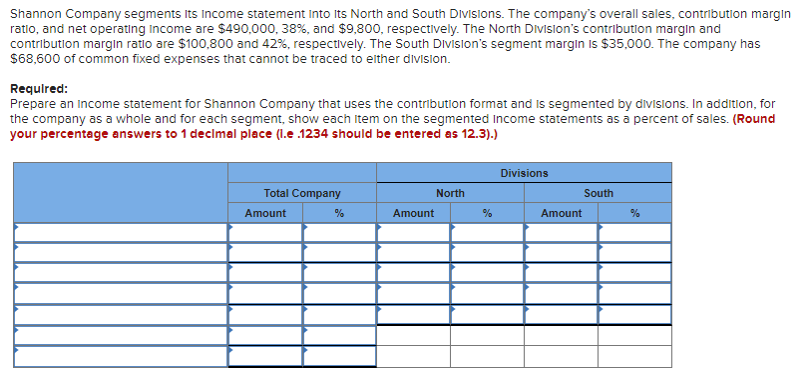

Transcribed Image Text:Shannon Company segments Its Income statement into Its North and South Divisions. The company's overall sales, contribution margin

ratio, and net operating income are $490,000, 38%, and $9,800, respectively. The North Division's contribution margin and

contribution margin ratio are $100,800 and 42%, respectively. The South Division's segment margin is $35,000. The company has

$68,600 of common fixed expenses that cannot be traced to either division.

Required:

Prepare an income statement for Shannon Company that uses the contribution format and is segmented by divisions. In addition, for

the company as a whole and for each segment, show each item on the segmented Income statements as a percent of sales. (Round

your percentage answers to 1 decimal place (l.e .1234 should be entered as 12.3).)

Total Company

Amount

%

Amount

North

%

Divisions

Amount

South

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning