Part 1 of 5 farginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $525,000 (in oday's dollars) over the next 5 years. The existing robotics would produce benefits of $423,000 (also in today's dollars) over that same time period. An initial cash investment of $210,000 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $82,000. thow how Ken will apply marginal cost-benefit analysis techniques to determine the following: - The marginal benefits of the proposed new robotics. The marginal cost of the proposed new robotics. - The net benefit of the proposed new robotics. L What should Ken recommend that the company do? Why? .What factors besides the costs and benefits should be considered before the final decision is made? - The marginal (added) benefits of the proposed new robotics is $- (Round to the nearest dollar.)

Part 1 of 5 farginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $525,000 (in oday's dollars) over the next 5 years. The existing robotics would produce benefits of $423,000 (also in today's dollars) over that same time period. An initial cash investment of $210,000 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $82,000. thow how Ken will apply marginal cost-benefit analysis techniques to determine the following: - The marginal benefits of the proposed new robotics. The marginal cost of the proposed new robotics. - The net benefit of the proposed new robotics. L What should Ken recommend that the company do? Why? .What factors besides the costs and benefits should be considered before the final decision is made? - The marginal (added) benefits of the proposed new robotics is $- (Round to the nearest dollar.)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.6C

Related questions

Question

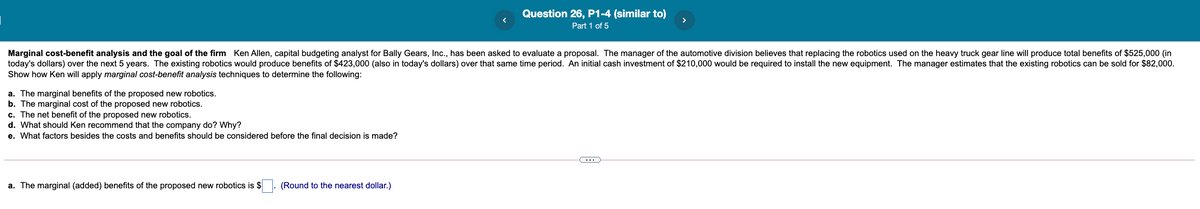

Transcribed Image Text:Question 26, P1-4 (similar to)

Part 1 of 5

Marginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $525,000 (in

today's dollars) over the next 5 years. The existing robotics would produce benefits of $423,000 (also in today's dollars) over that same time period. An initial cash investment of $210,000 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $82,000.

Show how Ken will apply marginal cost-benefit analysis techniques to determine the following:

a. The marginal benefits of the proposed new robotics.

b. The marginal cost of the proposed new robotics.

c. The net benefit of the proposed new robotics.

d. What should Ken recommend that the company do? Why?

e. What factors besides the costs and benefits should be considered before the final decision is made?

a. The marginal (added) benefits of the proposed new robotics is $. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning