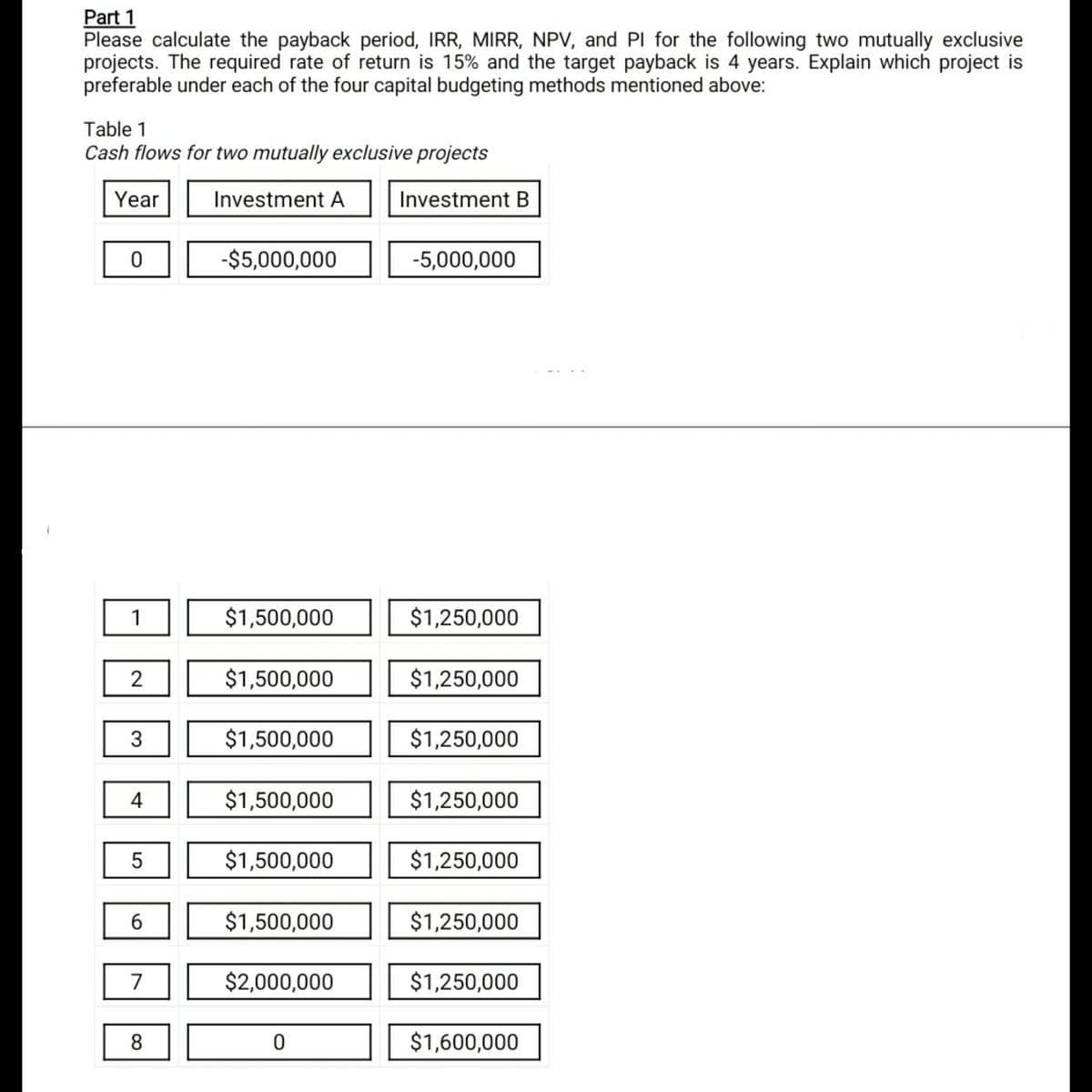

Part 1 Please calculate the payback period, IRR, MIRR, NPV, and PI for the following two mutually exclusive projects. The required rate of return is 15% and the target payback is 4 years. Explain which project is preferable under each of the four capital budgeting methods mentioned above: Table 1 Cash flows for two mutually exclusive projects Year Investment A Investment B -$5,000,000 -5,000,000

Part 1 Please calculate the payback period, IRR, MIRR, NPV, and PI for the following two mutually exclusive projects. The required rate of return is 15% and the target payback is 4 years. Explain which project is preferable under each of the four capital budgeting methods mentioned above: Table 1 Cash flows for two mutually exclusive projects Year Investment A Investment B -$5,000,000 -5,000,000

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter11: The Basics Of Capital Budgeting

Section: Chapter Questions

Problem 11P: CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS Project S costs 17,000, and its expected...

Related questions

Question

Kindly answer all the subparts asked

Transcribed Image Text:Part 1

Please calculate the payback period, IRR, MIRR, NPV, and PI for the following two mutually exclusive

projects. The required rate of return is 15% and the target payback is 4 years. Explain which project is

preferable under each of the four capital budgeting methods mentioned above:

Table 1

Cash flows for two mutually exclusive projects

Year

Investment A

Investment B

-$5,000,000

-5,000,000

1

$1,500,000

$1,250,000

2

$1,500,000

$1,250,000

3

$1,500,000

$1,250,000

4

$1,500,000

$1,250,000

5

$1,500,000

$1,250,000

$1,500,000

$1,250,000

7

$2,000,000

$1,250,000

8.

$1,600,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT