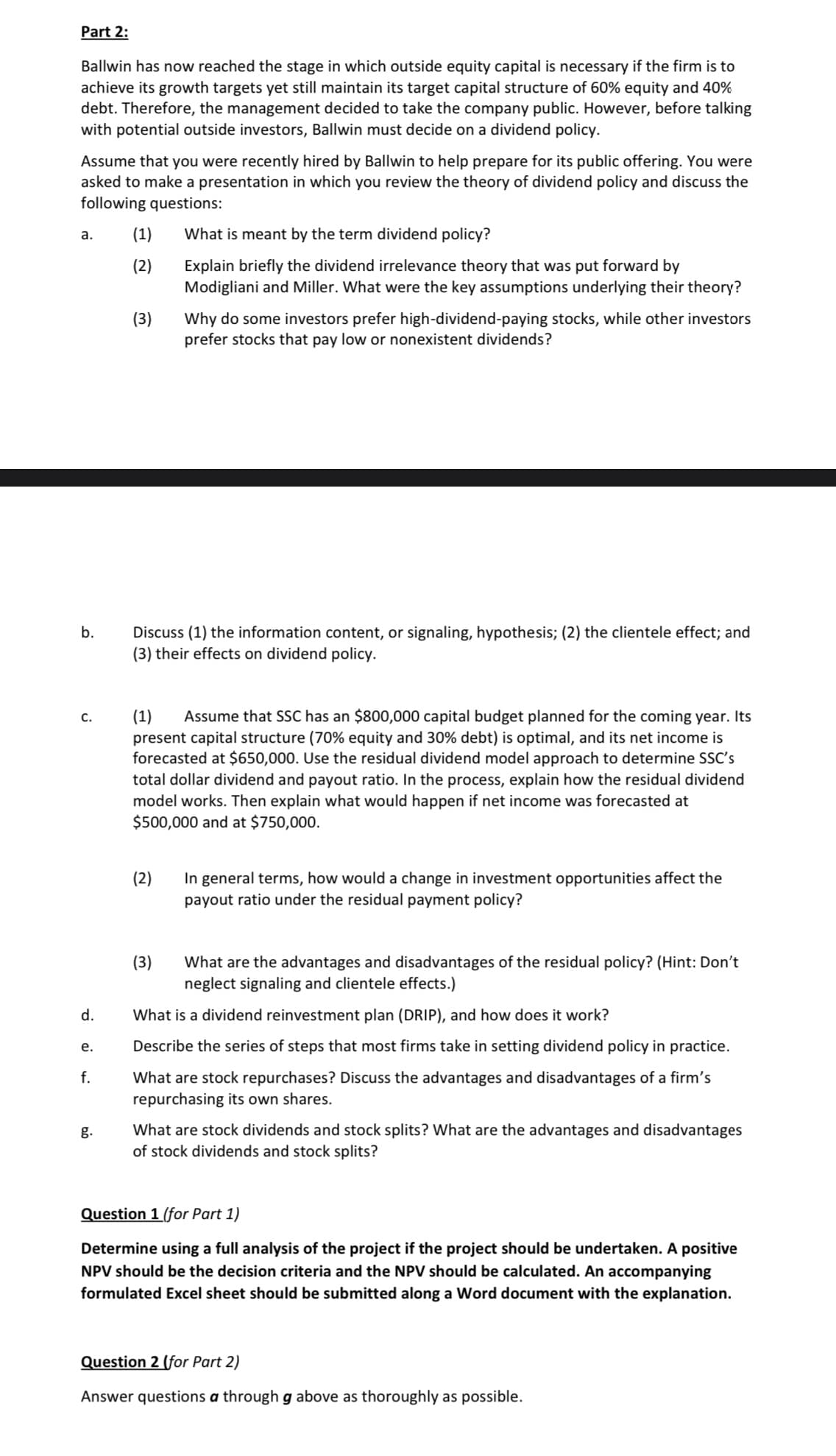

Part 2: Ballwin has now reached the stage in which outside equity capital is necessary if the firm is to achieve its growth targets yet still maintain its target capital structure of 60% equity and 40% debt. Therefore, the management decided to take the company public. However, before talking with potential outside investors, Ballwin must decide on a dividend policy. Assume that you were recently hired by Ballwin to help prepare for its public offering. You were asked to make a presentation in which you review the theory of dividend policy and discuss the following questions: (1) What is meant by the term dividend policy? а. (2) Explain briefly the dividend irrelevance theory that was put forward by Modigliani and Miller. What were the key assumptions underlying their theory? (3) Why do some investors prefer high-dividend-paying stocks, while other investors prefer stocks that pay low or nonexistent dividends? b. Discuss (1) the information content, or signaling, hypothesis; (2) the clientele effect; and (3) their effects on dividend policy. Assume that SSC has an $800,000 capital budget planned for the coming year. Its (1) present capital structure (70% equity and 30% debt) is optimal, and its net income is forecasted at $650,000. Use the residual dividend model approach to determine SSC's total dollar dividend and payout ratio. In the process, explain how the residual dividend model works. Then explain what would happen if net income was forecasted at $500,000 and at $750,000. С. (2) In general terms, how would a change in investment opportunities affect the payout ratio under the residual payment policy? (3) What are the advantages and disadvantages of the residual policy? (Hint: Don't neglect signaling and clientele effects.) d. What is a dividend reinvestment plan (DRIP), and how does it work? Describe the series of steps that most firms take in setting dividend policy in practice. е. f. What are stock repurchases? Discuss the advantages and disadvantages of a firm's repurchasing its own shares. What are stock dividends and stock splits? What are the advantages and disadvantages of stock dividends and stock splits? g. Question 1 (for Part 1) Determine using a full analysis of the project if the project should be undertaken. A positive NPV should be the decision criteria and the NPV should be calculated. An accompanying formulated Excel sheet should be submitted along a Word document with the explanation Question 2 (for Part 2) Answer questions a through g above as thoroughly as possible.

Part 2: Ballwin has now reached the stage in which outside equity capital is necessary if the firm is to achieve its growth targets yet still maintain its target capital structure of 60% equity and 40% debt. Therefore, the management decided to take the company public. However, before talking with potential outside investors, Ballwin must decide on a dividend policy. Assume that you were recently hired by Ballwin to help prepare for its public offering. You were asked to make a presentation in which you review the theory of dividend policy and discuss the following questions: (1) What is meant by the term dividend policy? а. (2) Explain briefly the dividend irrelevance theory that was put forward by Modigliani and Miller. What were the key assumptions underlying their theory? (3) Why do some investors prefer high-dividend-paying stocks, while other investors prefer stocks that pay low or nonexistent dividends? b. Discuss (1) the information content, or signaling, hypothesis; (2) the clientele effect; and (3) their effects on dividend policy. Assume that SSC has an $800,000 capital budget planned for the coming year. Its (1) present capital structure (70% equity and 30% debt) is optimal, and its net income is forecasted at $650,000. Use the residual dividend model approach to determine SSC's total dollar dividend and payout ratio. In the process, explain how the residual dividend model works. Then explain what would happen if net income was forecasted at $500,000 and at $750,000. С. (2) In general terms, how would a change in investment opportunities affect the payout ratio under the residual payment policy? (3) What are the advantages and disadvantages of the residual policy? (Hint: Don't neglect signaling and clientele effects.) d. What is a dividend reinvestment plan (DRIP), and how does it work? Describe the series of steps that most firms take in setting dividend policy in practice. е. f. What are stock repurchases? Discuss the advantages and disadvantages of a firm's repurchasing its own shares. What are stock dividends and stock splits? What are the advantages and disadvantages of stock dividends and stock splits? g. Question 1 (for Part 1) Determine using a full analysis of the project if the project should be undertaken. A positive NPV should be the decision criteria and the NPV should be calculated. An accompanying formulated Excel sheet should be submitted along a Word document with the explanation Question 2 (for Part 2) Answer questions a through g above as thoroughly as possible.

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Part 2:

Ballwin has now reached the stage in which outside equity capital is necessary if the firm is to

achieve its growth targets yet still maintain its target capital structure of 60% equity and 40%

debt. Therefore, the management decided to take the company public. However, before talking

with potential outside investors, Ballwin must decide on a dividend policy.

Assume that you were recently hired by Ballwin to help prepare for its public offering. You were

asked to make a presentation in which you review the theory of dividend policy and discuss the

following questions:

(1)

What is meant by the term dividend policy?

а.

(2)

Explain briefly the dividend irrelevance theory that was put forward by

Modigliani and Miller. What were the key assumptions underlying their theory?

(3)

Why do some investors prefer high-dividend-paying stocks, while other investors

prefer stocks that pay low or nonexistent dividends?

b.

Discuss (1) the information content, or signaling, hypothesis; (2) the clientele effect; and

(3) their effects on dividend policy.

Assume that SSC has an $800,000 capital budget planned for the coming year. Its

(1)

present capital structure (70% equity and 30% debt) is optimal, and its net income is

forecasted at $650,000. Use the residual dividend model approach to determine SSC's

total dollar dividend and payout ratio. In the process, explain how the residual dividend

model works. Then explain what would happen if net income was forecasted at

$500,000 and at $750,000.

С.

(2)

In general terms, how would a change in investment opportunities affect the

payout ratio under the residual payment policy?

(3)

What are the advantages and disadvantages of the residual policy? (Hint: Don't

neglect signaling and clientele effects.)

d.

What is a dividend reinvestment plan (DRIP), and how does it work?

Describe the series of steps that most firms take in setting dividend policy in practice.

е.

f.

What are stock repurchases? Discuss the advantages and disadvantages of a firm's

repurchasing its own shares.

What are stock dividends and stock splits? What are the advantages and disadvantages

of stock dividends and stock splits?

g.

Question 1 (for Part 1)

Determine using a full analysis of the project if the project should be undertaken. A positive

NPV should be the decision criteria and the NPV should be calculated. An accompanying

formulated Excel sheet should be submitted along a Word document with the explanation

Question 2 (for Part 2)

Answer questions a through g above as thoroughly as possible.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning