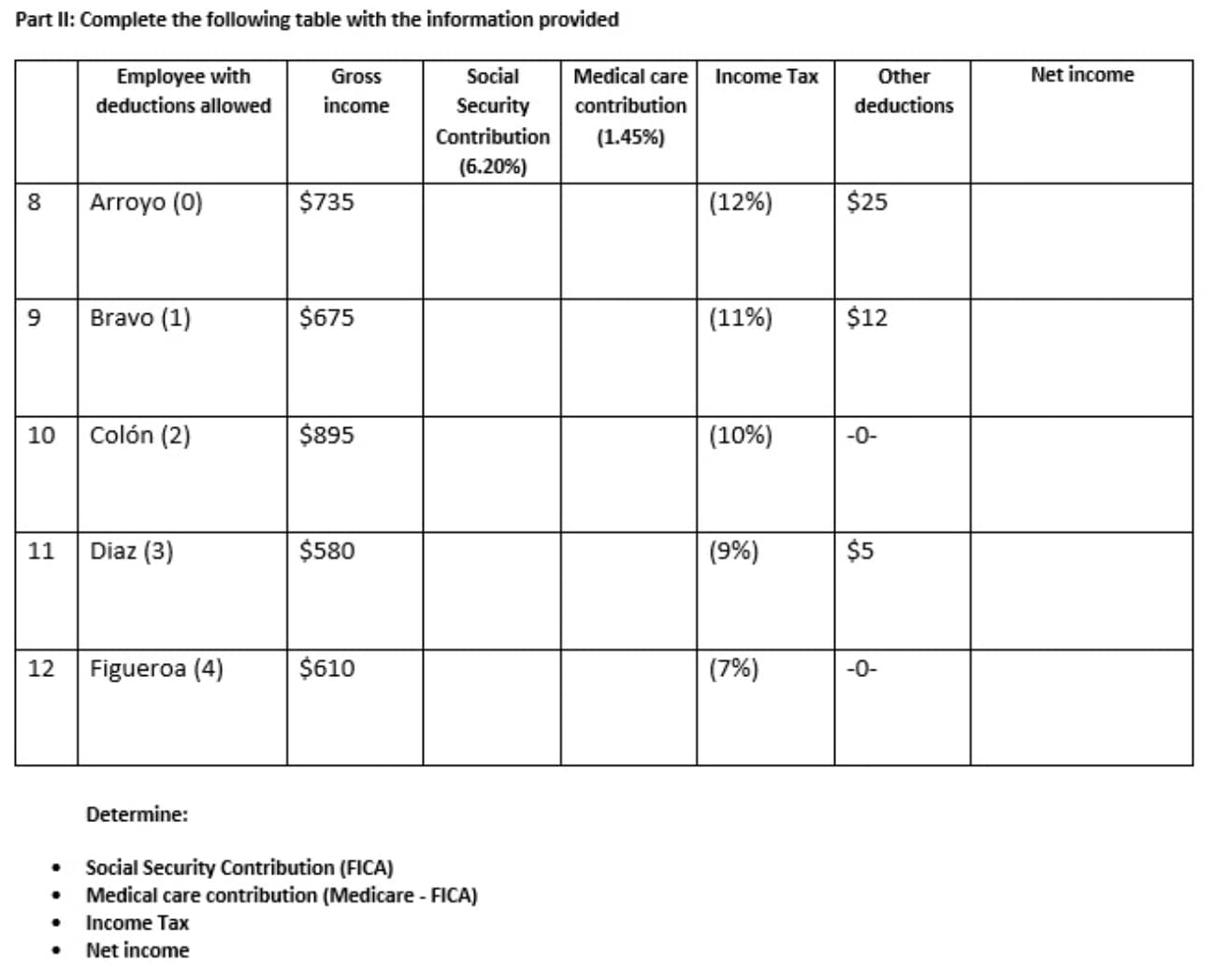

Part II: Complete the following table with the information provided Net income Medical care Social Employee with Other Gross Income Tax deductions allowed income Security contribution deductions Contribution (1.45%) (6.20%) $735 $25 (12%) Arroyo (0) $12 Bravo (1) $675 (11%) Colón (2) $895 (10%) 10 -0- Diaz (3) $580 $5 (9%) 11 $610 Figueroa (4) (7%) 12 -0- Determine: • Social Security Contribution (FICA) Medical care contribution (Medicare - FICA) Income Tax Net income

Part II: Complete the following table with the information provided Net income Medical care Social Employee with Other Gross Income Tax deductions allowed income Security contribution deductions Contribution (1.45%) (6.20%) $735 $25 (12%) Arroyo (0) $12 Bravo (1) $675 (11%) Colón (2) $895 (10%) 10 -0- Diaz (3) $580 $5 (9%) 11 $610 Figueroa (4) (7%) 12 -0- Determine: • Social Security Contribution (FICA) Medical care contribution (Medicare - FICA) Income Tax Net income

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 44P

Related questions

Question

100%

Transcribed Image Text:Part II: Complete the following table with the information provided

Net income

Medical care

Social

Employee with

Other

Gross

Income Tax

deductions allowed

income

Security

contribution

deductions

Contribution

(1.45%)

(6.20%)

$735

$25

(12%)

Arroyo (0)

$12

Bravo (1)

$675

(11%)

Colón (2)

$895

(10%)

10

-0-

Diaz (3)

$580

$5

(9%)

11

$610

Figueroa (4)

(7%)

12

-0-

Determine:

• Social Security Contribution (FICA)

Medical care contribution (Medicare - FICA)

Income Tax

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you