If Your Taxable But The Tax Of the Income Not You Amount Is Over Over Owe Is Over $ 8500 $ 34,500 $ 83,600 $ 10% 2$ $ 8500 $ 34,500 $ 83,600 $ 8500 $ 34,500 $ 83,600 $ 850.00 + 15% $ 4750.00 + 25% $ 17,025.00 + 28% $ 42,449.00 + 33% $174,400 $174,400 $379,150 $174,400 $379,150 $110,016.50 + 35% $379,150 0 379,150.

If Your Taxable But The Tax Of the Income Not You Amount Is Over Over Owe Is Over $ 8500 $ 34,500 $ 83,600 $ 10% 2$ $ 8500 $ 34,500 $ 83,600 $ 8500 $ 34,500 $ 83,600 $ 850.00 + 15% $ 4750.00 + 25% $ 17,025.00 + 28% $ 42,449.00 + 33% $174,400 $174,400 $379,150 $174,400 $379,150 $110,016.50 + 35% $379,150 0 379,150.

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 35P

Related questions

Question

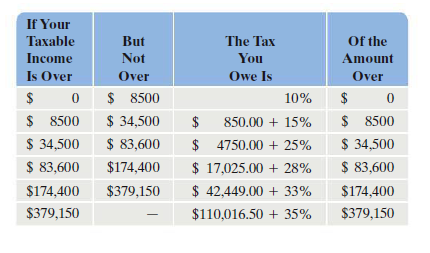

Here is the Federal Tax Rate Schedule X (see attached) that specifies the tax owed by a single taxpayer for a recent year.

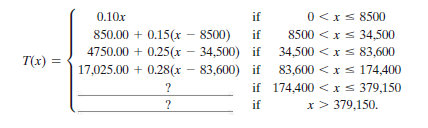

The given tax table can be modeled by a piecewise function (see attached), where x represents the taxable income of a single taxpayer and T(x) is the tax owed.

Then Find and interpret T(50,000).

Transcribed Image Text:If Your

Taxable

But

The Tax

Of the

Income

Not

You

Amount

Is Over

Over

Owe Is

Over

$ 8500

$ 34,500

$ 83,600

$

10%

2$

$ 8500

$ 34,500

$ 83,600

$ 8500

$ 34,500

$ 83,600

$

850.00 + 15%

$ 4750.00 + 25%

$ 17,025.00 + 28%

$ 42,449.00 + 33%

$174,400

$174,400

$379,150

$174,400

$379,150

$110,016.50 + 35%

$379,150

Transcribed Image Text:0 <xs 8500

8500 <xs 34,500

4750.00 + 0.25(x – 34,500) if 34,500 <xs 83,600

0.10x

if

850.00 + 0.15(x - 8500)

if

T(x) =

17,025.00 + 0.28(x – 83,600) if 83,600 < xs 174,400

if 174,400 < x s 379,150

?

?

if

x> 379,150.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you