PARTNERSHIP FORMATION - Handout 12-1B Held and Kamp decide to merge their proprietorships into a partnership called HeldKamp Company. The balance sheet of Kamp Co. shows: $15,000 Accounts receivable Less: Allowance for doubtful accounts Equipment Less: Accumulated depreciation 1200 $13,800 $20,000 8.000 12,000 The partners agree that the net realizable value of the receivables is $12,500 and that the fair market value of the equipment is $10,000 Prepare the journal entry to record the initial investment of Kamp. SOLUTION HINTS These non-cash assets should be recorded at their fair value. Remember, accumulated depreciation is not carried into the partnership books. A revised Allowance for Doubtful Accounts balance will need to be determined and will be journalized Cr. Ka mp, Cap. $22,500

PARTNERSHIP FORMATION - Handout 12-1B Held and Kamp decide to merge their proprietorships into a partnership called HeldKamp Company. The balance sheet of Kamp Co. shows: $15,000 Accounts receivable Less: Allowance for doubtful accounts Equipment Less: Accumulated depreciation 1200 $13,800 $20,000 8.000 12,000 The partners agree that the net realizable value of the receivables is $12,500 and that the fair market value of the equipment is $10,000 Prepare the journal entry to record the initial investment of Kamp. SOLUTION HINTS These non-cash assets should be recorded at their fair value. Remember, accumulated depreciation is not carried into the partnership books. A revised Allowance for Doubtful Accounts balance will need to be determined and will be journalized Cr. Ka mp, Cap. $22,500

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

100%

Please explain. Thanks

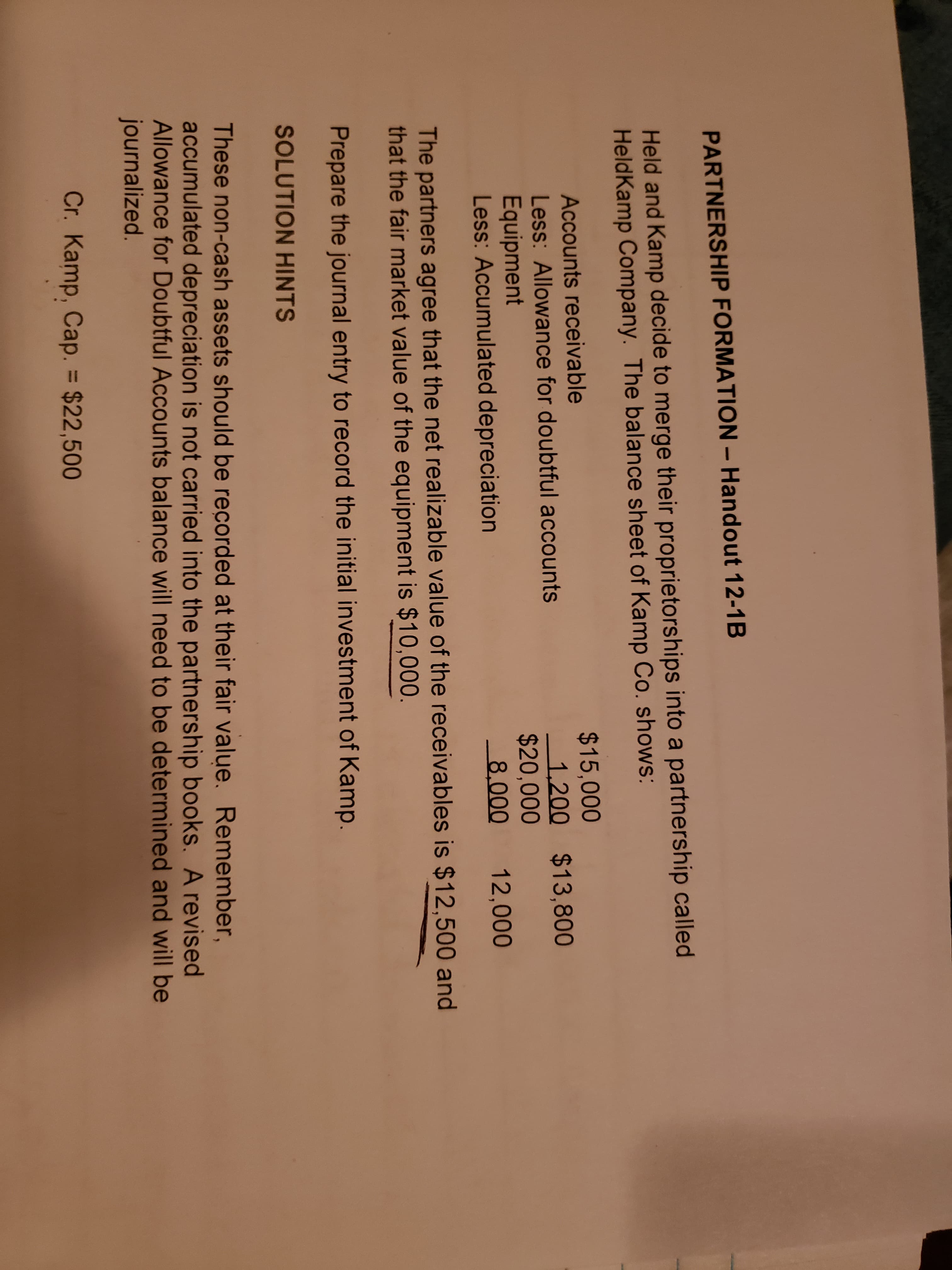

Transcribed Image Text:PARTNERSHIP FORMATION - Handout 12-1B

Held and Kamp decide to merge their proprietorships into a partnership called

HeldKamp Company. The balance sheet of Kamp Co. shows:

$15,000

Accounts receivable

Less: Allowance for doubtful accounts

Equipment

Less: Accumulated depreciation

1200 $13,800

$20,000

8.000 12,000

The partners agree that the net realizable value of the receivables is $12,500 and

that the fair market value of the equipment is $10,000

Prepare the journal entry to record the initial investment of Kamp.

SOLUTION HINTS

These non-cash assets should be recorded at their fair value. Remember,

accumulated depreciation is not carried into the partnership books. A revised

Allowance for Doubtful Accounts balance will need to be determined and will be

journalized

Cr.

Ka

mp, Cap. $22,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT