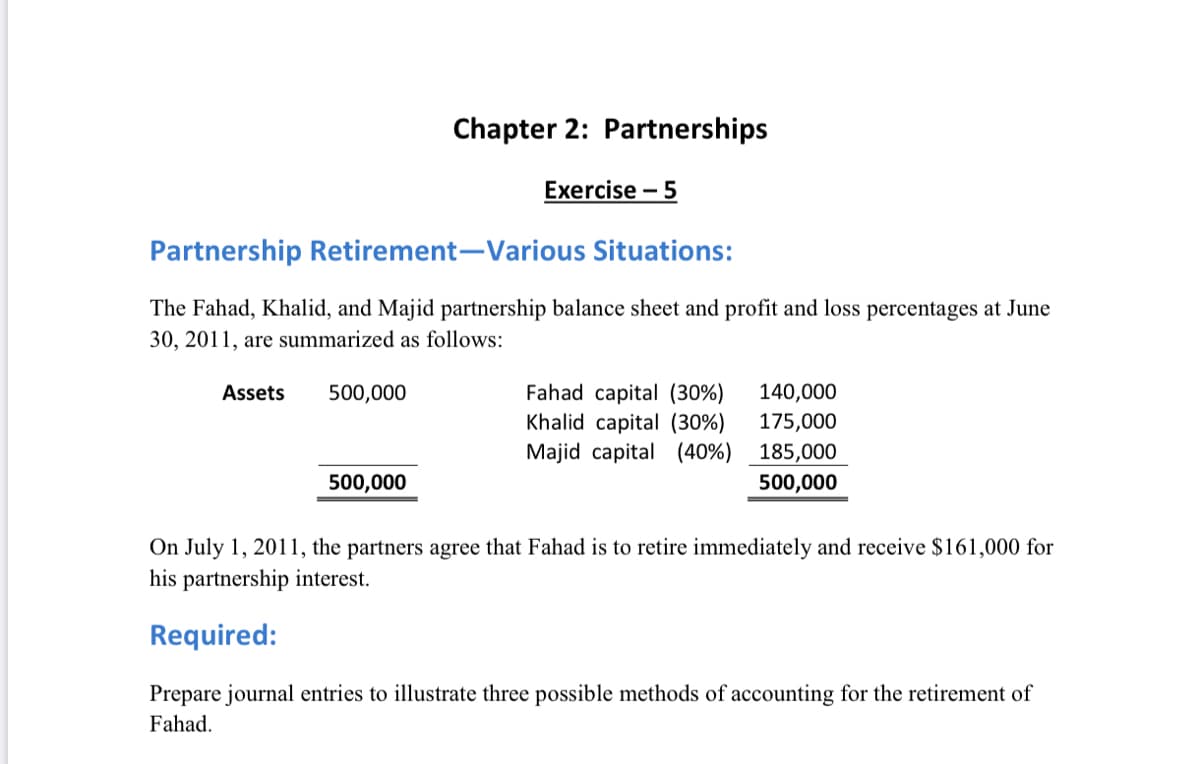

Partnership Retirement-Various Situations: The Fahad, Khalid, and Majid partnership balance sheet and profit and loss percentages at June 30, 2011, are summarized as follows: Fahad capital (30%) Khalid capital (30%) Majid capital (40%) 185,000 Assets 500,000 140,000 175,000 500,000 500,000 On July 1, 2011, the partners agree that Fahad is to retire immediately and receive $161,000 for his partnership interest. Required: Prepare journal entries to illustrate three possible methods of accounting for the retirement of Fahad.

Partnership Retirement-Various Situations: The Fahad, Khalid, and Majid partnership balance sheet and profit and loss percentages at June 30, 2011, are summarized as follows: Fahad capital (30%) Khalid capital (30%) Majid capital (40%) 185,000 Assets 500,000 140,000 175,000 500,000 500,000 On July 1, 2011, the partners agree that Fahad is to retire immediately and receive $161,000 for his partnership interest. Required: Prepare journal entries to illustrate three possible methods of accounting for the retirement of Fahad.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.22E

Related questions

Question

Transcribed Image Text:Chapter 2: Partnerships

Exercise –

- 5

Partnership Retirement-Various Situations:

The Fahad, Khalid, and Majid partnership balance sheet and profit and loss percentages at June

30, 2011, are summarized as follows:

Fahad capital (30%)

Khalid capital (30%)

Majid capital (40%) 185,000

Assets

500,000

140,000

175,000

500,000

500,000

On July 1, 2011, the partners agree that Fahad is to retire immediately and receive $161,000 for

his partnership interest.

Required:

Prepare journal entries to illustrate three possible methods of accounting for the retirement of

Fahad.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,