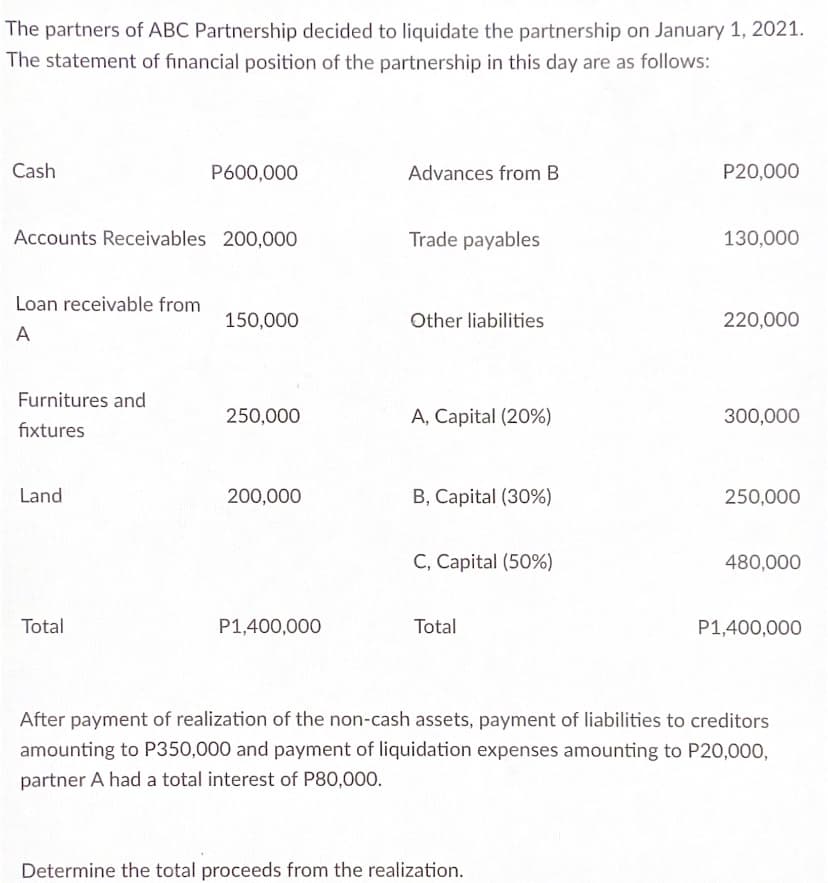

The partners of ABC Partnership decided to liquidate the partnership on January 1, 2021. The statement of financial position of the partnership in this day are as follows: Cash P600,000 Advances from B P20,000 Accounts Receivables 200,000 Trade payables 130,000 Loan receivable from 150,000 Other liabilities 220,000 A Furnitures and 250,000 A, Capital (20%) 300,000 fixtures Land 200,000 B, Capital (30%) 250,000 C, Capital (50%) 480,000 Total P1,400,000 Total P1,400,000 After payment of realization of the non-cash assets, payment of liabilities to creditors amounting to P350,000 and payment of liquidation expenses amounting to P20,000, partner A had a total interest of P80,000.

The partners of ABC Partnership decided to liquidate the partnership on January 1, 2021. The statement of financial position of the partnership in this day are as follows: Cash P600,000 Advances from B P20,000 Accounts Receivables 200,000 Trade payables 130,000 Loan receivable from 150,000 Other liabilities 220,000 A Furnitures and 250,000 A, Capital (20%) 300,000 fixtures Land 200,000 B, Capital (30%) 250,000 C, Capital (50%) 480,000 Total P1,400,000 Total P1,400,000 After payment of realization of the non-cash assets, payment of liabilities to creditors amounting to P350,000 and payment of liquidation expenses amounting to P20,000, partner A had a total interest of P80,000.

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:The partners of ABC Partnership decided to liquidate the partnership on January 1, 2021.

The statement of financial position of the partnership in this day are as follows:

Cash

P600,000

Advances from B

P20,000

Accounts Receivables 200,000

Trade payables

130,000

Loan receivable from

150,000

Other liabilities

220,000

A

Furnitures and

250,000

A, Capital (20%)

300,000

fixtures

Land

200,000

B, Capital (30%)

250,000

C, Capital (50%)

480,000

Total

P1,400,000

Total

P1,400,000

After payment of realization of the non-cash assets, payment of liabilities to creditors

amounting to P350,000 and payment of liquidation expenses amounting to P20,000,

partner A had a total interest of P80,000.

Determine the total proceeds from the realization.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College