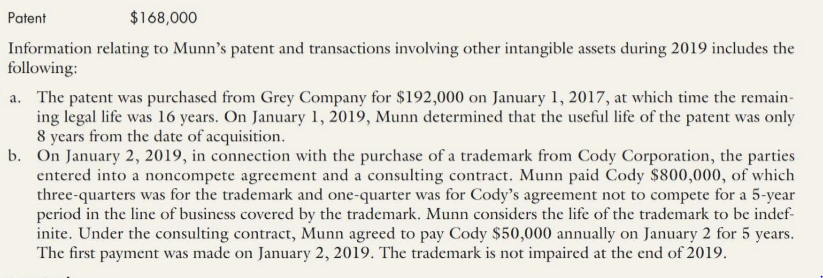

Patent $168,000 Information relating to Munn's patent and transactions involving other intangible assets during 2019 includes the following: a. The patent was purchased from Grey Company for $192,000 on January 1, 2017, at which time the remain- ing legal life was 16 years. On January 1, 2019, Munn determined that the useful life of the patent was only 8 years from the date of acquisition. b. On January 2, 2019, in connection with the purchase of a trademark from Cody Corporation, the parties entered into a noncompete agreement and a consulting contract. Munn paid Cody $800,000, of which three-quarters was for the trademark and one-quarter was for Cody's agreement not to compete for a 5-year period in the line of business covered by the trademark. Munn considers the life of the trademark to be indef- inite. Under the consulting contract, Munn agreed to pay Cody $50,000 annually on January 2 for 5 years. The first payment was made on January 2, 2019. The trademark is not impaired at the end of 2019.

Patent $168,000 Information relating to Munn's patent and transactions involving other intangible assets during 2019 includes the following: a. The patent was purchased from Grey Company for $192,000 on January 1, 2017, at which time the remain- ing legal life was 16 years. On January 1, 2019, Munn determined that the useful life of the patent was only 8 years from the date of acquisition. b. On January 2, 2019, in connection with the purchase of a trademark from Cody Corporation, the parties entered into a noncompete agreement and a consulting contract. Munn paid Cody $800,000, of which three-quarters was for the trademark and one-quarter was for Cody's agreement not to compete for a 5-year period in the line of business covered by the trademark. Munn considers the life of the trademark to be indef- inite. Under the consulting contract, Munn agreed to pay Cody $50,000 annually on January 2 for 5 years. The first payment was made on January 2, 2019. The trademark is not impaired at the end of 2019.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 8P

Related questions

Question

100%

Munn Inc. had the following intangible account balance at December 31, 2018:

1. Prepare a schedule of the expenses for 2019 relating to Munn's intangible asset balances at December 31, 2018, and transactions during 2019. 2. Prepare the intangible asset section of Munn’s balance sheet at December 31, 2019.

Transcribed Image Text:Patent

$168,000

Information relating to Munn's patent and transactions involving other intangible assets during 2019 includes the

following:

a. The patent was purchased from Grey Company for $192,000 on January 1, 2017, at which time the remain-

ing legal life was 16 years. On January 1, 2019, Munn determined that the useful life of the patent was only

8 years from the date of acquisition.

b. On January 2, 2019, in connection with the purchase of a trademark from Cody Corporation, the parties

entered into a noncompete agreement and a consulting contract. Munn paid Cody $800,000, of which

three-quarters was for the trademark and one-quarter was for Cody's agreement not to compete for a 5-year

period in the line of business covered by the trademark. Munn considers the life of the trademark to be indef-

inite. Under the consulting contract, Munn agreed to pay Cody $50,000 annually on January 2 for 5 years.

The first payment was made on January 2, 2019. The trademark is not impaired at the end of 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning