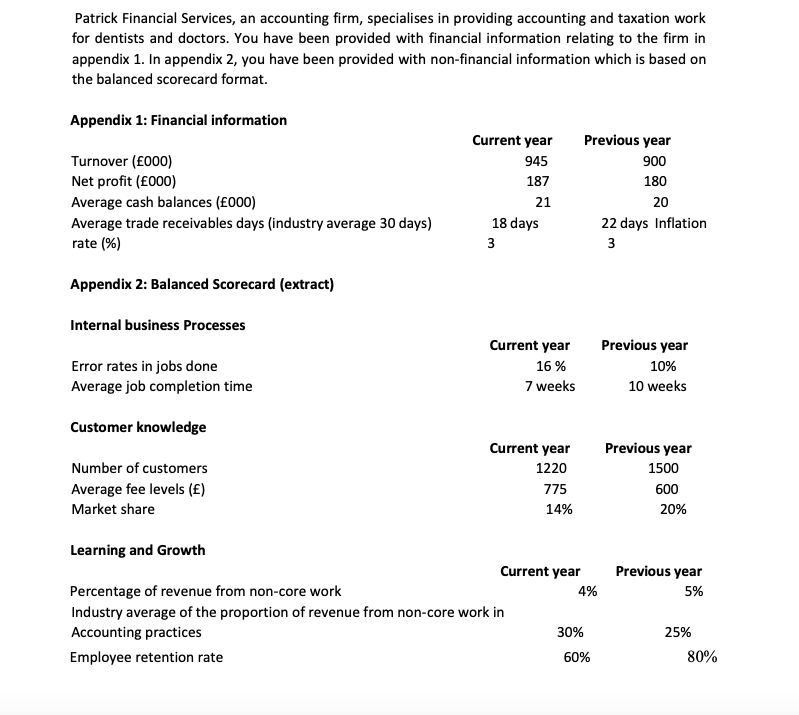

Patrick Financial Services, an accounting firm, specialises in providing accounting and taxation work for dentists and doctors. You have been provided with financial information relating to the firm in appendix 1. In appendix 2, you have been provided with non-financial information which is based on the balanced scorecard format. Notes Error rates measure the number of jobs with mistakes made by staff as a proportion of clients serviced. Core work is defined as being accountancy and taxation. On-core work is defined primarily as pension advice and business consultancy. On-core work is traditionally high margin work. Required: Using the information in appendix 1 only, comment on the financial performance of the business (briefly consider growth, profitability and credit management) Explain why non-financial information, such as the type shown in appendix 2, is likely to give a better indication of the likely future success of the business than the financial information given in appendix 1. Using the data given in appendix 2, comment on the performance of the business. Include comments on internal business processes, customer knowledge and learning/growth, and provide a concluding comment on the overall performance of the business.

Patrick Financial Services, an accounting firm, specialises in providing accounting and

Notes

-

Error rates measure the number of jobs with mistakes made by staff as a proportion of clients serviced.

-

Core work is defined as being accountancy and taxation. On-core work is defined primarily as pension advice and business consultancy. On-core work is traditionally high margin work.

Required:

-

Using the information in appendix 1 only, comment on the financial performance of the business (briefly consider growth, profitability and credit management)

-

Explain why non-financial information, such as the type shown in appendix 2, is likely to give a better indication of the likely future success of the business than the financial information given in appendix 1.

-

Using the data given in appendix 2, comment on the performance of the business. Include comments on internal business processes, customer knowledge and learning/growth, and provide a concluding comment on the overall performance of the business.

Step by step

Solved in 4 steps