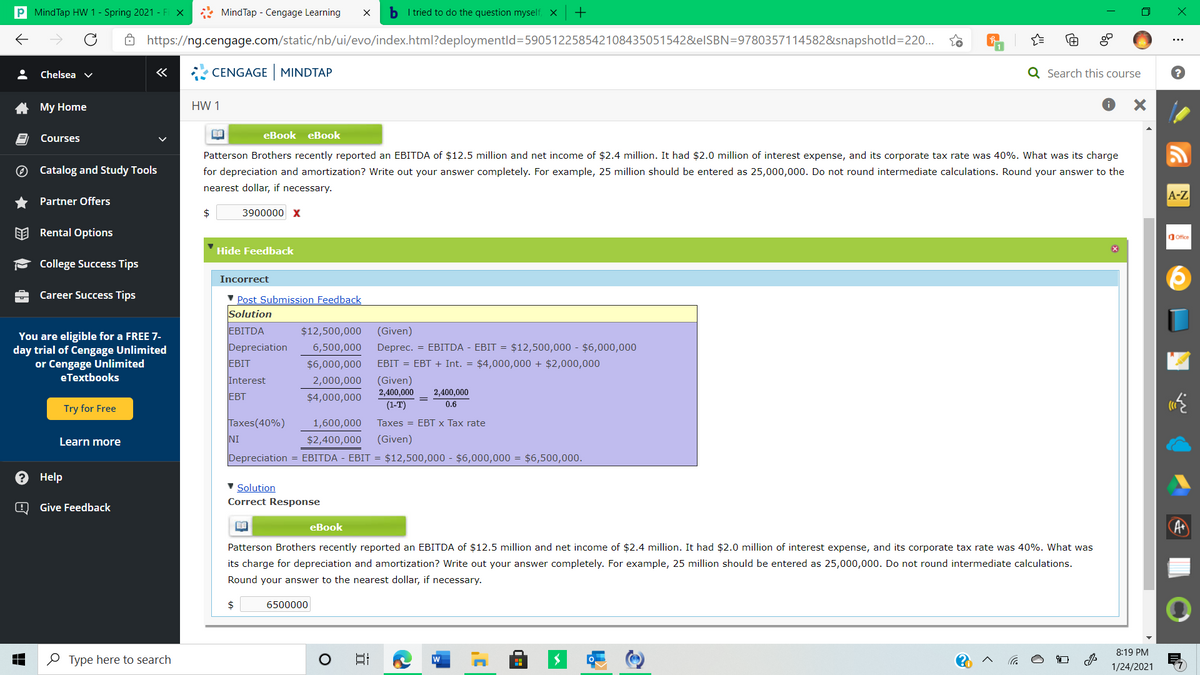

Patterson Brothers recently reported an EBITDA of $12.5 million and net income of $2.4 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest dollar, if necessary.

Patterson Brothers recently reported an EBITDA of $12.5 million and net income of $2.4 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest dollar, if necessary.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 1RP

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

100%

Transcribed Image Text:P MindTap HW 1 - Spring 2021 - Fi X

* MindTap - Cengage Learning

b I tried to do the question myself, X

8 https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld=590512258542108435051542&elSBN=9780357114582&snapshotld=22..

Chelsea v

CENGAGE MINDTAP

Q Search this course

A My Home

HW 1

Courses

eBook eBook

Patterson Brothers recently reported an EBITDA of $12.5 million and net income of $2.4 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge

O Catalog and Study Tools

for depreciation and amortization? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the

nearest dollar, if necessary.

A-Z

Partner Offers

$

3900000 x

EE Rental Options

dOffice

Hide Feedback

College Success Tips

Incorrect

Career Success Tips

Post Submission Feedback

Solution

EBITDA

$12,500,000

(Given)

You are eligible for a FREE 7-

day trial of Cengage Unlimited

or Cengage Unlimited

eTextbooks

Depreciation

EBIT

6,500,000

Deprec. = EBITDA - EBIT = $12,500,000 - $6,000,000

$6,000,000

EBIT = EBT + Int. = $4,000,000 + $2,000,000

Interest

2,000,000

(Given)

EBT

$4,000,000

2,400,000

2,400,000

Try for Free

(1-T)

0.6

Taxes(40%)

1,600,000

Taxes = EBT x Tax rate

Learn more

NI

$2,400,000

(Given)

Depreciation = EBITDA - EBIT = $12,500,000 - $6,000,000 = $6,500,000.

? Help

V Solution

Correct Response

O Give Feedback

eBook

Patterson Brothers recently reported an EBITDA of $12.5 million and net income of $2.4 million. It

$2.0

of interest expense, and its corporate tax rate was 40%. What was

its charge for depreciation and amortization? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations.

Round your answer to the nearest dollar, if necessary.

2$

6500000

8:19 PM

O Type here to search

1/24/2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you