Payback, Accounting Rate of Return, Net Present valde, Internal Rate of Retum Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirements below. Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $460,800. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year 1 2 3 4 5 Required: Cash Revenues $612,000 612,000 612,000 612,000 612,000 Cash Expenses $432,000 432,000 432,000 432,000 432,000 1. Compute the payback period for the NC equipment. Round your answer to two decimal places. 2.56 ✓ years Check My Work 2. Compute the NC equipment's ARR. Round the percentage to one decimal place. Assume straight-line depreciation. 19.1 ✓ % 3. Compute the investment's NPV, assuming required rate of return of 10%. Round present value calculations and your final answer to the nearest dollar. $221,541 X Previous

Payback, Accounting Rate of Return, Net Present valde, Internal Rate of Retum Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirements below. Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $460,800. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year 1 2 3 4 5 Required: Cash Revenues $612,000 612,000 612,000 612,000 612,000 Cash Expenses $432,000 432,000 432,000 432,000 432,000 1. Compute the payback period for the NC equipment. Round your answer to two decimal places. 2.56 ✓ years Check My Work 2. Compute the NC equipment's ARR. Round the percentage to one decimal place. Assume straight-line depreciation. 19.1 ✓ % 3. Compute the investment's NPV, assuming required rate of return of 10%. Round present value calculations and your final answer to the nearest dollar. $221,541 X Previous

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 21E: Net present value-unequal lives Bunker Hill Mining Company has two competing proposals: a processing...

Related questions

Question

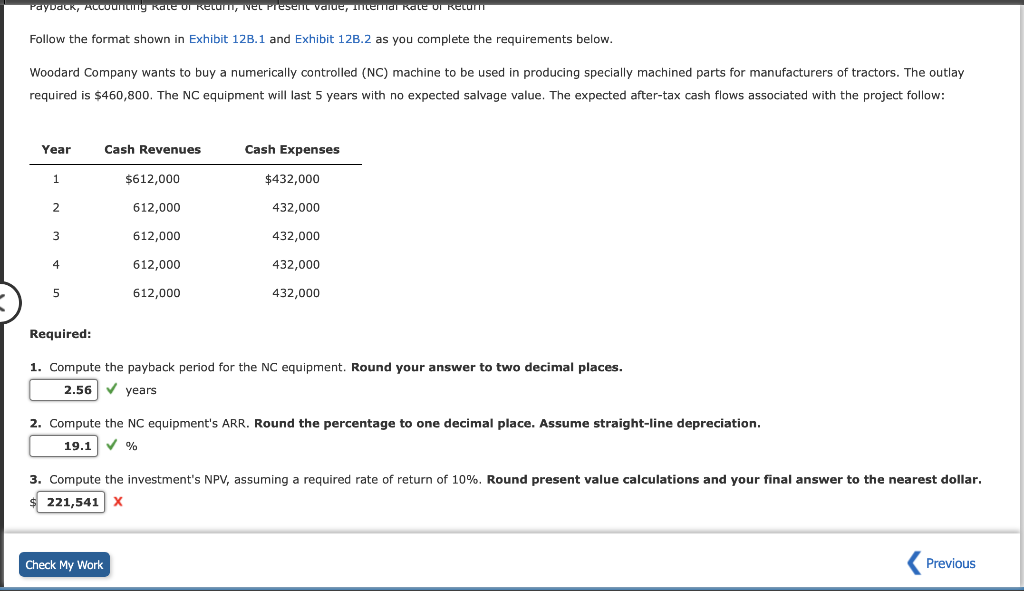

Transcribed Image Text:Payback, Accounting Rate of Return, Net Present valde, Internal Rate of Retum

Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirements below.

Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay

required is $460,800. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

Year

1

2

3

4

5

Required:

Cash Revenues

$612,000

612,000

612,000

612,000

612,000

Cash Expenses

$432,000

432,000

432,000

432,000

432,000

1. Compute the payback period for the NC equipment. Round your answer to two decimal places.

2.56 ✓ years

Check My Work

2. Compute the NC equipment's ARR. Round the percentage to one decimal place. Assume straight-line depreciation.

19.1 ✓ %

3. Compute the investment's NPV, assuming required rate of return of 10%. Round present value calculations and your final answer to the nearest dollar.

$221,541 X

Previous

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning