PB10-5 Recording and Explaining the Early Retirement of Debt [LO 10-3] QPF Movie Group owns and operates movie theaters worldwide. Assume the company issued 5 percent bonds at their $53,500,0C face value and then used all of these cash proceeds to retire bonds with a stated interest rate of 7 percent. At that time, the 7 perce bonds had a carrying value of $50,000,000. Required: 1. Prepare the journal entries to record the issuance of the 5 percent bonds and the early retirement of the 7 percent bonds. Assum both sets of bonds were issued at face value. 2. Where should AMC report any gain or loss on this transaction? 3. What dollar amount of interest expense is AMC saving each year by replacing the 7 percent bonds with the 5 percent bonds? Complete'this question hy entering your ancuorn

PB10-5 Recording and Explaining the Early Retirement of Debt [LO 10-3] QPF Movie Group owns and operates movie theaters worldwide. Assume the company issued 5 percent bonds at their $53,500,0C face value and then used all of these cash proceeds to retire bonds with a stated interest rate of 7 percent. At that time, the 7 perce bonds had a carrying value of $50,000,000. Required: 1. Prepare the journal entries to record the issuance of the 5 percent bonds and the early retirement of the 7 percent bonds. Assum both sets of bonds were issued at face value. 2. Where should AMC report any gain or loss on this transaction? 3. What dollar amount of interest expense is AMC saving each year by replacing the 7 percent bonds with the 5 percent bonds? Complete'this question hy entering your ancuorn

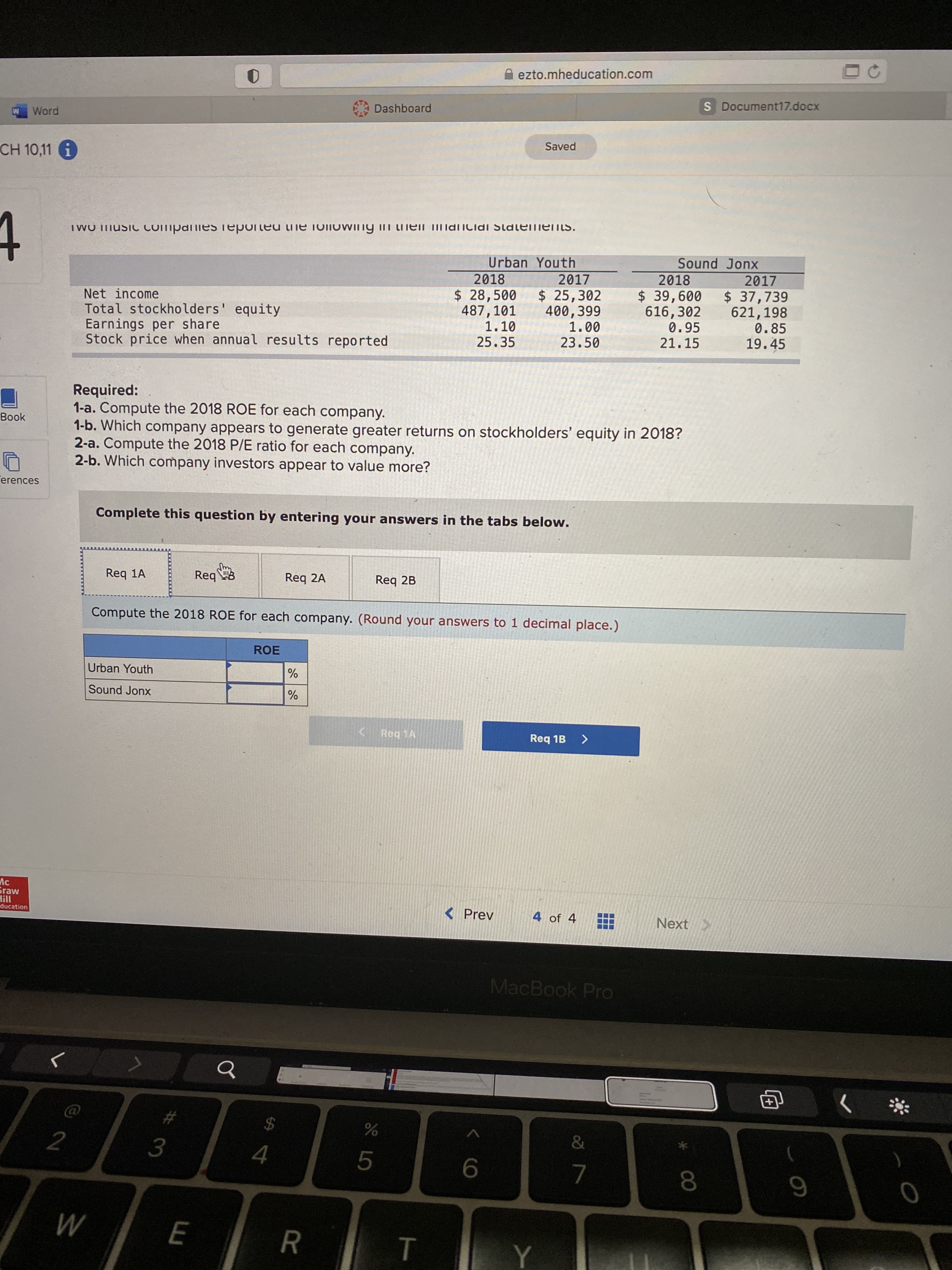

Chapter3: The Financial Environment: Markets, Institutions And Investment Banking

Section: Chapter Questions

Problem 10PROB

Related questions

Question

Help please

![PB10-5 Recording and Explaining the Early Retirement of Debt [LO 10-3]

QPF Movie Group owns and operates movie theaters worldwide. Assume the company issued 5 percent bonds at their $53,500,0C

face value and then used all of these cash proceeds to retire bonds with a stated interest rate of 7 percent. At that time, the 7 perce

bonds had a carrying value of $50,000,000.

Required:

1. Prepare the journal entries to record the issuance of the 5 percent bonds and the early retirement of the 7 percent bonds. Assum

both sets of bonds were issued at face value.

2. Where should AMC report any gain or loss on this transaction?

3. What dollar amount of interest expense is AMC saving each year by replacing the 7 percent bonds with the 5 percent bonds?

Complete'this question hy entering your ancuorn](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fd27d0c4e-6795-4ab4-8f0f-c209cec01fb9%2F347b1b44-dbd5-4903-989a-3079b9861e39%2F8v966t5.jpeg&w=3840&q=75)

Transcribed Image Text:PB10-5 Recording and Explaining the Early Retirement of Debt [LO 10-3]

QPF Movie Group owns and operates movie theaters worldwide. Assume the company issued 5 percent bonds at their $53,500,0C

face value and then used all of these cash proceeds to retire bonds with a stated interest rate of 7 percent. At that time, the 7 perce

bonds had a carrying value of $50,000,000.

Required:

1. Prepare the journal entries to record the issuance of the 5 percent bonds and the early retirement of the 7 percent bonds. Assum

both sets of bonds were issued at face value.

2. Where should AMC report any gain or loss on this transaction?

3. What dollar amount of interest expense is AMC saving each year by replacing the 7 percent bonds with the 5 percent bonds?

Complete'this question hy entering your ancuorn

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you