Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Peanut Company Cash Accounts Receivable Inventory Investment in Snoopy Company 200 Land But 1 Buildings and Equipment 200 Cost of Goods Sold Depreciation Expense Depr Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Debit $ 158,000 165,000 200,000 319,500 200,000 700,000 200,000 50,000 225,000 100,000 $2,317,500 Credit 450,000 75,000 200,000 500,000 225,000 800,000 67,500 $2,317,500 Snoopy Company Debit $ 80,000 65,000 75,000 200 100,000 200,000 125,000 10,000 40,000 20,000 $715,000 Credit 20,000 60,000 85,000 200,000 100,000 250,000 0 $715,000

Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Peanut Company Cash Accounts Receivable Inventory Investment in Snoopy Company 200 Land But 1 Buildings and Equipment 200 Cost of Goods Sold Depreciation Expense Depr Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Debit $ 158,000 165,000 200,000 319,500 200,000 700,000 200,000 50,000 225,000 100,000 $2,317,500 Credit 450,000 75,000 200,000 500,000 225,000 800,000 67,500 $2,317,500 Snoopy Company Debit $ 80,000 65,000 75,000 200 100,000 200,000 125,000 10,000 40,000 20,000 $715,000 Credit 20,000 60,000 85,000 200,000 100,000 250,000 0 $715,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Subject :- Accounting

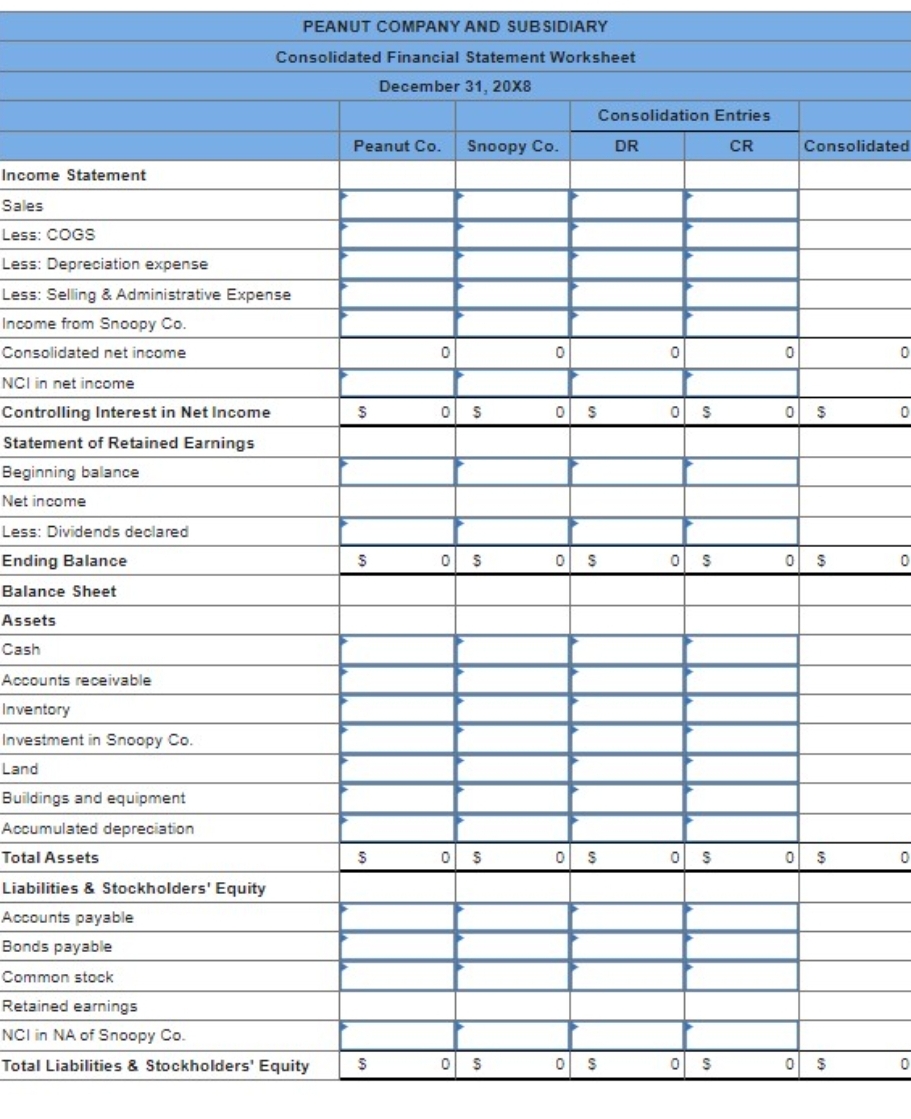

Transcribed Image Text:Income Statement

Sales

Less: COGS

Less: Depreciation expense

Less: Selling & Administrative Expense

Income from Snoopy Co.

Consolidated net income

NCI in net income

Controlling Interest in Net Income

Statement of Retained Earnings

Beginning balance

Net income

Less: Dividends declared

Ending Balance

Balance Sheet

Assets

Cash

Accounts receivable

Inventory

Investment in Snoopy Co.

PEANUT COMPANY AND SUBSIDIARY

Consolidated Financial Statement Worksheet

December 31, 20X8

Land

Buildings and equipment

Accumulated depreciation

Total Assets

Liabilities & Stockholders' Equity

Accounts payable

Bonds payable

Common stock

Retained earnings

NCI in NA of Snoopy Co.

Total Liabilities & Stockholders' Equity

Peanut Co.

$

S

$

$

0

Snoopy Co.

0 S

0 S

0

$

0 $

0

0

S

0 S

0 $

Consolidation Entries

CR

0 S

DR

0

0

S

0 S

0 S

S

0

Consolidated

0 $

0 $

0 $

0

0

0

0

0

0

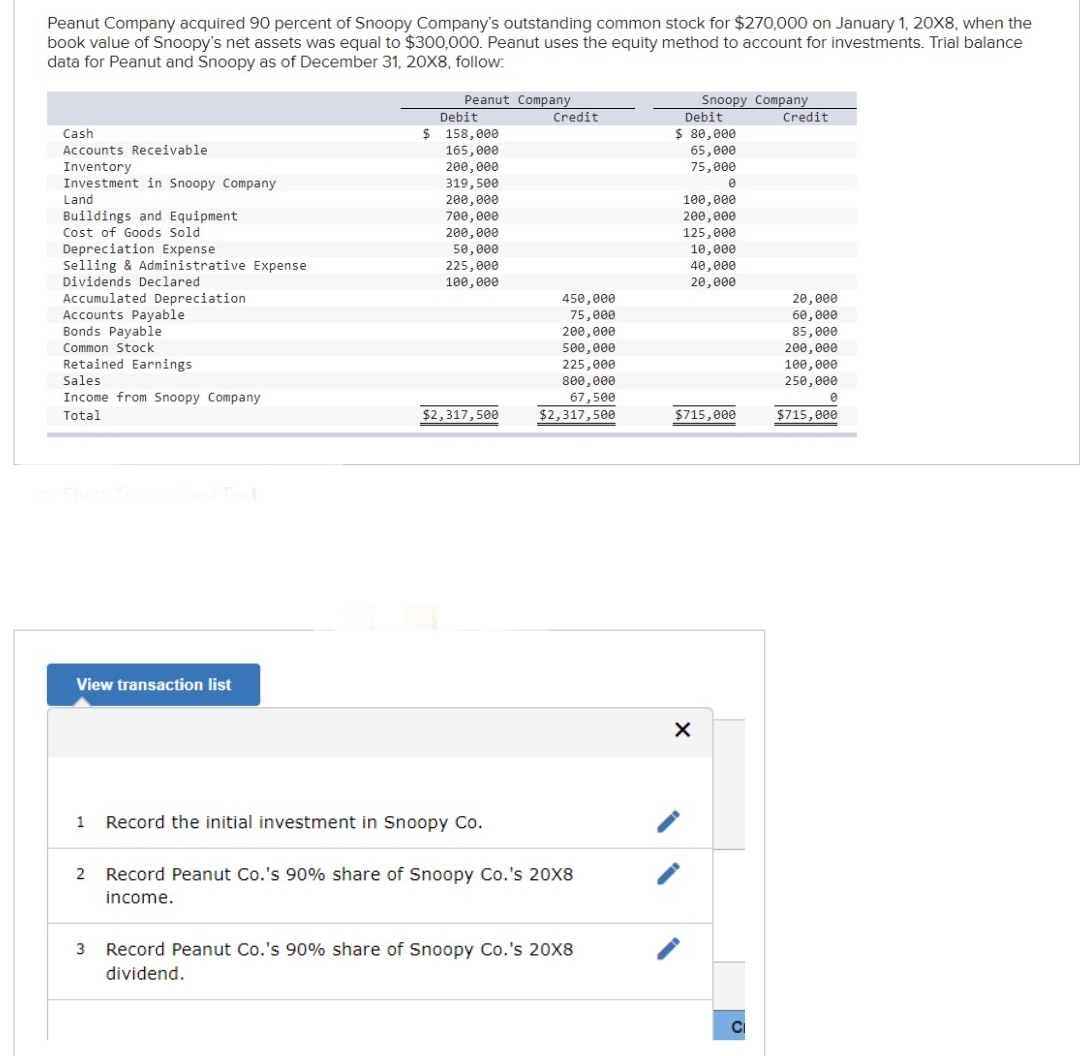

Transcribed Image Text:Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $270,000 on January 1, 20X8, when the

book value of Snoopy's net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance

data for Peanut and Snoopy as of December 31, 20X8, follow:

Cash

Accounts Receivable

Inventory

Investment in Snoopy Company

Land

Lang

Buildings and Equipment

Cost of Goods Sold

Depreciation Expense

Selling & Administrative Expense

Dividends Declared

Accumulated Depreciation

Accounts Payable

Bonds Payable

Common Stock

Retained Earnings

Sales

Income from Snoopy Company

Total

Show Transcribed Text

View transaction list

Peanut Company

Debit

$ 158,000

165,000

200,000

319,500

200,000

700,000

200,000

50,000

225,000

100,000

$2,317,500

Record the initial investment in Snoopy Co.

Credit

450,000

75,000

200,000

500,000

225,000

800,000

67,500

$2,317,500

2 Record Peanut Co.'s 90% share of Snoopy Co.'s 20X8

income.

3 Record Peanut Co.'s 90% share of Snoopy Co.'s 20X8

dividend.

Snoopy Company

Debit

Credit

$ 80,000

65,000

75,000

e

100,000

200,000

125,000

10,000

40,000

20,000

$715,000

X

CI

20,000

60,000

85,000

200,000

100,000

250,000

$715,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning