O $853,623 O $896,325 O$1.128,600

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 8DQ

Related questions

Question

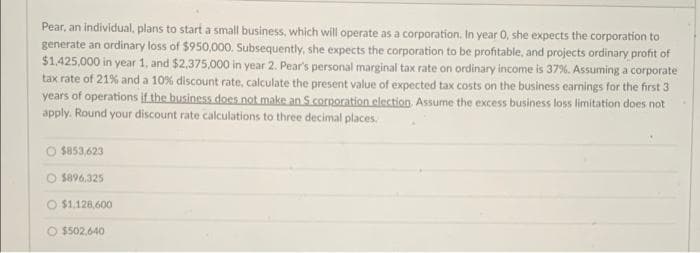

Transcribed Image Text:Pear, an individual, plans to start a small business, which will operate as a corporation. In year 0, she expects the corporation to

generate an ordinary loss of $950,000. Subsequently, she expects the corporation to be profitable, and projects ordinary profit of

$1.425,000 in year 1, and $2,375.000 in year 2. Pear's personal marginal tax rate on ordinary income is 37%. Assuming a corporate

tax rate of 21% and a 10% discount rate, calculate the present value of expected tax costs on the business earnings for the first 3

years of operations if the business does not make an S corporation election Assume the excess business loss limitation does not

apply. Round your discount rate calculations to three decimal places.

O sas3,623

O $896,325

O $1.128,600

O $502.640

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you