Pensacola Inc. purchased equipment on January 1, 2016 for $135,000.After 3 years Pensacola exchanged the equioment for a truck from Mami, inc. in a exchange. The balance in the Accumulated Depreciation account at the time of the exchange was $75,000 Assume the exchange lacks commercial substance. At the time of the exchange, the fair value of the equipment was $77,000 and the fair value of the truck was $57,000. Miami paid $20,000 cashvboot to Pensacola monetan What is the cost basis of the truck acquired by Pensacola? $44,415 $52,585 O $57,000 O $40,000 O None of the above

Pensacola Inc. purchased equipment on January 1, 2016 for $135,000.After 3 years Pensacola exchanged the equioment for a truck from Mami, inc. in a exchange. The balance in the Accumulated Depreciation account at the time of the exchange was $75,000 Assume the exchange lacks commercial substance. At the time of the exchange, the fair value of the equipment was $77,000 and the fair value of the truck was $57,000. Miami paid $20,000 cashvboot to Pensacola monetan What is the cost basis of the truck acquired by Pensacola? $44,415 $52,585 O $57,000 O $40,000 O None of the above

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 32CE

Related questions

Question

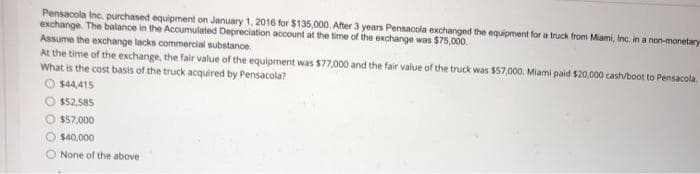

Transcribed Image Text:Pensacola Inc. purchased equipment on January 1, 2016 for $135,000. After 3 years Pensacola exchanged the equipment for a truck from Miami, Inc., in a non-monetary

exchange. The balance in the Accumulated Depreciation account at the time of the exchange was $75,000.

Assume the exchange lacks commercial substance.

At the time of the exchange, the fair value of the equipment was $77,000 and the fair value of the truck was $57,000, Miami paid $20,000 cash/boot to Pensacola.

What is the cost basis of the truck acquired by Pensacola?

O $44,415

$52,585

O $57,000

$40,000

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College