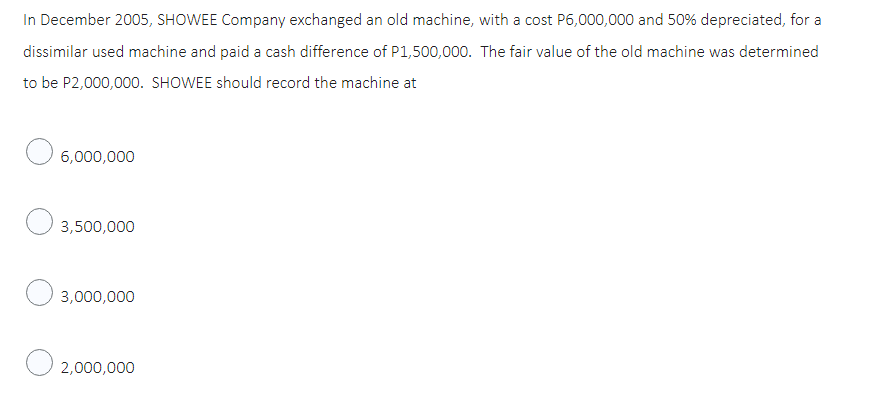

In December 2005, SHOWEE Company exchanged an old machine, with a cost P6,000,000 and 50% depreciated, for a dissimilar used machine and paid a cash difference of P1,500,000. The fair value of the old machine was determined to be P2,000,000. SHOWEE should record the machine at O 6,000,000 3,500,000 3,000,000

In December 2005, SHOWEE Company exchanged an old machine, with a cost P6,000,000 and 50% depreciated, for a dissimilar used machine and paid a cash difference of P1,500,000. The fair value of the old machine was determined to be P2,000,000. SHOWEE should record the machine at O 6,000,000 3,500,000 3,000,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 6MC: Ashton Company exchanged a nonmonetary asset with a cost of 30,000 and accumulated depreciation of...

Related questions

Question

Transcribed Image Text:In December 2005, SHOWEE Company exchanged an old machine, with a cost P6,000,000 and 50% depreciated, for a

dissimilar used machine and paid a cash difference of P1,500,000. The fair value of the old machine was determined

to be P2,000,000. SHOWEE should record the machine at

6,000,000

3,500,000

3,000,000

2,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College