%24 MY COURSES MENO PARENTS STAFF ADMIN Randall's refrigerator stopped working and he needs a new one right away. He found a highly rated refrigerator that will fit his needs for $1,800. He has $500 in savings and can afford up to $125 more per month in his budget. He is concerned about using up his savings and not having any emergency money. He is also worried abut pushing his monthly budget to the limit. Randall's credit card has an APR of 18% and would require a minimum monthly payment of $40 for this purchase. Help Randall consider his options and make a smart decision. • Option 1: Don't use savings and pay the minimum $40 per month. • Option 2: Don't use savings and pay $125 per month. • Option 3: Use the $500 savings and pay the minimum $40 per month. • Option 4: Use the $500 savings and pay $125 per month. Option 1 Option 2 Option 3 Option 4 Initial Balance $1,800 $1,800 $1,800 - $500 = $1,300 $1,800 $500 = $1,300 Monthly Payment $40 $125 $40 $125 75 months = 18 months = 45 months = 12 months = Time to Pay Off + year(s) : year(s) + year(s) + year(s) Total Paid $3,020 $2,043 $2,296 $1,924 Interest Paid $4 $4 24 $4

%24 MY COURSES MENO PARENTS STAFF ADMIN Randall's refrigerator stopped working and he needs a new one right away. He found a highly rated refrigerator that will fit his needs for $1,800. He has $500 in savings and can afford up to $125 more per month in his budget. He is concerned about using up his savings and not having any emergency money. He is also worried abut pushing his monthly budget to the limit. Randall's credit card has an APR of 18% and would require a minimum monthly payment of $40 for this purchase. Help Randall consider his options and make a smart decision. • Option 1: Don't use savings and pay the minimum $40 per month. • Option 2: Don't use savings and pay $125 per month. • Option 3: Use the $500 savings and pay the minimum $40 per month. • Option 4: Use the $500 savings and pay $125 per month. Option 1 Option 2 Option 3 Option 4 Initial Balance $1,800 $1,800 $1,800 - $500 = $1,300 $1,800 $500 = $1,300 Monthly Payment $40 $125 $40 $125 75 months = 18 months = 45 months = 12 months = Time to Pay Off + year(s) : year(s) + year(s) + year(s) Total Paid $3,020 $2,043 $2,296 $1,924 Interest Paid $4 $4 24 $4

Elementary Algebra

17th Edition

ISBN:9780998625713

Author:Lynn Marecek, MaryAnne Anthony-Smith

Publisher:Lynn Marecek, MaryAnne Anthony-Smith

Chapter6: Polynomials

Section6.2: Use Multiplication Properties Of Exponents

Problem 168E: Depreciation Once a new car is driven away from the dealer, it begins to lose value. Each year, a...

Related questions

Question

Transcribed Image Text:Randall has turned to you for advice. Which option do you suggest, or do you have a different option in mind? Be sure to explain to Randall why you

think he should choose the option you suggest. Remember, Randall is concerned about not having any money for emergencies and pushing his

monthly budget to the limit.

</>

I

U

T:

Option you suggest:

Reasoning:

Transcribed Image Text:%24

%24

%24

%24

MY COURSES MENU

STODENI LIPE

PARENTS

STAFF

ADMIN

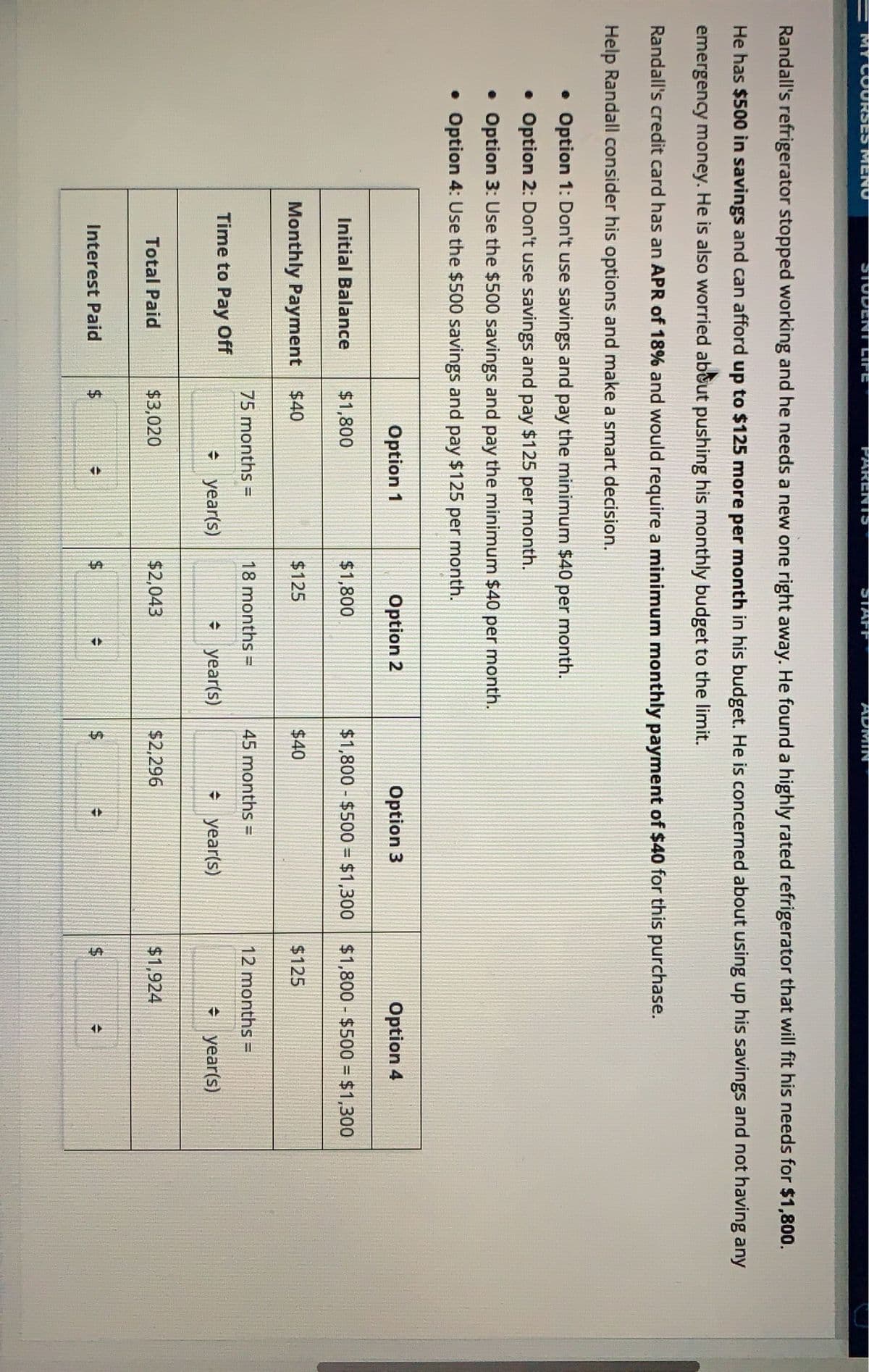

Randall's refrigerator stopped working and he needs a new one right away. He found a highly rated refrigerator that will fit his needs for $1,800.

He has $500 in savings and can afford up to $125 more per month in his budget. He is concerned about using up his savings and not having any

emergency money. He is also worried about pushing his monthly budget to the limit.

Randall's credit card has an APR of 18% and would require a minimum monthly payment of $40 for this purchase.

Help Randall consider his options and make a smart decision.

• Option 1: Don't use savings and pay the minimum $40 per month.

• Option 2: Don't use savings and pay $125 per month.

• Option 3: Use the $500 savings and pay the minimum $40 per month.

• Option 4: Use the $500 savings and pay $125 per month.

Option 1

Option 2

Option 3

Option 4

Initial Balance

$1,800

$1,800

$1,800 $500 = $1,300 $1,800 - $500 = $1,300

%3D

Monthly Payment $40

$125

$40

$125

75 months =

18 months =

45 months =

12 months =

%3D

Time to Pay Off

+ year(s)

e year(s)

+ year(s)

+ year(s)

Total Paid

$3,020

$2,043

$2,296

$1,924

Interest Paid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Elementary Algebra

Algebra

ISBN:

9780998625713

Author:

Lynn Marecek, MaryAnne Anthony-Smith

Publisher:

OpenStax - Rice University

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Elementary Algebra

Algebra

ISBN:

9780998625713

Author:

Lynn Marecek, MaryAnne Anthony-Smith

Publisher:

OpenStax - Rice University

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill