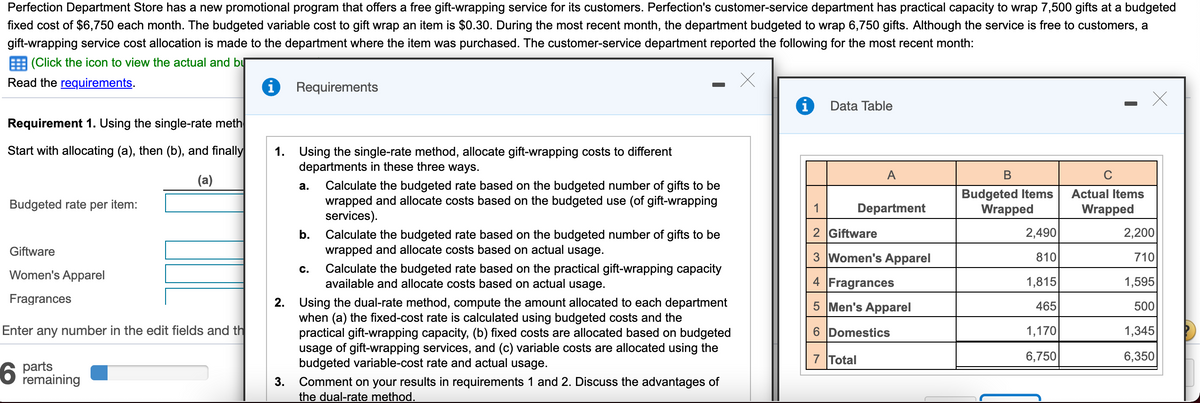

Perfection Department Store has a new promotional program that offers a free gift-wrapping service for its customers. Perfection's customer-service department has practical capacity to wrap 7,500 gifts at a budgeted fixed cost of $6,750 each month. The budgeted variable cost to gift wrap an item is $0.30. During the most recent month, the department budgeted to wrap 6,750 gifts. Although the service is free to customers, a gift-wrapping service cost allocation is made to the department where the item was purchased. The customer-service department reported the following for the most recent month: E (Click the icon to view the actual and b Read the requirements. Requirements Data Table %3 Requirement 1. Using the single-rate meth Start with allocating (a), then (b), and finally 1. Using the single-rate method, allocate gift-wrapping costs to different departments in these three ways. A B (a) Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on the budgeted use (of gift-wrapping services). b. Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on actual usage. c. Calculate the budgeted rate based on the practical gift-wrapping capacity available and allocate costs based on actual usage. a. Budgeted Items Actual Items Wrapped Budgeted rate per item: Department Wrapped 2 Giftware 2,490 2,200 Giftware 3 Women's Apparel 810 710 Women's Apparel 4 Fragrances 1,815 1,595 500 Fragrances 2. Using the dual-rate method, compute the amount allocated to each department when (a) the fixed-cost rate is calculated using budgeted costs and the practical gift-wrapping capacity, (b) fixed costs are allocated based on budgeted usage of gift-wrapping services, and (c) variable costs are allocated using the budgeted variable-cost rate and actual usage. 5 Men's Apparel 465 Enter any number in the edit fields and th 6 Domestics 1,170 1,345 7 Total 6,750 6,350 parts remaining 3. Comment on your results in requirements 1 and 2. Discuss the advantages of the dual-rate method.

Perfection Department Store has a new promotional program that offers a free gift-wrapping service for its customers. Perfection's customer-service department has practical capacity to wrap 7,500 gifts at a budgeted fixed cost of $6,750 each month. The budgeted variable cost to gift wrap an item is $0.30. During the most recent month, the department budgeted to wrap 6,750 gifts. Although the service is free to customers, a gift-wrapping service cost allocation is made to the department where the item was purchased. The customer-service department reported the following for the most recent month: E (Click the icon to view the actual and b Read the requirements. Requirements Data Table %3 Requirement 1. Using the single-rate meth Start with allocating (a), then (b), and finally 1. Using the single-rate method, allocate gift-wrapping costs to different departments in these three ways. A B (a) Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on the budgeted use (of gift-wrapping services). b. Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on actual usage. c. Calculate the budgeted rate based on the practical gift-wrapping capacity available and allocate costs based on actual usage. a. Budgeted Items Actual Items Wrapped Budgeted rate per item: Department Wrapped 2 Giftware 2,490 2,200 Giftware 3 Women's Apparel 810 710 Women's Apparel 4 Fragrances 1,815 1,595 500 Fragrances 2. Using the dual-rate method, compute the amount allocated to each department when (a) the fixed-cost rate is calculated using budgeted costs and the practical gift-wrapping capacity, (b) fixed costs are allocated based on budgeted usage of gift-wrapping services, and (c) variable costs are allocated using the budgeted variable-cost rate and actual usage. 5 Men's Apparel 465 Enter any number in the edit fields and th 6 Domestics 1,170 1,345 7 Total 6,750 6,350 parts remaining 3. Comment on your results in requirements 1 and 2. Discuss the advantages of the dual-rate method.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 6CE: Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following...

Related questions

Question

can you help me

C.5Q2

Transcribed Image Text:Perfection Department Store has a new promotional program that offers a free gift-wrapping service for its customers. Perfection's customer-service department has practical capacity to wrap 7,500 gifts at a budgeted

fixed cost of $6,750 each month. The budgeted variable cost to gift wrap an item is $0.30. During the most recent month, the department budgeted to wrap 6,750 gifts. Although the service is free to customers, a

gift-wrapping service cost allocation is made to the department where the item was purchased. The customer-service department reported the following for the most recent month:

E (Click the icon to view the actual and by

Read the requirements.

Requirements

Data Table

Requirement 1. Using the single-rate meth

Start with allocating (a), then (b), and finally

1. Using the single-rate method, allocate gift-wrapping costs to different

departments in these three ways.

A

В

C

(a)

Calculate the budgeted rate based on the budgeted number of gifts to be

wrapped and allocate costs based on the budgeted use (of gift-wrapping

services).

а.

Budgeted Items

Wrapped

Actual Items

Budgeted rate per item:

1

Department

Wrapped

b.

2 Giftware

2,490

2,200

Calculate the budgeted rate based on the budgeted number of gifts to be

wrapped and allocate costs based on actual usage.

Giftware

3 Women's Apparel

810

710

Calculate the budgeted rate based on the practical gift-wrapping capacity

available and allocate costs based on actual usage.

с.

Women's Apparel

4 Fragrances

1,815

1,595

Fragrances

2. Using the dual-rate method, compute the amount allocated to each department

when (a) the fixed-cost rate is calculated using budgeted costs and the

practical gift-wrapping capacity, (b) fixed costs are allocated based on budgeted

usage of gift-wrapping services, and (c) variable costs are allocated using the

budgeted variable-cost rate and actual usage.

5 Men's Apparel

465

500

Enter any number in the edit fields and th

6 Domestics

1,170

1,345

7 Total

6,750

6,350

parts

remaining

Comment on your results in requirements 1 and 2. Discuss the advantages of

the dual-rate method.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning