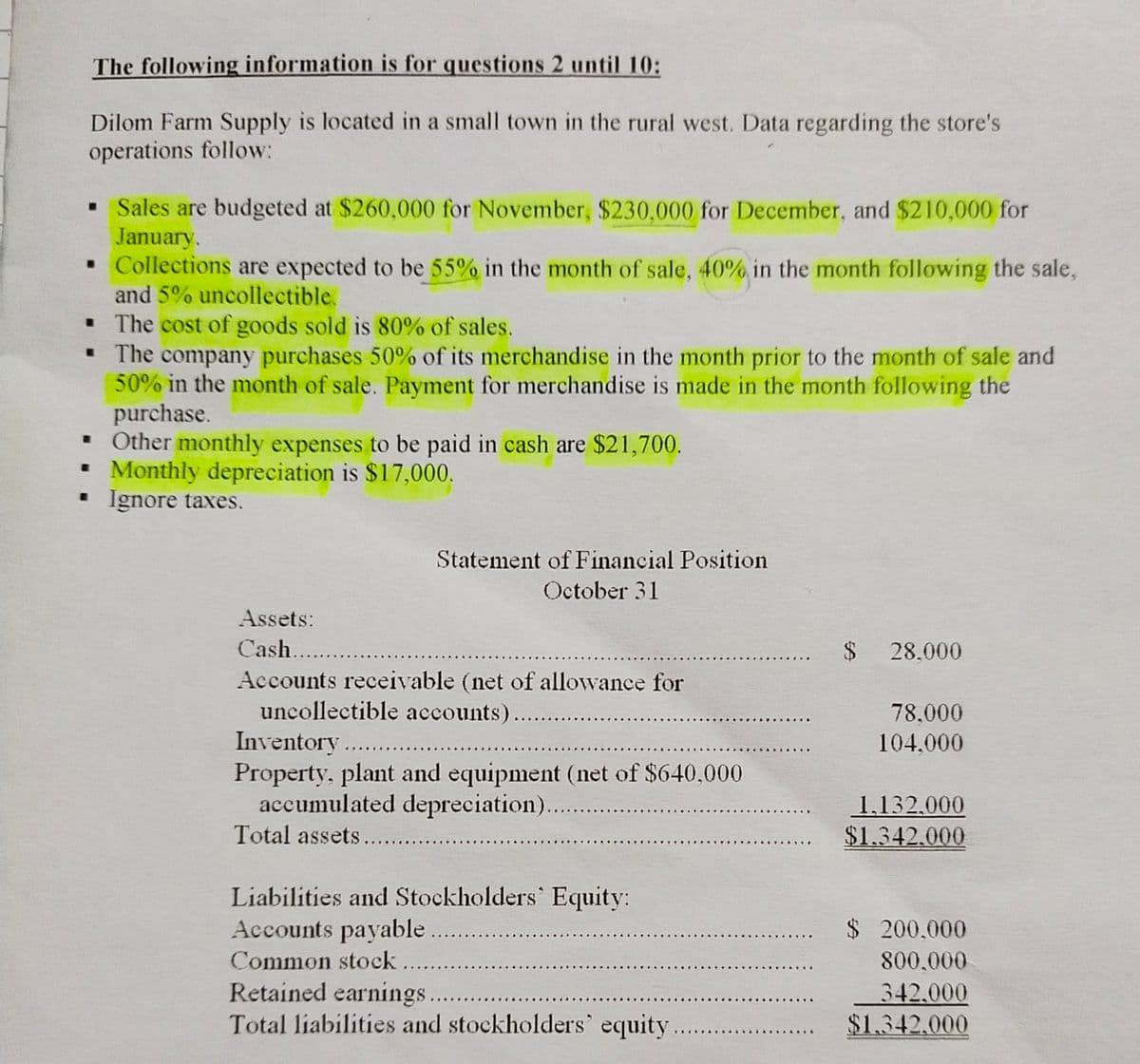

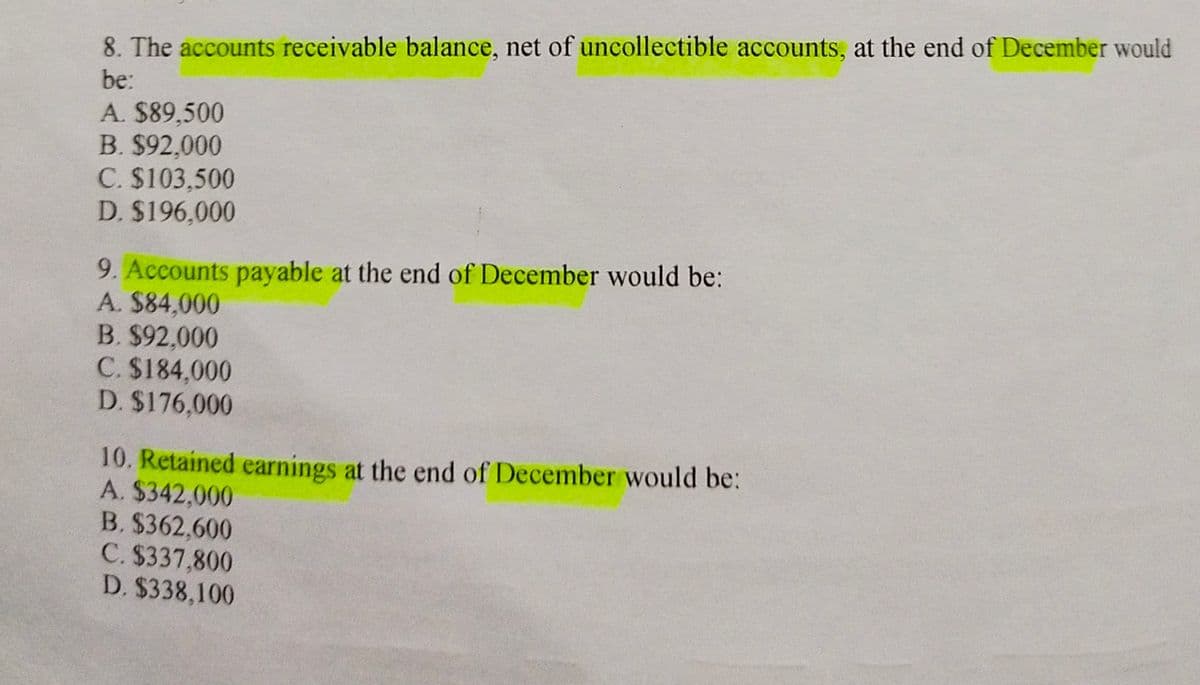

The following information is for questions 2 until 10: Dilom Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow: • Sales are budgeted at $260,000 for November, $230,000 for December, and $210,000 for January. • Collections are expected to be 55% in the month of sale, 40% in the month following the sale, and 5% uncollectible. • The cost of goods sold is 80% of sales. • The company purchases 50% of its merchandise in the month prior to the month of sale and 50% in the month of sale. Payment for merchandise is made in the month following the purchase. • Other monthly expenses to be paid in cash are $21,700. Monthly depreciation is $17,000. • Ignore taxes. Statement of Financial Position October 31 Assets: Cash. $ 28.000 Accounts receivable (net of allowance for uncollectible accounts) Inventory. 78.000 104.000 Property. plant and equipment (net of $640,000 accumulated depreciation).. Total assets... 1.132.000 $1,342,000 Liabilities and Stockholders Equity: Accounts payable $ 200.000 Common stock 800.000 Retained earnings. Total liabilities and stockholders' equity 342.000 $1,342.000

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images