Perform ratio analysis to the financial statements

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.2EX

Related questions

Question

Perform ratio analysis to the financial statements

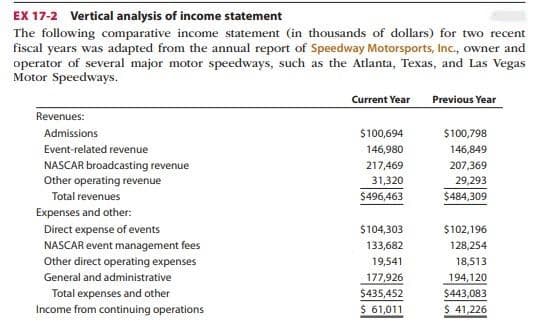

Transcribed Image Text:EX 17-2 Vertical analysis of income statement

The following comparative income statement (in thousands of dollars) for two recent

fiscal years was adapted from the annual report of Speedway Motorsports, Inc., owner and

operator of several major motor speedways, such as the Atlanta, Texas, and Las Vegas

Motor Speedways.

Previous Year

Revenues:

Admissions

Event-related revenue

NASCAR broadcasting revenue

Other operating revenue

Total revenues

Expenses and other:

Direct expense of events

NASCAR event management fees

Other direct operating expenses

General and administrative

Total expenses and other

Income from continuing operations

Current Year

$100,694

146,980

217,469

31,320

$496,463

$104,303

133,682

19,541

177,926

$435,452

$ 61,011

$100,798

146,849

207,369

29,293

$484,309

$102,196

128,254

18,513

194,120

$443,083

$ 41,226

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning