You are a Toronto based tour operator with a series of flights starting up from Vancouver to Montego Bay, Jamaica. The charter will operate every Sunday and the duration of your package is 7 nights. The aircraft has 179 seats and the anticipated load factor is 81%. The first rotation is Nov 06, 2022, and the last flight rotation is on April 30, 2023. Operating costs are $100,000 for each live/live and $85,000 for rotations with a ferry portion. Air taxes per person are $220. The hotel has a rate of $121 per person per night plus $12 per person per night for hotel taxes, charges and service fees. Transfer (airport to hotel return) per person is $46. Credit card fees are high, so we need to cost them in at $6. 00 per person “below the line” (non-commissionable). Travel Agent commission is 8%. Find:- 1) a. Air Cost Calculation b Hotel Cost Calculation c. Transfer Cost Calculation d. Margin Calculation (Net Margin amount pp = Add PP net costs and margin to get - Final Net Selling Price PP = $ ) e. Retail (Travel Agent) Commission Calculation ( Commission amount pp = Add Final Net Selling Price PP to get - Final Gross Selling Price PP ) f. Tax and Service Charges Calculation(Final Gross Selling Price PP = ? Final T&SC PP = ?

Costing details to use for the assignment, all are Canadian dollars-

- You are a Toronto based tour operator with a series of flights starting up from Vancouver to Montego Bay, Jamaica.

- The charter will operate every Sunday and the duration of your package is 7 nights. The aircraft has 179 seats and the anticipated load factor is 81%.

- The first rotation is Nov 06, 2022, and the last flight rotation is on April 30, 2023.

- Operating costs are $100,000 for each live/live and $85,000 for rotations with a ferry portion.

- Air taxes per person are $220.

- The hotel has a rate of $121 per person per night plus $12 per person per night for hotel taxes, charges and service fees.

- Transfer (airport to hotel return) per person is $46.

- Credit card fees are high, so we need to cost them in at $6. 00 per person “below the line” (non-commissionable).

- Travel Agent commission is 8%.

Find:-

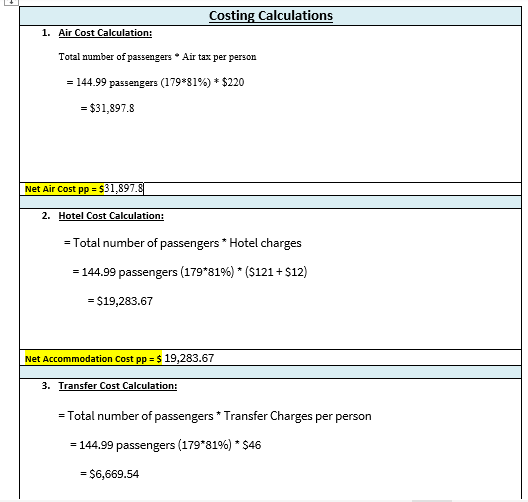

1) a. Air Cost Calculation

b Hotel Cost Calculation

c. Transfer Cost Calculation

d. Margin Calculation (Net Margin amount pp = Add PP net costs and margin to get - Final Net Selling Price PP = $ )

e. Retail (Travel Agent) Commission Calculation ( Commission amount pp = Add Final Net Selling Price PP to get - Final Gross Selling Price PP )

f. Tax and Service Charges Calculation(Final Gross Selling Price PP = ? Final T&SC PP = ?

Note:-

All Answers Needed in Soft Form & Don*T Copy From others.

|

4. Margin Calculation:

|

|

Net Margin amount pp = $ Final Net Selling Price PP = $ |

|

|

|

5. Retail (Travel Agent) Commission Calculation:

|

|

Commission amount pp = $ Final Gross Selling Price PP $ |

|

|

|

6. Tax and Service Charges Calculation:

|

|

Final Tax, fees and service charges total Amount PP= $ |

|

|

|

Final Gross Selling Price PP = $ Final T&SC PP = $ |

NOTE:

NEED PART 4,5 & 6 ONLY ,I uploaded part a,b,c solved for Refrences

Step by step

Solved in 2 steps

Final T&SC PP = $ ? where answer for this.?