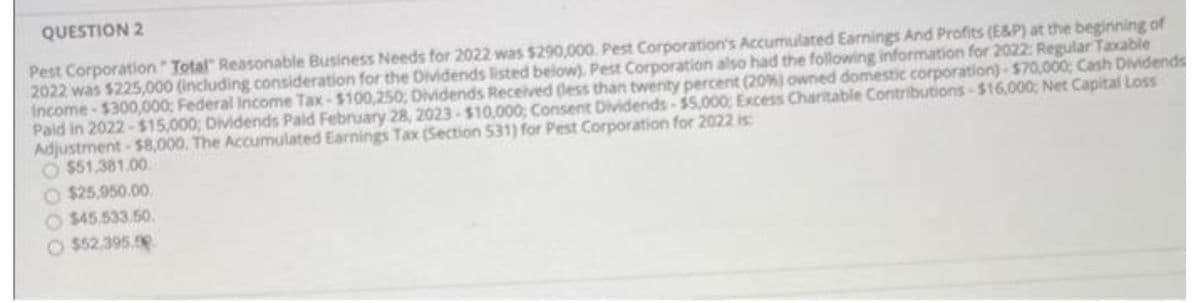

Pest Corporation Total Reasonable Business Needs for 2022 was $290,000. Pest Corporation's Accu 2022 was $225,000 (including consideration for the Dividends listed below). Pest Corporation also had the following information for 2022: Regular Taxable Income $300,000; Federal Income Tax-$100,250; Dividends Received (less than twenty percent (20%) owned domestic corporation)-$70,000; Cash Dividends Paid in 2022-$15,000; Dividends Pald February 28, 2023-$10,000; Consent Dividends $5,000; Excess Charitable Contributions-$16,000; Net Capital Loss Adjustment-$8,000. The Accumulated Earnings Tax (Section 531) for Pest Corporation for 2022 is: O $51,381.00. O$25,950.00 O $45.533.50. O$52.395.00

Pest Corporation Total Reasonable Business Needs for 2022 was $290,000. Pest Corporation's Accu 2022 was $225,000 (including consideration for the Dividends listed below). Pest Corporation also had the following information for 2022: Regular Taxable Income $300,000; Federal Income Tax-$100,250; Dividends Received (less than twenty percent (20%) owned domestic corporation)-$70,000; Cash Dividends Paid in 2022-$15,000; Dividends Pald February 28, 2023-$10,000; Consent Dividends $5,000; Excess Charitable Contributions-$16,000; Net Capital Loss Adjustment-$8,000. The Accumulated Earnings Tax (Section 531) for Pest Corporation for 2022 is: O $51,381.00. O$25,950.00 O $45.533.50. O$52.395.00

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 51P

Related questions

Question

Transcribed Image Text:QUESTION 2

Pest Corporation Total Reasonable Business Needs for 2022 was $290,000. Pest Corporation's Accumulated Earnings And Profits (E&P) at the beginning of

2022 was $225,000 (including consideration for the Dividends listed below), Pest Corporation also had the following information for 2022: Regular Taxable

Income-$300,000; Federal Income Tax-$100,250; Dividends Received (less than twenty percent (20%) owned domestic corporation)-$70,000; Cash Dividends

Paid in 2022-$15,000; Dividends Pald February 28, 2023-$10,000; Consent Dividends $5,000; Excess Charitable Contributions-$16,000; Net Capital Loss

Adjustment-$8,000. The Accumulated Earnings Tax (Section 531) for Pest Corporation for 2022 is:

$51,381.00

$25,950.00

$45,533.50.

$52.395.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning