sing the information from the requirements above, complete the 'Analysis'. (Calculate the ratios to the nearest 1 decimal lace.) Analyze the following for Displays Incorporated: Suppose Displays Incorporated decided to maintain its internal records using FIFO but to use LIFO for external reporting. Assuming e ending balance of inventory under LIFO would have been $114,000, calculate the LIFO reserve. FO reserve is: Assume Displays Incorporated $77,000 beginning balance of inventory comes from the base year with a cost index of 1.00. The st index at the end of 2021 of 1.1. Calculate the amount the company would report for inventory using dollar-value LIFO. ding inventory using dollar-value LIFO: Indicate whether each of the amounts below would be higher or lower when reporting inventory using LIFO (or dollar-value LIFO) stead of FIFO in periods of rising inventory costs and stable inventory quantities. Inventory turnover ratio Average days in inventory Gross profit ratio < Balance Sheet Analysis >

sing the information from the requirements above, complete the 'Analysis'. (Calculate the ratios to the nearest 1 decimal lace.) Analyze the following for Displays Incorporated: Suppose Displays Incorporated decided to maintain its internal records using FIFO but to use LIFO for external reporting. Assuming e ending balance of inventory under LIFO would have been $114,000, calculate the LIFO reserve. FO reserve is: Assume Displays Incorporated $77,000 beginning balance of inventory comes from the base year with a cost index of 1.00. The st index at the end of 2021 of 1.1. Calculate the amount the company would report for inventory using dollar-value LIFO. ding inventory using dollar-value LIFO: Indicate whether each of the amounts below would be higher or lower when reporting inventory using LIFO (or dollar-value LIFO) stead of FIFO in periods of rising inventory costs and stable inventory quantities. Inventory turnover ratio Average days in inventory Gross profit ratio < Balance Sheet Analysis >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Requirement

General

Journal

LIFO reserve is:

General

Ledger

Trial Balance

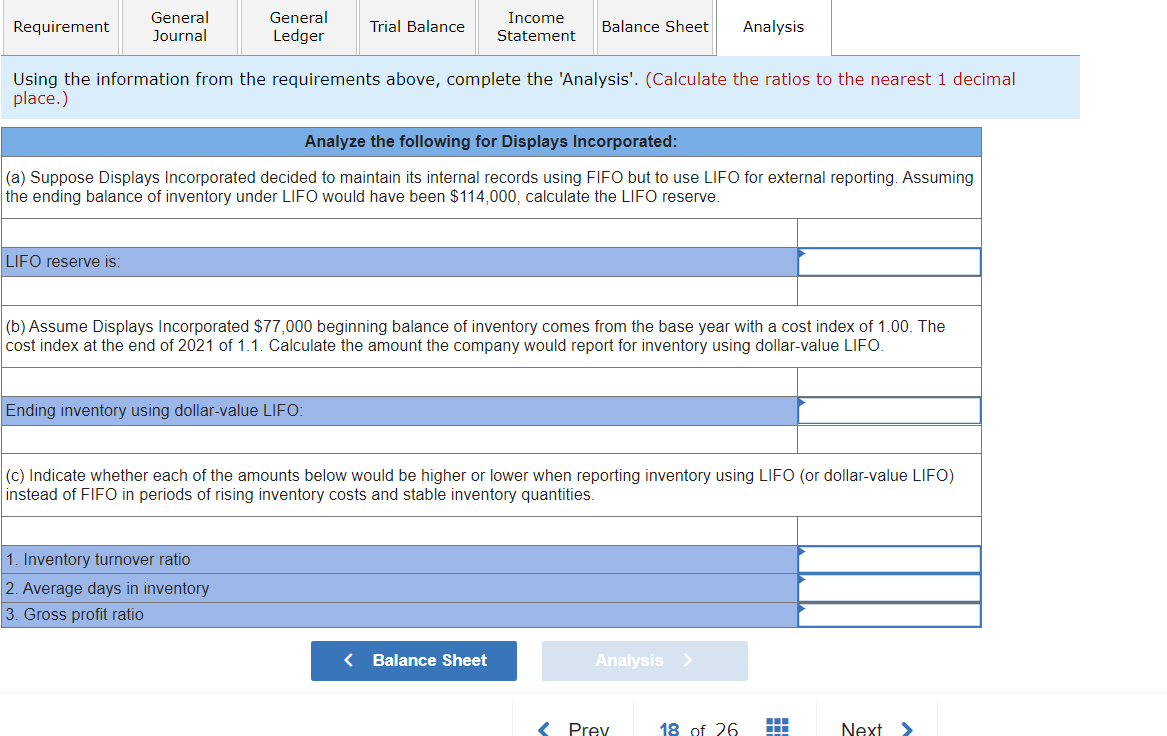

Using the information from the requirements above, complete the 'Analysis'. (Calculate the ratios to the nearest 1 decimal

place.)

Analyze the following for Displays Incorporated:

(a) Suppose Displays Incorporated decided to maintain its internal records using FIFO but to use LIFO for external reporting. Assuming

the ending balance of inventory under LIFO would have been $114,000, calculate the LIFO reserve.

Ending inventory using dollar-value LIFO:

Income

Statement

1. Inventory turnover ratio

2. Average days in inventory

3. Gross profit ratio

Balance Sheet Analysis

(b) Assume Displays Incorporated $77,000 beginning balance of inventory comes from the base year with a cost index of 1.00. The

cost index at the end of 2021 of 1.1. Calculate the amount the company would report for inventory using dollar-value LIFO.

(c) Indicate whether each of the amounts below would be higher or lower when reporting inventory using LIFO (or dollar-value LIFO)

instead of FIFO in periods of rising inventory costs and stable inventory quantities.

< Balance Sheet

Analysis >

Prev

18 of 26

▬

Next >

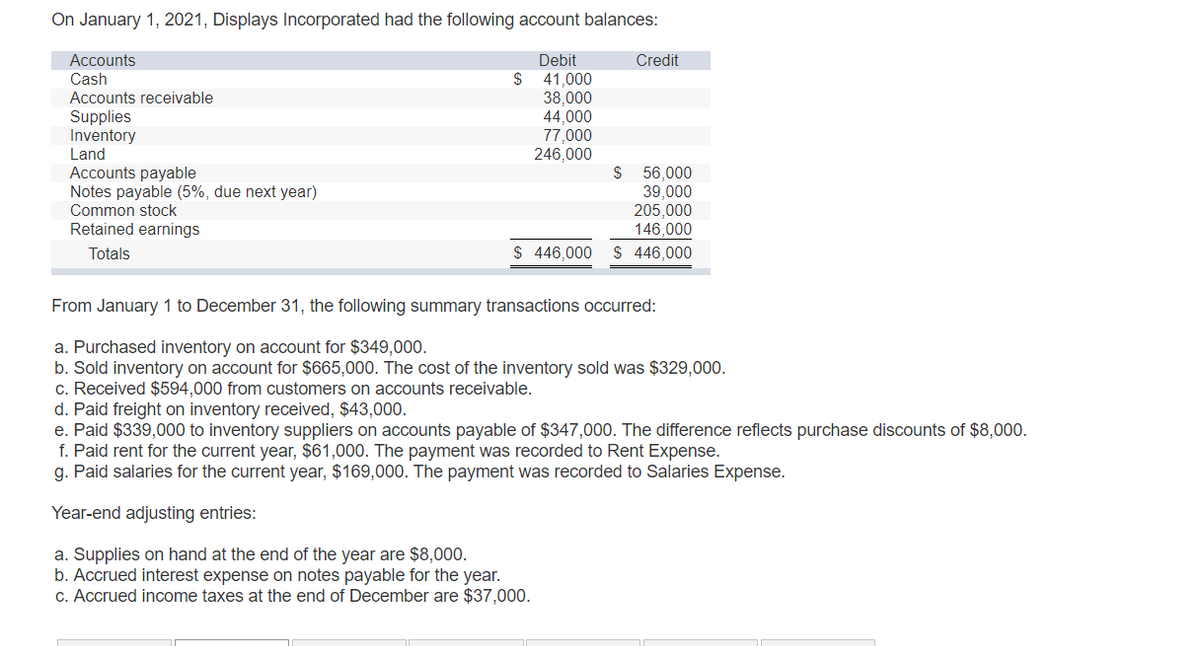

Transcribed Image Text:On January 1, 2021, Displays Incorporated had the following account balances:

Debit

41,000

38,000

44,000

77,000

246,000

Accounts

Cash

Accounts receivable

Supplies

Inventory

Land

Accounts payable

Notes payable (5%, due next year)

Common stock

Retained earnings

Totals

$

Credit

$ 56,000

39,000

205,000

146,000

$ 446,000 $ 446,000

From January 1 to December 31, the following summary transactions occurred:

a. Purchased inventory on account for $349,000.

b. Sold inventory on account for $665,000. The cost of the inventory sold was $329,000.

c. Received $594,000 from customers on accounts receivable.

d. Paid freight on inventory received, $43,000.

e. Paid $339,000 to inventory suppliers on accounts payable of $347,000. The difference reflects purchase discounts of $8,000.

f. Paid rent for the current year, $61,000. The payment was recorded to Rent Expense.

g. Paid salaries for the current year, $169,000. The payment was recorded to Salaries Expense.

Year-end adjusting entries:

a. Supplies on hand at the end of the year are $8,000.

b. Accrued interest expense on notes payable for the year.

c. Accrued income taxes at the end of December are $37,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning