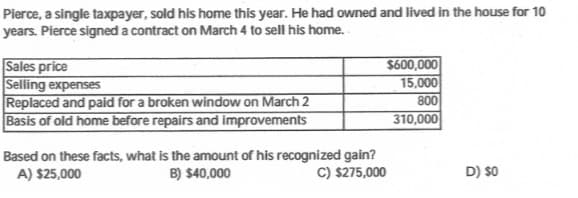

Pierce, a single taxpayer, sold his home this year. He had owned and lived in the house for 10 years. Plerce signed a contract on March 4 to sell his home. Sales price Selling expenses Replaced and paid for a broken window on March 2 Basis of old home before repairs and improvements $600,000 15,000 800 310,000 Based on these facts, what is the amount of his recognized gain? B) $40,000 A) $25,000 C) $275,000 D) $0

Pierce, a single taxpayer, sold his home this year. He had owned and lived in the house for 10 years. Plerce signed a contract on March 4 to sell his home. Sales price Selling expenses Replaced and paid for a broken window on March 2 Basis of old home before repairs and improvements $600,000 15,000 800 310,000 Based on these facts, what is the amount of his recognized gain? B) $40,000 A) $25,000 C) $275,000 D) $0

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 9BCRQ

Related questions

Question

Please solve in accounts

Transcribed Image Text:Pierce, a single taxpayer, sold his home this year. He had owned and lived in the house for 10

years. Pierce signed a contract on March 4 to sell his home.

$600,000

15,000

Sales price

Selling expenses

Replaced and paid for a broken window on March 2

Basis of old home before repairs and improvements

800

310,000

Based on these facts, what is the amount of his recognized gain?

B) $40,000

C) $275,000

A) $25,000

D) $0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you