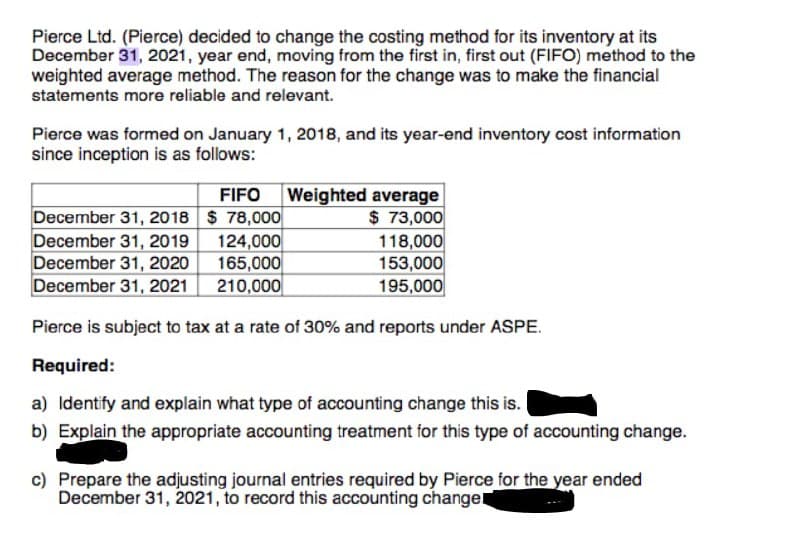

Pierce Ltd. (Pierce) decided to change the costing method for its inventory at its December 31, 2021, year end, moving from the first in, first out (FIFO) method to the weighted average method. The reason for the change was to make the financial statements more reliable and relevant. Pierce was formed on January 1, 2018, and its year-end inventory cost information since inception is as follows: December 31, 2018 $ 78,000 December 31, 2019 December 31, 2020 December 31, 2021 124,000 165,000 210,000 FIFO Weighted average $ 73,000 118,000 153,000 195,000 Pierce is subject to tax at a rate of 30% and reports under ASPE. Required: a) Identify and explain what type of accounting change this is. b) Explain the appropriate accounting treatment for this type of accounting change. c) Prepare the adjusting journal entries required by Pierce for the year ended December 31, 2021, to record this accounting change

Pierce Ltd. (Pierce) decided to change the costing method for its inventory at its December 31, 2021, year end, moving from the first in, first out (FIFO) method to the weighted average method. The reason for the change was to make the financial statements more reliable and relevant. Pierce was formed on January 1, 2018, and its year-end inventory cost information since inception is as follows: December 31, 2018 $ 78,000 December 31, 2019 December 31, 2020 December 31, 2021 124,000 165,000 210,000 FIFO Weighted average $ 73,000 118,000 153,000 195,000 Pierce is subject to tax at a rate of 30% and reports under ASPE. Required: a) Identify and explain what type of accounting change this is. b) Explain the appropriate accounting treatment for this type of accounting change. c) Prepare the adjusting journal entries required by Pierce for the year ended December 31, 2021, to record this accounting change

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 14RE: Refer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a...

Related questions

Question

100%

I need the answer as soon as possible

Transcribed Image Text:Pierce Ltd. (Pierce) decided to change the costing method for its inventory at its

December 31, 2021, year end, moving from the first in, first out (FIFO) method to the

weighted average method. The reason for the change was to make the financial

statements more reliable and relevant.

Pierce was formed on January 1, 2018, and its year-end inventory cost information

since inception is as follows:

December 31, 2018 $ 78,000

December 31, 2019

December 31, 2020

December 31, 2021

124,000

165,000

210,000

FIFO Weighted average

$ 73,000

118,000

153,000

195,000

Pierce is subject to tax at a rate of 30% and reports under ASPE.

Required:

a) Identify and explain what type of accounting change this is.

b) Explain the appropriate accounting treatment for this type of accounting change.

c) Prepare the adjusting journal entries required by Pierce for the year ended

December 31, 2021, to record this accounting change

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning