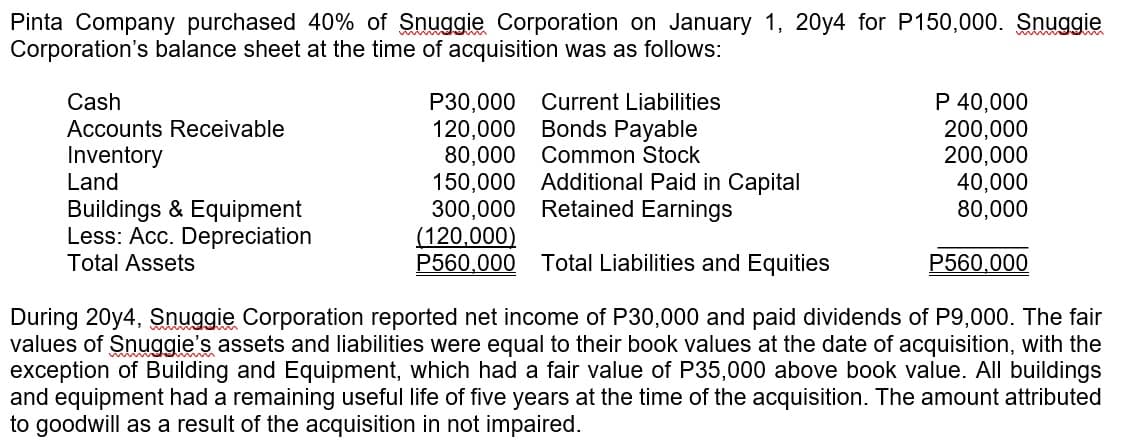

Pinta Company purchased 40% of Snuggie Corporation on January 1, 20y4 for P150,000. Snuggie Corporation's balance sheet at the time of acquisition was as follows: Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Acc. Depreciation Total Assets P30,000 Current Liabilities 120,000 Bonds Payable 80,000 Common Stock 150,000 Additional Paid in Capital Retained Earnings 300,000 (120,000) P560,000 Total Liabilities and Equities P 40,000 200,000 200,000 40,000 80,000 P560,000 During 20y4, Snuggie Corporation reported net income of P30,000 and paid dividends of P9,000. The fair values of Snuggie's assets and liabilities were equal to their book values at the date of acquisition, with the exception of Building and Equipment, which had a fair value of P35,000 above book value. All buildings and equipment had a remaining useful life of five years at the time of the acquisition. The amount attributed to goodwill as a result of the acquisition in not impaired.

Pinta Company purchased 40% of Snuggie Corporation on January 1, 20y4 for P150,000. Snuggie Corporation's balance sheet at the time of acquisition was as follows: Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Acc. Depreciation Total Assets P30,000 Current Liabilities 120,000 Bonds Payable 80,000 Common Stock 150,000 Additional Paid in Capital Retained Earnings 300,000 (120,000) P560,000 Total Liabilities and Equities P 40,000 200,000 200,000 40,000 80,000 P560,000 During 20y4, Snuggie Corporation reported net income of P30,000 and paid dividends of P9,000. The fair values of Snuggie's assets and liabilities were equal to their book values at the date of acquisition, with the exception of Building and Equipment, which had a fair value of P35,000 above book value. All buildings and equipment had a remaining useful life of five years at the time of the acquisition. The amount attributed to goodwill as a result of the acquisition in not impaired.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

- What amount of investment income will Pinta record during 20y4 under the equity method of accounting?

A. 12,800

B. 9,200

C. 15,600

D. 3,600

Transcribed Image Text:Pinta Company purchased 40% of Snuggie Corporation on January 1, 20y4 for P150,000. Snuggie

Corporation's balance sheet at the time of acquisition was as follows:

Cash

Accounts Receivable

Inventory

Land

Buildings & Equipment

Less: Acc. Depreciation

Total Assets

P30,000

120,000

80,000

Current Liabilities

Bonds Payable

Common Stock

150,000 Additional Paid in Capital

300,000 Retained Earnings

(120,000)

P560,000 Total Liabilities and Equities

P 40,000

200,000

200,000

40,000

80,000

P560,000

During 20y4, Snuggie Corporation reported net income of P30,000 and paid dividends of P9,000. The fair

values of Snuggie's assets and liabilities were equal to their book values at the date of acquisition, with the

exception of Building and Equipment, which had a fair value of P35,000 above book value. All buildings

and equipment had a remaining useful life of five years at the time of the acquisition. The amount attributed

to goodwill as a result of the acquisition in not impaired.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub