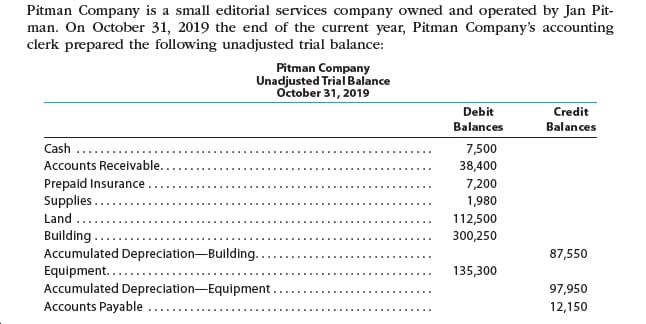

Pitman Company is a small editorial services company owned and operated by Jan Pit- man. On October 31, 2019 the end of the current year, Pitman Company's accounting clerk prepared the following unadjusted trial balance: Pitman Company Unadjusted Triai Balance October 31, 2019 Debit Credit Balances Balances Cash 7,500 Accounts Receivable. 38,400 Prepaid Insurance Supplies. 7,200 1,980 Land 112,500 Building Accumulated Depreciation-Building Equipment.... . Accumulated Depreciation-Equipment Accounts Payable 300,250 87,550 135,300 97,950 12,150 Unearned Rent... 6,750 Jan Pitman, Capital Jan Pitman, Drawing. 371,000 15,000 Fees Earned.... 324,600 Salaries and Wages Expense.. Utilities Expense Advertising Expense 193,370 42,375 22,800 Repairs Expense.. Miscellaneous Expense 17,250 6,075 900,000 900,000 The data needed to determine year-end adjustments are as follows: Unexpired insurance at October 31, $600. Supplies on hand at October 31, $675. Depreciation of building for the year, $12,000 Depreciation of equipment for the year, $8,600. Unearned rent at October 31, $2,250. Accrued salaries and wages at October 31, $2,800. Fees earned but unbilled on October 31, $10,050. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense-Building Depreciation Expense-Equipment, and Supplies Expense 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance

Pitman Company is a small editorial services company owned and operated by Jan Pit- man. On October 31, 2019 the end of the current year, Pitman Company's accounting clerk prepared the following unadjusted trial balance: Pitman Company Unadjusted Triai Balance October 31, 2019 Debit Credit Balances Balances Cash 7,500 Accounts Receivable. 38,400 Prepaid Insurance Supplies. 7,200 1,980 Land 112,500 Building Accumulated Depreciation-Building Equipment.... . Accumulated Depreciation-Equipment Accounts Payable 300,250 87,550 135,300 97,950 12,150 Unearned Rent... 6,750 Jan Pitman, Capital Jan Pitman, Drawing. 371,000 15,000 Fees Earned.... 324,600 Salaries and Wages Expense.. Utilities Expense Advertising Expense 193,370 42,375 22,800 Repairs Expense.. Miscellaneous Expense 17,250 6,075 900,000 900,000 The data needed to determine year-end adjustments are as follows: Unexpired insurance at October 31, $600. Supplies on hand at October 31, $675. Depreciation of building for the year, $12,000 Depreciation of equipment for the year, $8,600. Unearned rent at October 31, $2,250. Accrued salaries and wages at October 31, $2,800. Fees earned but unbilled on October 31, $10,050. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense-Building Depreciation Expense-Equipment, and Supplies Expense 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 10E: Kling Company was organized in late 2019 and began operations on January 2, 2020. Prior to the start...

Related questions

Question

Transcribed Image Text:Pitman Company is a small editorial services company owned and operated by Jan Pit-

man. On October 31, 2019 the end of the current year, Pitman Company's accounting

clerk prepared the following unadjusted trial balance:

Pitman Company

Unadjusted Triai Balance

October 31, 2019

Debit

Credit

Balances

Balances

Cash

7,500

Accounts Receivable.

38,400

Prepaid Insurance

Supplies.

7,200

1,980

Land

112,500

Building

Accumulated Depreciation-Building

Equipment.... .

Accumulated Depreciation-Equipment

Accounts Payable

300,250

87,550

135,300

97,950

12,150

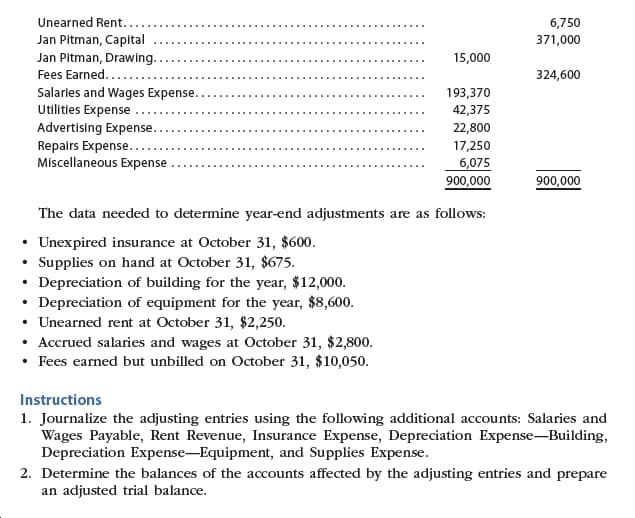

Transcribed Image Text:Unearned Rent...

6,750

Jan Pitman, Capital

Jan Pitman, Drawing.

371,000

15,000

Fees Earned....

324,600

Salaries and Wages Expense..

Utilities Expense

Advertising Expense

193,370

42,375

22,800

Repairs Expense..

Miscellaneous Expense

17,250

6,075

900,000

900,000

The data needed to determine year-end adjustments are as follows:

Unexpired insurance at October 31, $600.

Supplies on hand at October 31, $675.

Depreciation of building for the year, $12,000

Depreciation of equipment for the year, $8,600.

Unearned rent at October 31, $2,250.

Accrued salaries and wages at October 31, $2,800.

Fees earned but unbilled on October 31, $10,050.

Instructions

1. Journalize the adjusting entries using the following additional accounts: Salaries and

Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense-Building

Depreciation Expense-Equipment, and Supplies Expense

2. Determine the balances of the accounts affected by the adjusting entries and prepare

an adjusted trial balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 7 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning