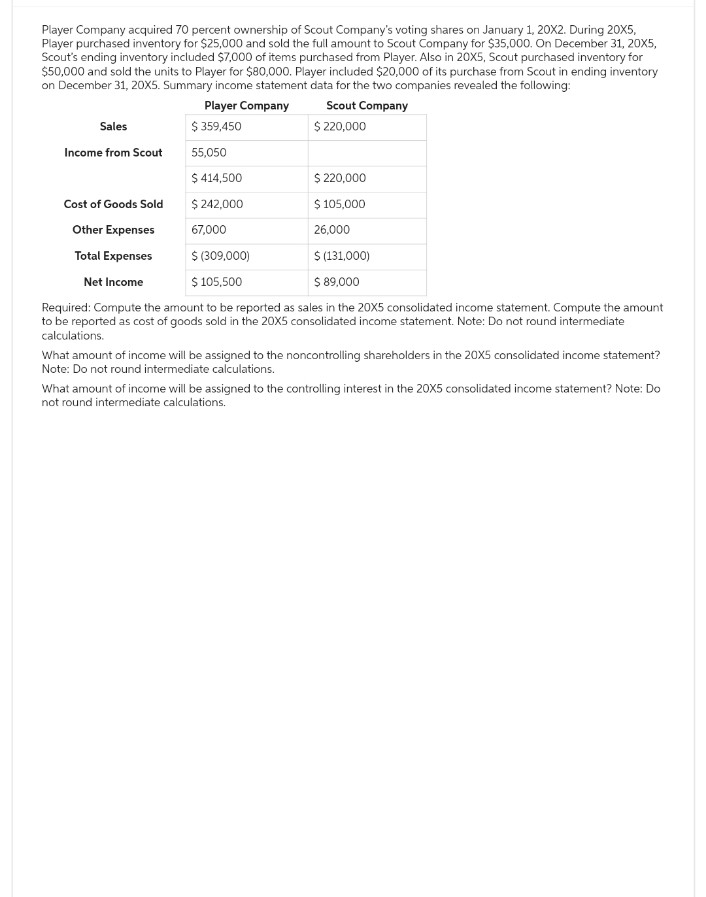

Player Company acquired 70 percent ownership of Scout Company's voting shares on January 1, 20X2. During 20X5, Player purchased inventory for $25,000 and sold the full amount to Scout Company for $35,000. On December 31, 20X5, Scout's ending inventory included $7,000 of items purchased from Player. Also in 20X5, Scout purchased inventory for $50,000 and sold the units to Player for $80,000. Player included $20,000 of its purchase from Scout in ending inventory on December 31, 20X5. Summary income statement data for the two companies revealed the following: Player Company Sales Income from Scout Scout Company $ 359,450 55,050 $ 414,500 $ 220,000 Cost of Goods Sold $242,000 $ 105,000 Other Expenses 67,000 26,000 Total Expenses $ (309,000) $ (131,000) Net Income $ 105,500 $ 89,000 Required: Compute the amount to be reported as sales in the 20X5 consolidated income statement. Compute the amount to be reported as cost of goods sold in the 20X5 consolidated income statement. Note: Do not round intermediate calculations. $ 220,000 What amount of income will be assigned to the noncontrolling shareholders in the 20X5 consolidated income statement? Note: Do not round intermediate calculations. What amount of income will be assigned to the controlling interest in the 20X5 consolidated income statement? Note: Do not round intermediate calculations.

Player Company acquired 70 percent ownership of Scout Company's voting shares on January 1, 20X2. During 20X5, Player purchased inventory for $25,000 and sold the full amount to Scout Company for $35,000. On December 31, 20X5, Scout's ending inventory included $7,000 of items purchased from Player. Also in 20X5, Scout purchased inventory for $50,000 and sold the units to Player for $80,000. Player included $20,000 of its purchase from Scout in ending inventory on December 31, 20X5. Summary income statement data for the two companies revealed the following: Player Company Sales Income from Scout Scout Company $ 359,450 55,050 $ 414,500 $ 220,000 Cost of Goods Sold $242,000 $ 105,000 Other Expenses 67,000 26,000 Total Expenses $ (309,000) $ (131,000) Net Income $ 105,500 $ 89,000 Required: Compute the amount to be reported as sales in the 20X5 consolidated income statement. Compute the amount to be reported as cost of goods sold in the 20X5 consolidated income statement. Note: Do not round intermediate calculations. $ 220,000 What amount of income will be assigned to the noncontrolling shareholders in the 20X5 consolidated income statement? Note: Do not round intermediate calculations. What amount of income will be assigned to the controlling interest in the 20X5 consolidated income statement? Note: Do not round intermediate calculations.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:Player Company acquired 70 percent ownership of Scout Company's voting shares on January 1, 20X2. During 20X5,

Player purchased inventory for $25,000 and sold the full amount to Scout Company for $35,000. On December 31, 20X5,

Scout's ending inventory included $7,000 of items purchased from Player. Also in 20X5, Scout purchased inventory for

$50,000 and sold the units to Player for $80,000. Player included $20,000 of its purchase from Scout in ending inventory

on December 31, 20X5. Summary income statement data for the two companies revealed the following:

Scout Company

$ 220,000

Sales

Income from Scout

Player Company

$ 359,450

55,050

$ 414,500

$ 242,000

67,000

$ 220,000

$ 105,000

Cost of Goods Sold

Other Expenses

Total Expenses

$ (309,000)

$ (131,000)

Net Income

$ 105,500

$ 89,000

Required: Compute the amount to be reported as sales in the 20X5 consolidated income statement. Compute the amount

to be reported as cost of goods sold in the 20X5 consolidated income statement. Note: Do not round intermediate

calculations.

26,000

What amount of income will be assigned to the noncontrolling shareholders in the 20X5 consolidated income statement?

Note: Do not round intermediate calculations.

What amount of income will be assigned to the controlling interest in the 20X5 consolidated income statement? Note: Do

not round intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning