Please assist Return on average owner's equity (2018 =40%; industry average = 45%) Round to two decimal places.

Please assist Return on average owner's equity (2018 =40%; industry average = 45%) Round to two decimal places.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please assist

Return on average owner's equity (2018 =40%; industry average

= 45%)

Round to two decimal places.

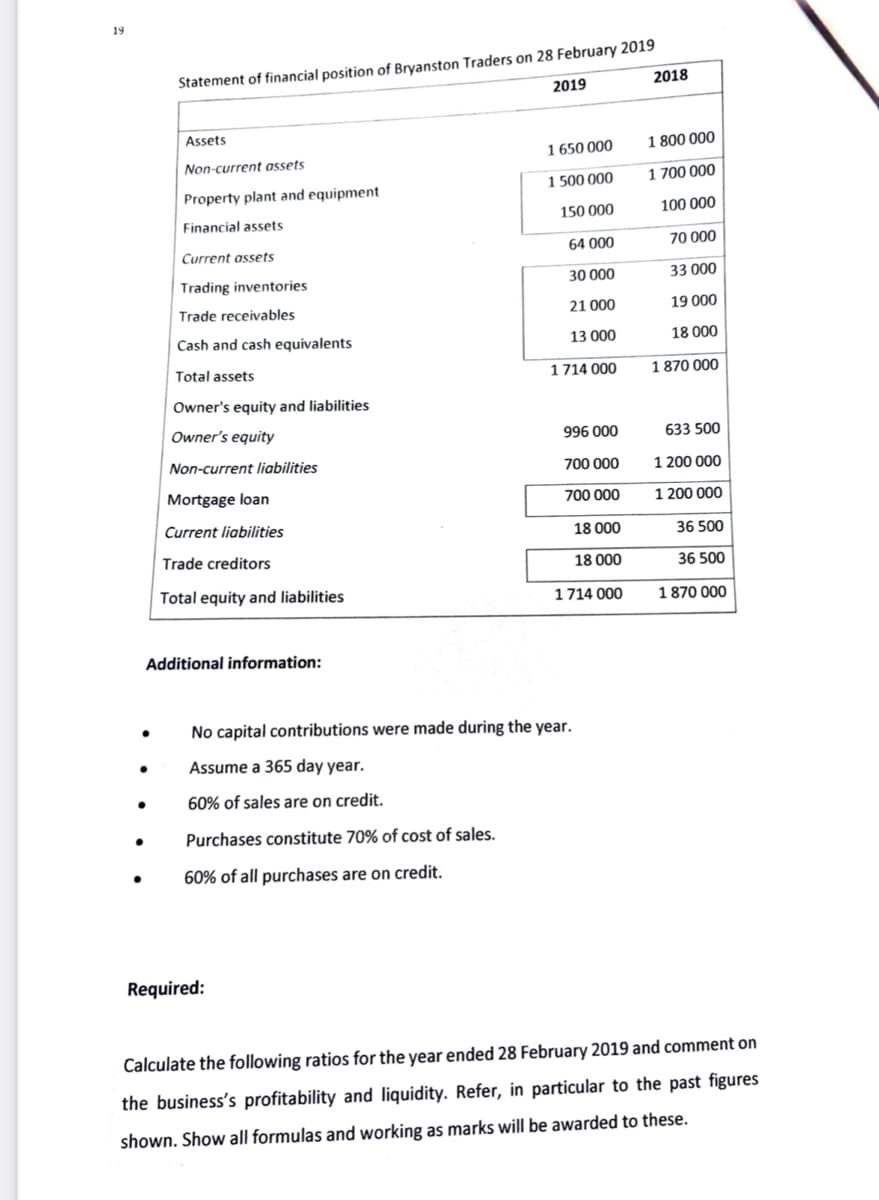

Transcribed Image Text:19

Statement of financial position of Bryanston Traders on 28 February 2019

2018

2019

Assets

1 650 000

1 800 000

Non-current assets

1 500 000

1 700 000

Property plant and equipment

100 000

150 000

Financial assets

Current assets

64

000

70 000

Trading inventories

30 000

33 000

Trade receivables

21 000

19 000

Cash and cash equivalents

13 000

18 000

Total assets

1714 000

1870 000

Owner's equity and liabilities

Owner's equity

996 000

633 500

Non-current liabilities

700 000

1 200 000

Mortgage loan

700 000

1 200 000

Current liabilities

18 000

36 500

Trade creditors

18 000

36 500

Total equity and liabilities

1714 000

1 870 000

Additional information:

No capital contributions were made during the year.

Assume a 365 day year.

60% of sales are on credit.

Purchases constitute 70% of cost of sales.

60% of all purchases are on credit.

Required:

Calculate the following ratios for the year ended 28 February 2019 and comment on

the business's profitability and liquidity. Refer, in particular to the past figures

shown. Show all formulas and working as marks will be awarded to these.

●

●

●

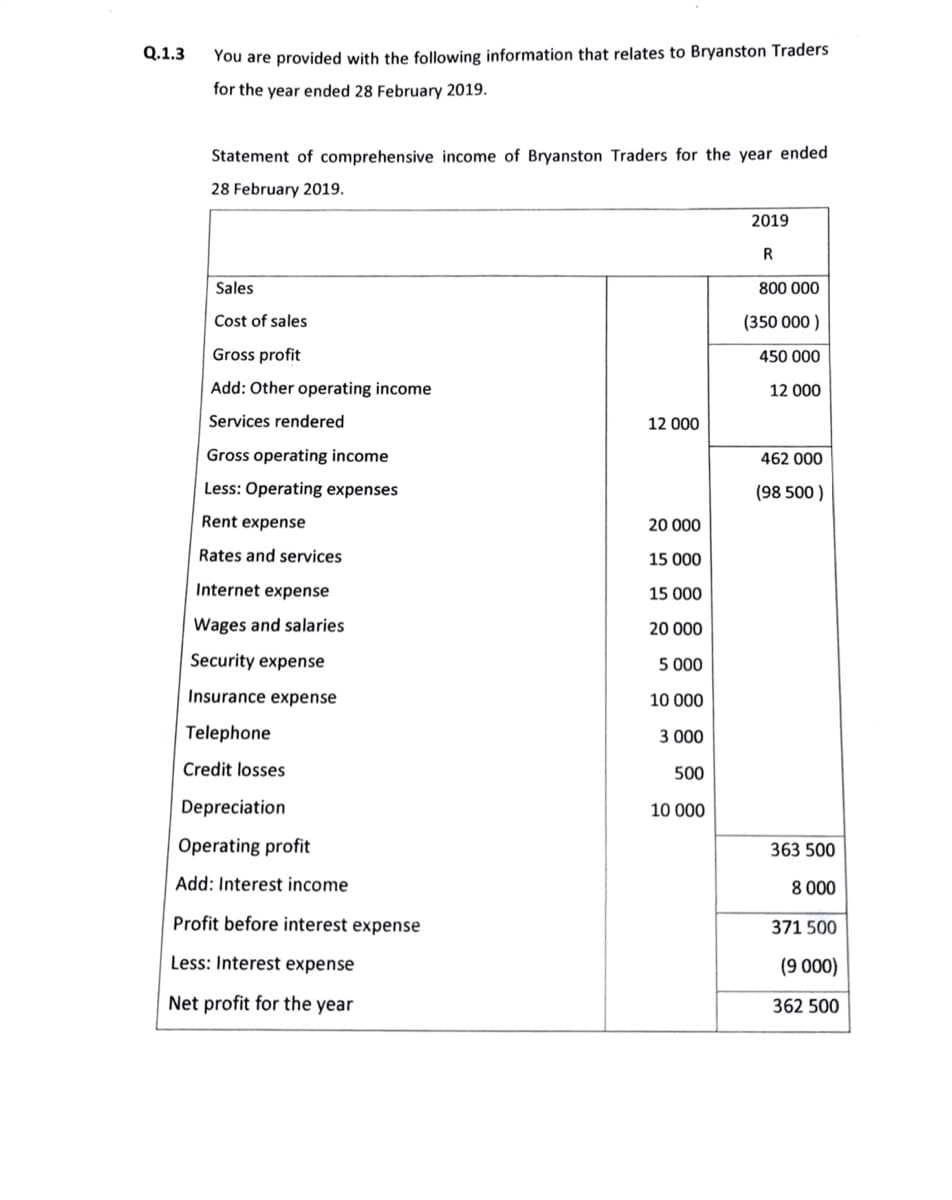

Transcribed Image Text:You are provided with the following information that relates to Bryanston Traders

for the year ended 28 February 2019.

Statement of comprehensive income of Bryanston Traders for the year ended

28 February 2019.

2019

R

Sales

800 000

Cost of sales

(350 000)

Gross profit

450 000

Add: Other operating income

12 000

Services rendered

Gross operating income

462 000

Less: Operating expenses

(98 500)

Rent expense

Rates and services

Internet expense

Wages and salaries

Security expense

Insurance expense

Telephone

Credit losses

Depreciation

Operating profit

Add: Interest income

Profit before interest expense

Less: Interest expense

Net profit for the year

Q.1.3

12 000

20 000

15 000

15 000

20 000

5 000

000

3 000

500

10 000

10

363 500

8 000

371 500

(9 000)

362 500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education