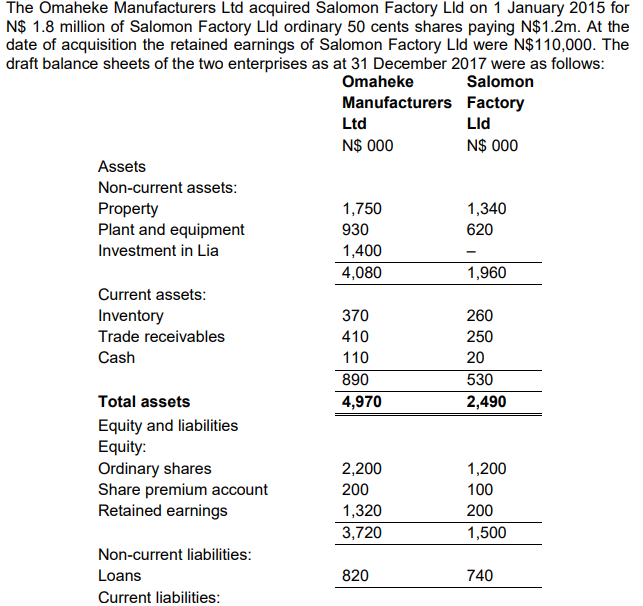

The Omaheke Manufacturers Ltd acquired Salomon Factory Lld on 1 January 2015 for N$ 1.8 million of Salomon Factory Lld ordinary 50 cents shares paying N$1.2m. At the date of acquisition the retained earnings of Salomon Factory Lld were N$110,000. The draft balance sheets of the two enterprises as at 31 December 2017 were as follows: Omaheke Salomon Manufacturers Factory Ltd Lld N$ 000 N$ 000 Assets Non-current assets: Property Plant and equipment 1,750 1,340 930 620 Investment in Lia 1,400 4,080 1,960 Current assets: 260 250 Inventory 370 Trade receivables 410 Cash 110 20 890 530 Total assets 4,970 2,490 Equity and liabilities Equity: Ordinary shares Share premium account Retained earnings 2,200 200 1,200 100 1,320 200 3,720 1,500

The Omaheke Manufacturers Ltd acquired Salomon Factory Lld on 1 January 2015 for N$ 1.8 million of Salomon Factory Lld ordinary 50 cents shares paying N$1.2m. At the date of acquisition the retained earnings of Salomon Factory Lld were N$110,000. The draft balance sheets of the two enterprises as at 31 December 2017 were as follows: Omaheke Salomon Manufacturers Factory Ltd Lld N$ 000 N$ 000 Assets Non-current assets: Property Plant and equipment 1,750 1,340 930 620 Investment in Lia 1,400 4,080 1,960 Current assets: 260 250 Inventory 370 Trade receivables 410 Cash 110 20 890 530 Total assets 4,970 2,490 Equity and liabilities Equity: Ordinary shares Share premium account Retained earnings 2,200 200 1,200 100 1,320 200 3,720 1,500

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 35P

Related questions

Question

The last part basically says this:

Salomon Factory Lld balance sheet has not taken account of

these fair values. Group

and equipment 10% per annum using straight-line basis. Depreciation is

calculated on fair values where available.

iii. An impairment review has been carried out on the consolidated

end of each year since the acquisition the goodwill impaired has been as follows:

in 2015/12/31 N$ 5 000, 2016/12/31 N$ 2 000, 2017/12/31 N$ 3 000 respectively

Required:

Prepare the consolidated balance sheet of the Omaheke Manufacturers as at 31

December 2017.

Transcribed Image Text:The Omaheke Manufacturers Ltd acquired Salomon Factory Lld on 1 January 2015 for

N$ 1.8 million of Salomon Factory Lld ordinary 50 cents shares paying N$1.2m. At the

date of acquisition the retained earnings of Salomon Factory Lld were N$110,000. The

draft balance sheets of the two enterprises as at 31 December 2017 were as follows:

Omaheke

Salomon

Manufacturers Factory

Ltd

Lld

N$ 000

N$ 000

Assets

Non-current assets:

Property

Plant and equipment

1,750

1,340

930

620

Investment in Lia

1,400

4,080

1,960

Current assets:

260

250

Inventory

370

Trade receivables

410

Cash

110

20

890

530

Total assets

4,970

2,490

Equity and liabilities

Equity:

Ordinary shares

Share premium account

Retained earnings

2,200

200

1,200

100

1,320

200

3,720

1,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning