Please explain how to arrive at the "Market Price of Bonds (% of face) = 94.285%" section in the excel sheet.

Please explain how to arrive at the "Market Price of Bonds (% of face) = 94.285%" section in the excel sheet.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

100%

Please explain how to arrive at the "Market Price of Bonds (% of face) = 94.285%" section in the excel sheet.

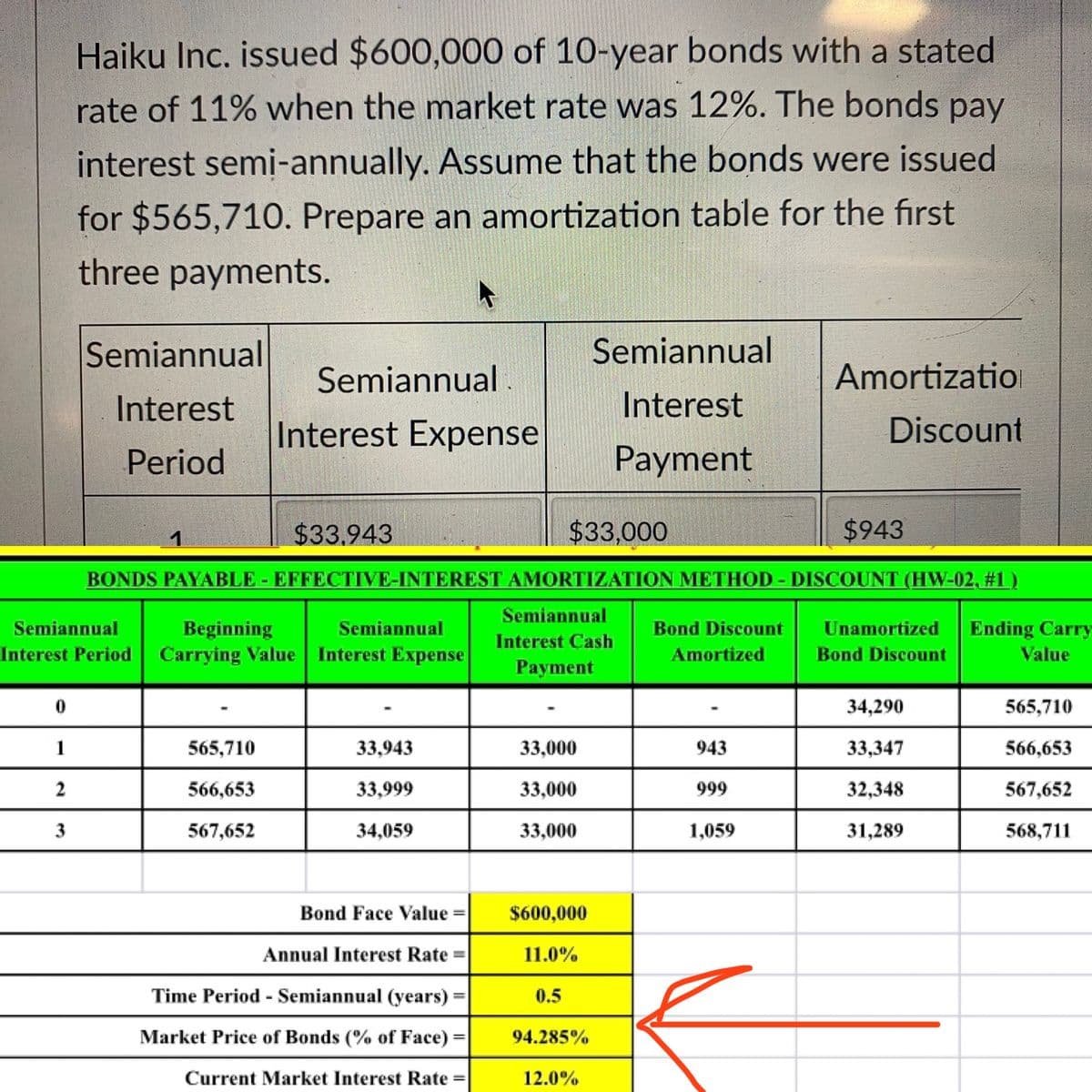

Transcribed Image Text:Haiku Inc. issued $600,000 of 10-year bonds with a stated

rate of 11% when the market rate was 12%. The bonds pay

interest semi-annually. Assume that the bonds were issued

for $565,710. Prepare an amortization table for the first

three payments.

Semiannual

Semiannual

Semiannual .

Amortization

Interest

Interest

Interest Expense

Discount

Period

Payment

$33.943

$33,000

$943

BONDS PAYABLE - EFFECTIVE-INTEREST AMORTIZATION METHOD - DISCOUNT (HW-02, #1)

Semiannual

Bond Discount

Beginning

Interest Period Carrying Value Interest Expense

Semiannual

Semiannual

Unamortized

Ending Carry

Interest Cash

Amortized

Bond Discount

Value

Payment

34,290

565,710

1

565,710

33,943

33,000

943

33,347

566,653

2

566,653

33,999

33,000

999

32,348

567,652

3

567,652

34,059

33,000

1,059

31,289

568,711

Bond Face Value =

$600,000

%3D

Annual Interest Rate =

11.0%

Time Period - Semiannual (years) =

0.5

Market Price of Bonds (% of Face) =

94.285%

Current Market Interest Rate =

12.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College