Please help fill out the attached excel example to answer instructions of problem 13-13! Instead of just whoing the correct answers, can you please include the formula you used to get the answers so I can learn how to do the work! Thank you!

Please help fill out the attached excel example to answer instructions of problem 13-13! Instead of just whoing the correct answers, can you please include the formula you used to get the answers so I can learn how to do the work! Thank you!

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 5E: Investment Discount Amortization Schedule On January 1, 2019, Rodgers Company purchased 200,000 face...

Related questions

Question

Please help fill out the attached excel example to answer instructions of problem 13-13! Instead of just whoing the correct answers, can you please include the formula you used to get the answers so I can learn how to do the work! Thank you!

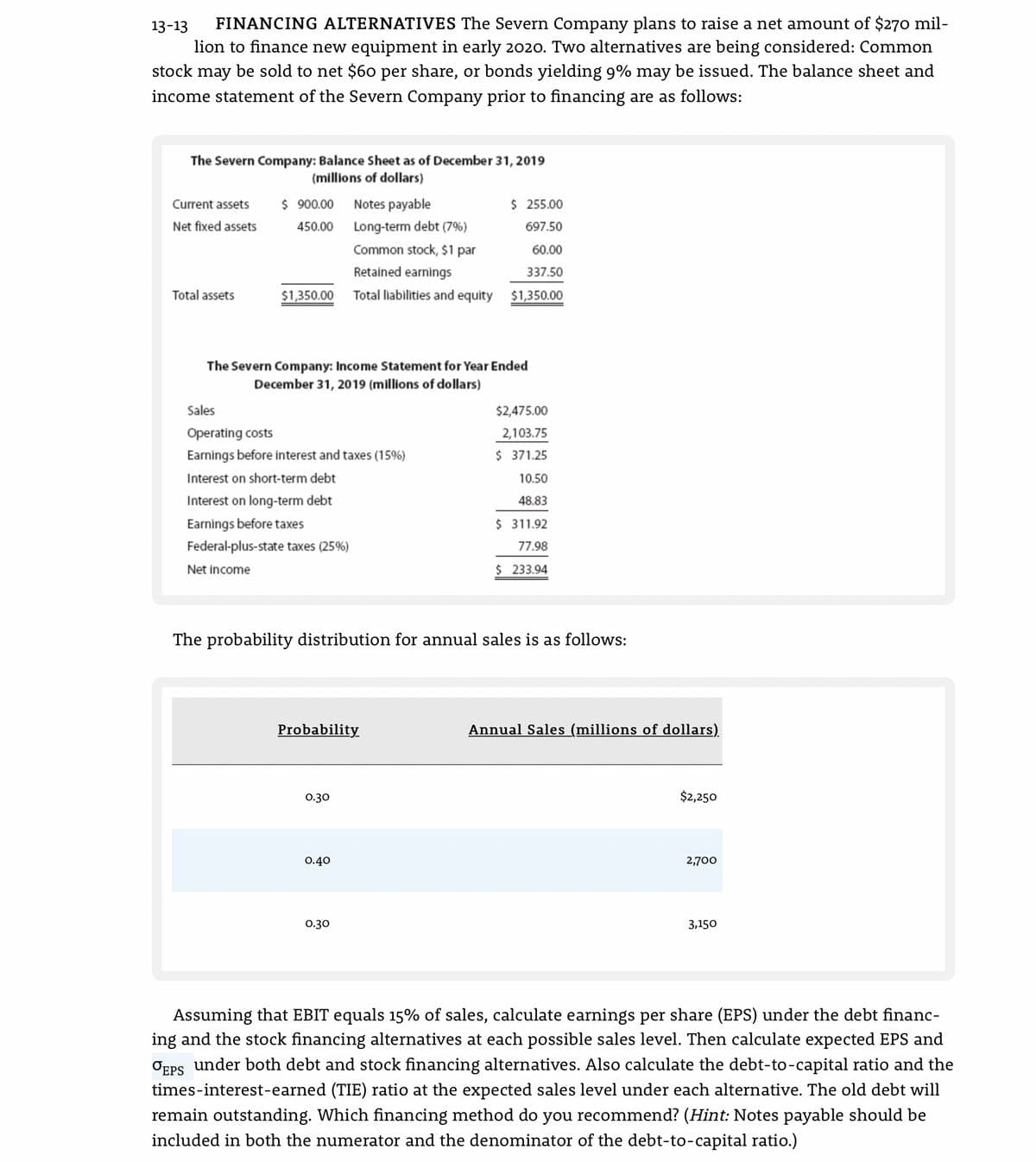

Transcribed Image Text:FINANCING ALTERNATIVES The Severn Company plans to raise a net amount of $270 mil-

lion to finance new equipment in early 2020. Two alternatives are being considered: Common

stock may be sold to net $60 per share, or bonds yielding 9% may be issued. The balance sheet and

13-13

income statement of the Severn Company prior to financing are as follows:

The Severn Company: Balance Sheet as of December 31, 2019

(millions of dollars)

Current assets

$ 900.00

Notes payable

$ 255.00

Net fixed assets

450.00

Long-term debt (7%)

697.50

Common stock, $1 par

60.00

Retained earnings

337.50

Total assets

$1,350.00 Total liabilities and equity $1,350.00

The Severn Company: Income Statement for Year Ended

December 31, 2019 (millions of dollars)

Sales

$2,475.00

Operating costs

2,103.75

Earnings before interest and taxes (15%)

$ 371.25

Interest on short-term debt

10.50

Interest on long-term debt

48.83

Earnings before taxes

$ 311.92

Federal-plus-state taxes (25%)

77.98

Net income

$233.94

The probability distribution for annual sales is as follows:

Probability

Annual Sales (millions of dollars)

0.30

$2,250

0.40

2,700

0.30

3,150

Assuming that EBIT equals 15% of sales, calculate earnings per share (EPS) under the debt financ-

ing and the stock financing alternatives at each possible sales level. Then calculate expected EPS and

Opps under both debt and stock financing alternatives. Also calculate the debt-to-capital ratio and the

times-interest-earned (TIE) ratio at the expected sales level under each alternative. The old debt will

remain outstanding. Which financing method do you recommend? (Hint: Notes payable should be

included in both the numerator and the denominator of the debt-to-capital ratio.)

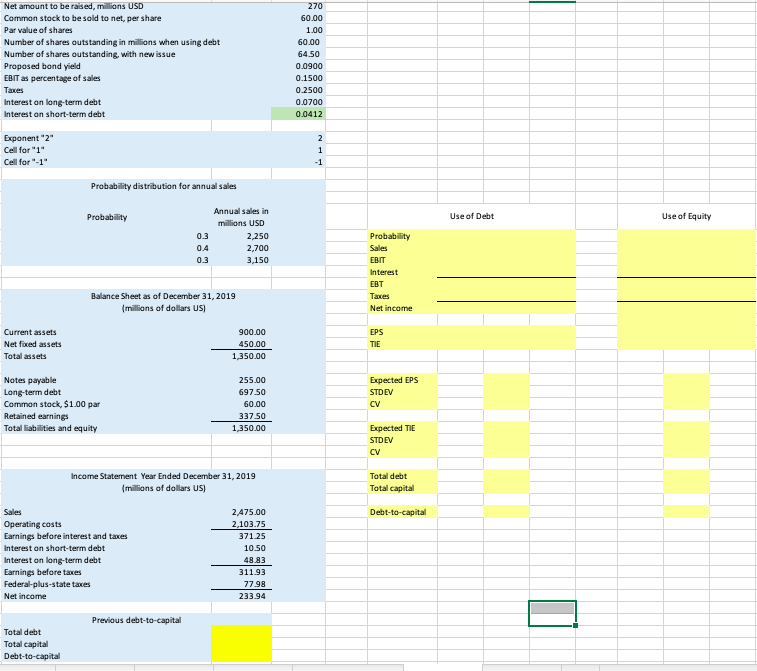

Transcribed Image Text:Net amount to be raised, millions USD

270

Common stock to be sold to net, per share

60.00

Par value of shares

1.00

60.00

64.50

Number of shares outstanding in millions when using debt

Number of shares outstanding, with new issue

Proposed bond yield

EBIT as percentage of sales

0.0900

0.1500

Тахes

0.2500

Interest on long-term debt

0.0700

Interest on short-term debt

0.0412

Exponent "2"

2

Cell for "1"

1

Cell for "-1"

-1

Probability distribution for annual sales

Annual sales in

Probability

Use of Debt

Use of Equity

millions USD

0.

2,250

Probability

0.4

2,700

Sales

0.3

3,150

EBIT

Interest

EBT

Balance Sheet as of December 31, 2019

Taxes

(millions of dollars US)

Net income

Current assets

900.00

EPS

Net fixed assets

450.00

TIE

Total assets

1,350.00

Notes payable

Long-term debt

Common stock, $1.00 par

Retained earnings

Total liabilities and equity

255.00

Expected EPS

697.50

STDEV

60.00

CV

337.50

1,350.00

Еxpected TIE

STDEV

CV

Income Statement Year Ended December 31, 2019

Total debt

(millions of dollars US)

Total capital

Sales

2,475.00

Debt-to-capital

Operating costs

Earnings before interest and taxes

2,103.75

371.25

Interest on short-term debt

10.50

Interest on long-term debt

48 83

Earnings before taxes

Federal-plus-state taxes

311.93

77.98

233.94

Net income

Previous debt-to-capital

Total debt

Total capital

Debt-to-capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning