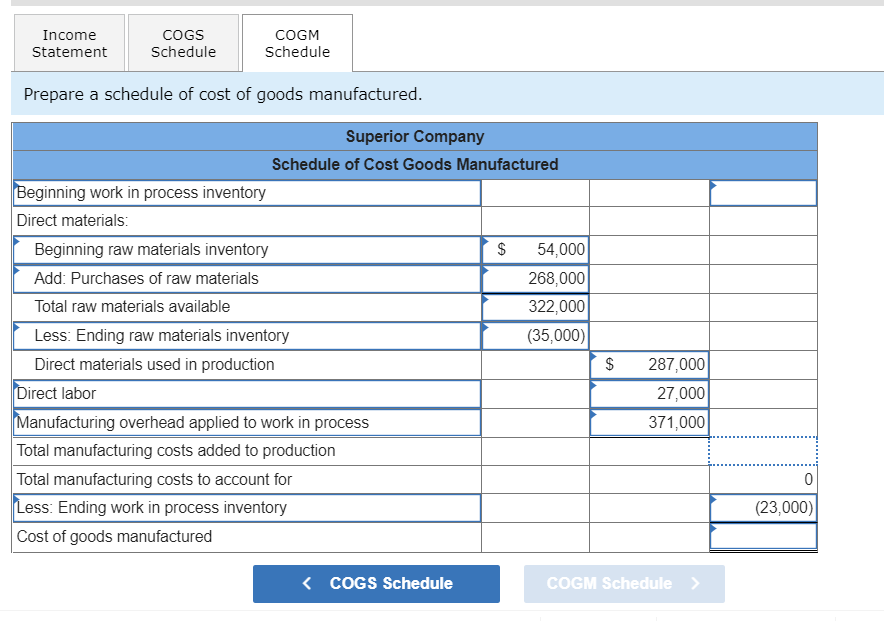

PLEASE I NEED FROM THE COGM SCHEDULE: BEGGINING WORK IN PROCESS INVENTORY TOTAL MANUFACTURING COSTST O ACCOUNT FOR AND COST OF GOODS MANUFACTURED I just asked this question a while ago and Idk from where they took a different data to sole the problem. please check the data before giving back an answer because it seem that the prevoius person took the answers from a similar problem without checking if the info matches with the question that I am aking for. Thank you

PLEASE I NEED FROM THE COGM SCHEDULE:

BEGGINING WORK IN PROCESS INVENTORY

TOTAL MANUFACTURING COSTST O ACCOUNT FOR

AND COST OF GOODS MANUFACTURED

I just asked this question a while ago and Idk from where they took a different data to sole the problem.

please check the data before giving back an answer because it seem that the prevoius person took the answers from a similar problem without checking if the info matches with the question that I am aking for.

Thank you

![Problem 3-13 (Algo) Schedules of Cost of Goods Manufactured and Cost of Goods Sold; Income

Statement [L03-3]

Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct

materials):

Selling expenses

Purchases of raw materials

$ 217,000

$ 268,000

Direct labor

Administrative expenses

Manufacturing overhead applied to work in process

Actual manufacturing overhead cost

$ 159,000

$ 371,000

$ 359,000

Inventory balances at the beginning and end of the year were as follows:

Beginning

$ 54,000

Ending

$ 35,000

$ 23,000

Raw materials

Work in process

Finished goods

$ 39,000

?

The total manufacturing costs added to production for the year were $685,000; the cost of goods available for sale totaled $735,0003;

the unadjusted cost of goods sold totaled $662,000; and the net operating income was $40,000. The company's underapplied or

overapplied overhead is closed to Cost of Goods Sold.

Required:

Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income

statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured.)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F8f61e626-7d33-482f-bf18-423884fdaa73%2F33a2f669-7f35-47f0-ad8d-7d380b17a84a%2Fgwhmsod_processed.png&w=3840&q=75)

The cost of goods sold is calculated as difference between cost of goods available for sale and ending inventory of finished goods.

Cost of goods manufactured is calculated as cost of goods available for sale minus beginning inventory of finished goods.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps