Corona Company uses a sales journal, a cash receipts journal, and a general journal to record transactions with its customers. Record the following transactions in the appropriate journals. The cost of all merchandise sold was 65% of the sales price. July 2 Sold merchandise for $18,000 to M. Jordan on account. Credit terms 1/10, n/30. Sales invoice No. 100. July Received a check for $1,300 from K. Bryant in payment of his account. 5 July July 8 Sold merchandise to S. O'Neal for $900 cash. 10 Received a check in payment of Sales invoice No. 100 from M. Jordan minus the 1% discount. July 15 Sold merchandise for $7,000 to K. Jabbar on account. Credit terms 1/10, n/30. Sales invoice No. 101. July 18 Borrowed $15,000 cash from Pacific Bank signing a 6-month, 10% note. July 20 Sold merchandise for $12,000 to J. West on account. Credit terms 1/10, n/30. Sales invoice No. 102. July 25 Issued a credit (reduction) of $760 to J. West as an allowance for damaged merchandise previously sold on account. July 31 Received a check from K. Jabbar for $5,500 as payment on account. CORONA COMPANY Sales Journal si Invoice A/R. Dr. COGS. Dr. Date Account Debited No. Ref. Sales Rev. Cr. Inventory. Cr. CORONA COMPANY General Journal

Corona Company uses a sales journal, a cash receipts journal, and a general journal to record transactions with its customers. Record the following transactions in the appropriate journals. The cost of all merchandise sold was 65% of the sales price. July 2 Sold merchandise for $18,000 to M. Jordan on account. Credit terms 1/10, n/30. Sales invoice No. 100. July Received a check for $1,300 from K. Bryant in payment of his account. 5 July July 8 Sold merchandise to S. O'Neal for $900 cash. 10 Received a check in payment of Sales invoice No. 100 from M. Jordan minus the 1% discount. July 15 Sold merchandise for $7,000 to K. Jabbar on account. Credit terms 1/10, n/30. Sales invoice No. 101. July 18 Borrowed $15,000 cash from Pacific Bank signing a 6-month, 10% note. July 20 Sold merchandise for $12,000 to J. West on account. Credit terms 1/10, n/30. Sales invoice No. 102. July 25 Issued a credit (reduction) of $760 to J. West as an allowance for damaged merchandise previously sold on account. July 31 Received a check from K. Jabbar for $5,500 as payment on account. CORONA COMPANY Sales Journal si Invoice A/R. Dr. COGS. Dr. Date Account Debited No. Ref. Sales Rev. Cr. Inventory. Cr. CORONA COMPANY General Journal

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter10: Accounting For Sales And Cash Receipts

Section: Chapter Questions

Problem 2CE: Prepare journal entries for the following sales and cash receipts transactions. (a) Merchandise is...

Related questions

Question

Can you help with these questions?

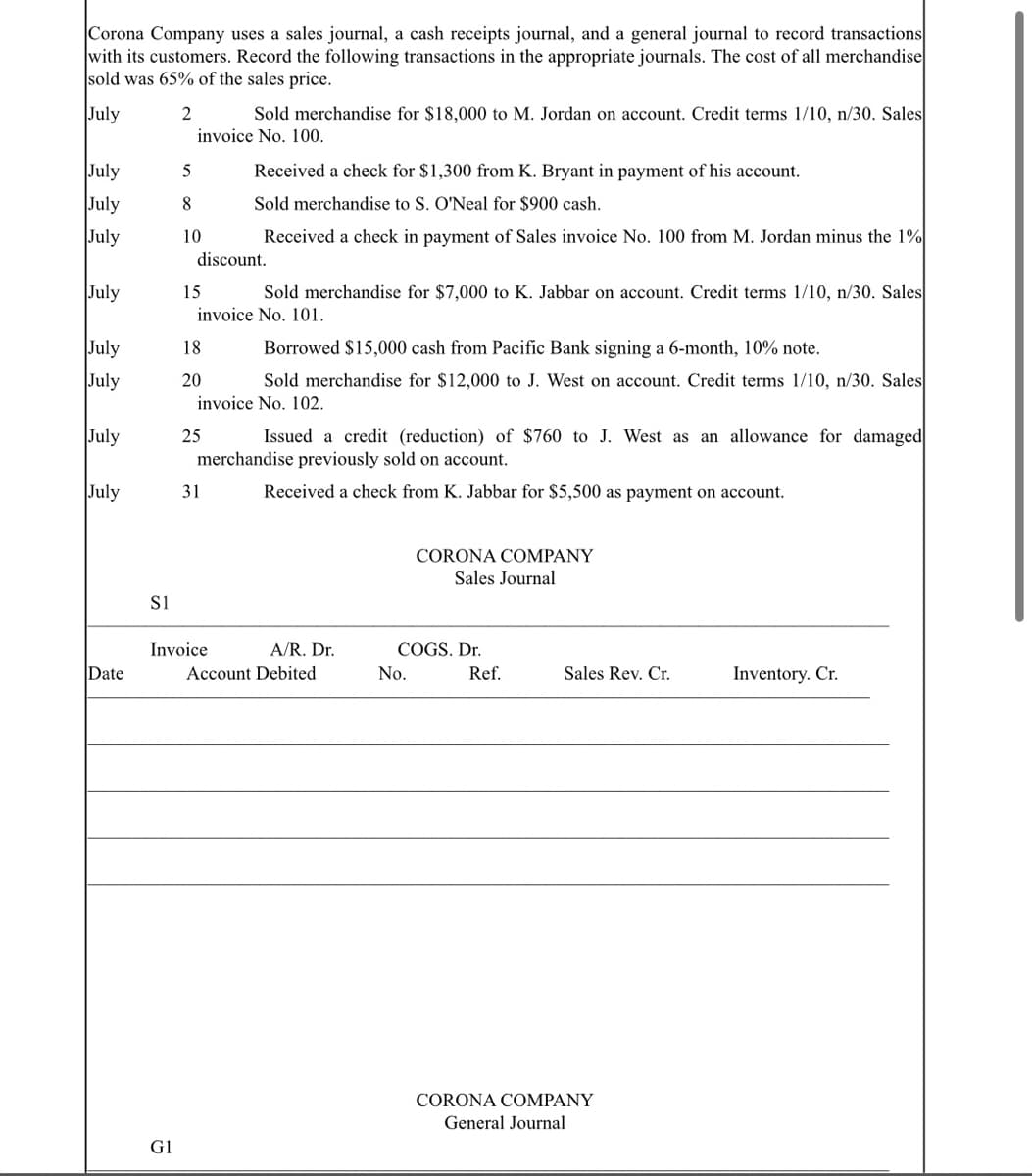

Transcribed Image Text:Corona Company uses a sales journal, a cash receipts journal, and a general journal to record transactions

with its customers. Record the following transactions in the appropriate journals. The cost of all merchandise

sold was 65% of the sales price.

July

2

Sold merchandise for $18,000 to M. Jordan on account. Credit terms 1/10, n/30. Sales

invoice No. 100.

July

July

5

Received a check for $1,300 from K. Bryant in payment of his account.

8

Sold merchandise to S. O'Neal for $900 cash.

July

10

Received a check in payment of Sales invoice No. 100 from M. Jordan minus the 1%

discount.

July

15

Sold merchandise for $7,000 to K. Jabbar on account. Credit terms 1/10, n/30. Sales

invoice No. 101.

July

July

18

Borrowed $15,000 cash from Pacific Bank signing a 6-month, 10% note.

20

Sold merchandise for $12,000 to J. West on account. Credit terms 1/10, n/30. Sales

invoice No. 102.

July

25

Issued a credit (reduction) of $760 to J. West as an allowance for damaged

merchandise previously sold on account.

July

31

Received a check from K. Jabbar for $5,500 as payment on account.

CORONA COMPANY

Sales Journal

S1

Invoice

A/R. Dr.

COGS. Dr.

Date

Account Debited

No.

Ref.

Sales Rev. Cr.

Inventory. Cr.

CORONA COMPANY

General Journal

G1

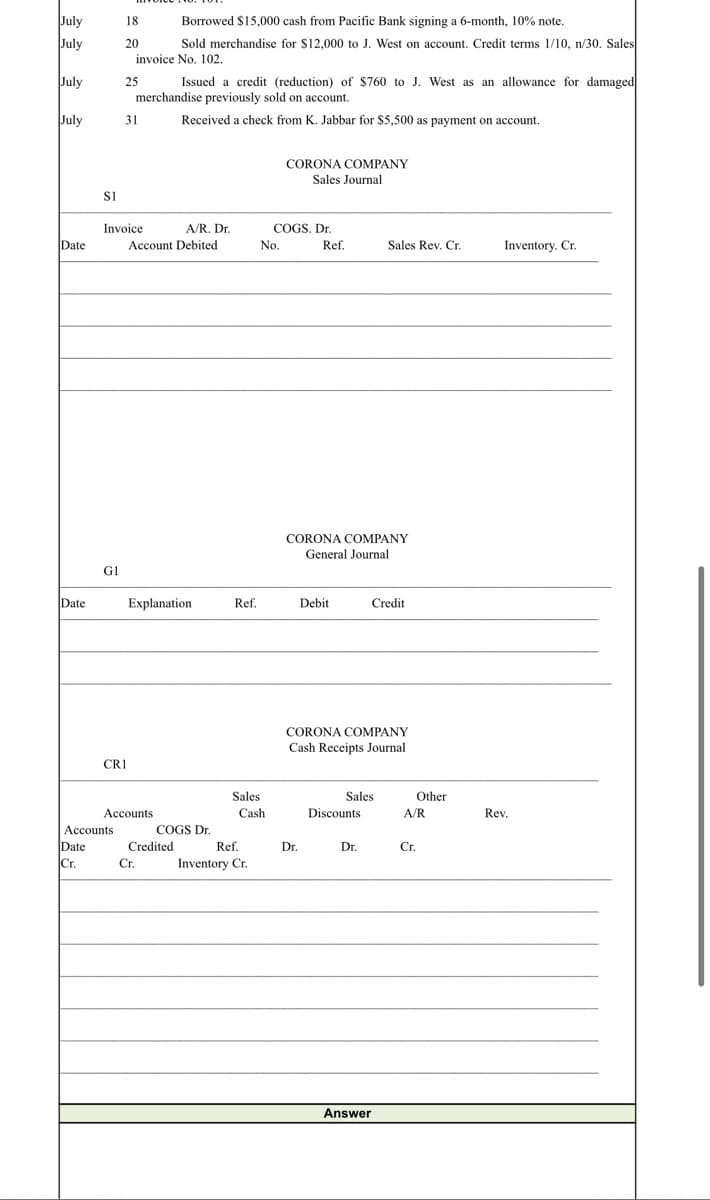

Transcribed Image Text:July

18

Borrowed $15,000 cash from Pacific Bank signing a 6-month, 10% note.

July

20

Sold merchandise for $12,000 to J. West on account. Credit terms 1/10, n/30. Sales

invoice No. 102.

July

25

Issued a credit (reduction) of $760 to J. West as an allowance for damaged

merchandise previously sold on account.

July

31

Received a check from K. Jabbar for $5,500 as payment on account.

CORONA COMPANY

Sales Journal

si

Invoice

A/R. Dr.

COGS, Dr.

Date

Account Debited

No.

Ref.

Sales Rev. Cr.

Inventory. Cr.

CORONA COMPANY

General Journal

G1

Date

Explanation

Ref.

Debit

Credit

CORONA COMPANY

Cash Receipts Journal

CRI

Sales

Sales

Other

Accounts

Cash

Discounts

A/R

Rev.

Асcounts

COGS Dr.

Date

Cr.

Credited

Ref.

Dr.

Dr.

Cr.

Cr.

Inventory Cr.

Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning