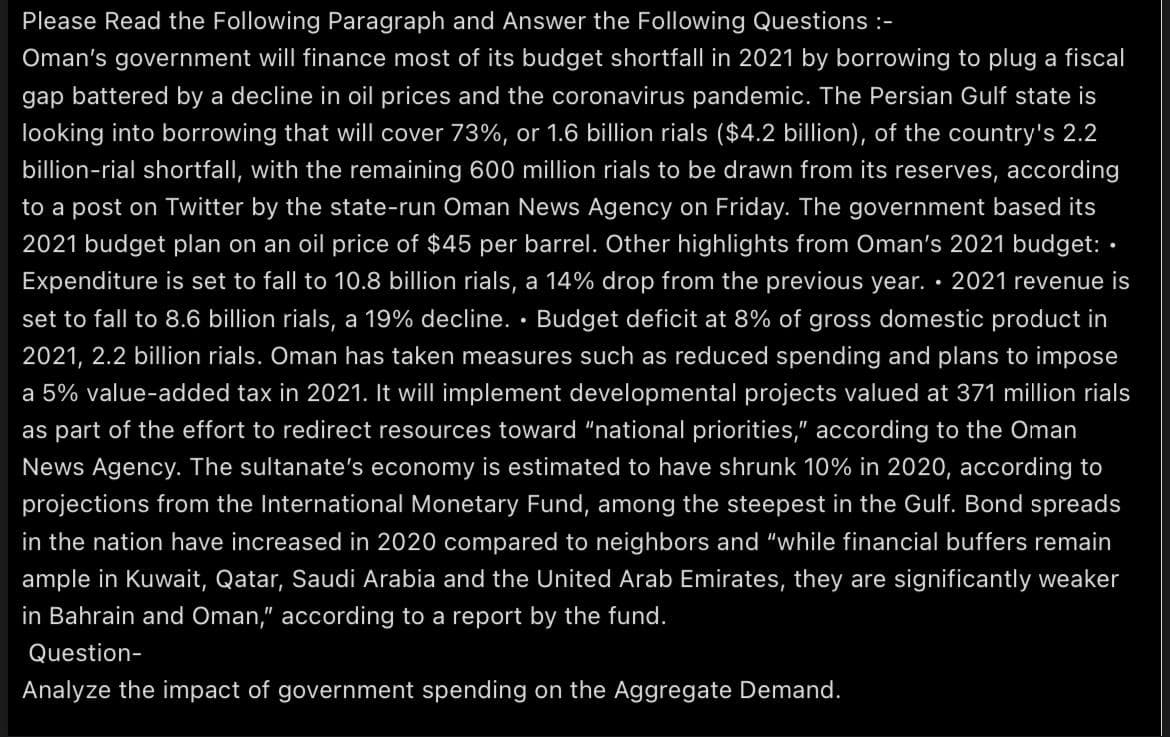

Please Read the Following Paragraph and Answer the Following Questions :- Oman's government will finance most of its budget shortfall in 2021 by borrowing to plug a fiscal gap battered by a decline in oil prices and the coronavirus pandemic. The Persian Gulf state is looking into borrowing that will cover 73%, or 1.6 billion rials ($4.2 billion), of the country's 2.2 billion-rial shortfall, with the remaining 600 million rials to be drawn from its reserves, according to a post on Twitter by the state-run Oman News Agency on Friday. The government based its 2021 budget plan on an oil price of $45 per barrel. Other highlights from Oman's 2021 budget: · Expenditure is set to fall to 10.8 billion rials, a 14% drop from the previous year. · 2021 revenue is set to fall to 8.6 billion rials, a 19% decline. • Budget deficit at 8% of gross domestic product in 2021, 2.2 billion rials. Oman has taken measures such as reduced spending and plans to impose a 5% value-added tax in 2021. It will implement developmental projects valued at 371 million rials as part of the effort to redirect resources toward "national priorities," according to the Oman News Agency. The sultanate's economy is estimated to have shrunk 10% in 2020, according to projections from the International Monetary Fund, among the steepest in the Gulf. Bond spreads in the nation have increased in 2020 compared to neighbors and "while financial buffers remain ample in Kuwait, Qatar, Saudi Arabia and the United Arab Emirates, they are significantly weaker in Bahrain and Oman," according to a report by the fund. Question- Analyze the impact of government spending on the Aggregate Demand.

Please Read the Following Paragraph and Answer the Following Questions :- Oman's government will finance most of its budget shortfall in 2021 by borrowing to plug a fiscal gap battered by a decline in oil prices and the coronavirus pandemic. The Persian Gulf state is looking into borrowing that will cover 73%, or 1.6 billion rials ($4.2 billion), of the country's 2.2 billion-rial shortfall, with the remaining 600 million rials to be drawn from its reserves, according to a post on Twitter by the state-run Oman News Agency on Friday. The government based its 2021 budget plan on an oil price of $45 per barrel. Other highlights from Oman's 2021 budget: · Expenditure is set to fall to 10.8 billion rials, a 14% drop from the previous year. · 2021 revenue is set to fall to 8.6 billion rials, a 19% decline. • Budget deficit at 8% of gross domestic product in 2021, 2.2 billion rials. Oman has taken measures such as reduced spending and plans to impose a 5% value-added tax in 2021. It will implement developmental projects valued at 371 million rials as part of the effort to redirect resources toward "national priorities," according to the Oman News Agency. The sultanate's economy is estimated to have shrunk 10% in 2020, according to projections from the International Monetary Fund, among the steepest in the Gulf. Bond spreads in the nation have increased in 2020 compared to neighbors and "while financial buffers remain ample in Kuwait, Qatar, Saudi Arabia and the United Arab Emirates, they are significantly weaker in Bahrain and Oman," according to a report by the fund. Question- Analyze the impact of government spending on the Aggregate Demand.

Chapter24: Fiscal Policy

Section: Chapter Questions

Problem 5P

Related questions

Question

i need the answer quickly

Transcribed Image Text:Please Read the Following Paragraph and Answer the Following Questions :-

Oman's government will finance most of its budget shortfall in 2021 by borrowing to plug a fiscal

gap battered by a decline in oil prices and the coronavirus pandemic. The Persian Gulf state is

looking into borrowing that will cover 73%, or 1.6 billion rials ($4.2 billion), of the country's 2.2

billion-rial shortfall, with the remaining 600 million rials to be drawn from its reserves, according

to a post on Twitter by the state-run Oman News Agency on Friday. The government based its

2021 budget plan on an oil price of $45 per barrel. Other highlights from Oman's 2021 budget: •

Expenditure is set to fall to 10.8 billion rials, a 14% drop from the previous year. · 2021 revenue is

set to fall to 8.6 billion rials, a 19% decline. • Budget deficit at 8% of gross domestic product in

2021, 2.2 billion rials. Oman has taken measures such as reduced spending and plans to impose

a 5% value-added tax in 2021. It will implement developmental projects valued at 371 million rials

as part of the effort to redirect resources toward "national priorities," according to the Oman

News Agency. The sultanate's economy is estimated to have shrunk 10% in 2020, according to

projections from the International Monetary Fund, among the steepest in the Gulf. Bond spreads

in the nation have increased in 2020 compared to neighbors and "while financial buffers remain

ample in Kuwait, Qatar, Saudi Arabia and the United Arab Emirates, they are significantly weaker

in Bahrain and Oman," according to a report by the fund.

Question-

Analyze the impact of government spending on the Aggregate Demand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax