Please show your computations through excel. b. Compute the total service allocated to finishing department using DIRECT method.

Please show your computations through excel. b. Compute the total service allocated to finishing department using DIRECT method.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 30E: A company uses charging rates to allocate service department costs to the using departments. The...

Related questions

Question

Please show your computations through excel.

b. Compute the total service allocated to finishing department using DIRECT method.

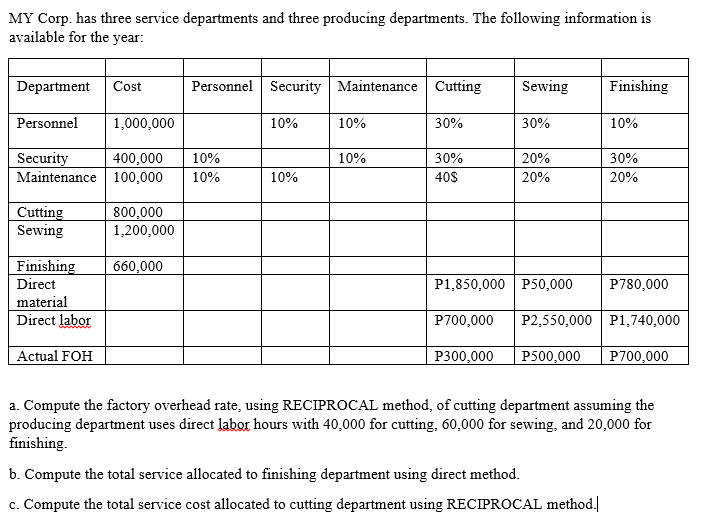

Transcribed Image Text:MY Corp. has three service departments and three producing departments. The following information is

available for the year:

Department

Cost

Personnel Security Maintenance Cutting

Sewing

Finishing

Personnel

1,000,000

10%

10%

30%

30%

10%

Security

Maintenance 100,000

400,000

10%

10%

30%

20%

30%

10%

10%

40S

20%

20%

Cutting

Sewing

800,000

1,200,000

Finishing

Direct

660,000

P1,850,000 P50,000

P780,000

material

Direct labor

P700,000

P2,550,000 P1,740,000

Actual FOH

P300,000

P500,000

P700,000

a. Compute the factory overhead rate, using RECIPROCAL method, of cutting department assuming the

producing department uses direct labor hours with 40,000 for cutting, 60,000 for sewing, and 20,000 for

finishing.

b. Compute the total service allocated to finishing department using direct method.

c. Compute the total service cost allocated to cutting department using RECIPROCAL method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning