Please solve the below and provide explanation thank you

Q: (i) What required rate of return should Pisctataway use to evaluate the QI proposal? 20% Explain…

A: It has been given in the question that all the manufacturing as well as sales and distribution is to…

Q: Characteristics of Production Process, Cost Measurement Vince Kim, of EcoScape Company, designs and…

A: Costing is an approach that an entity applies to appropriately note the expenses paid during…

Q: The trial balance of Pacilio Security Services, Incorporated as of January 1, Year 3, had the…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: A seller uses a perpetual inventory system, and on April 17, a customer returns $1,000 of…

A: JOURNAL ENTRIES Journal Entry is the Process of Recording & Posting the Financial & Non…

Q: A taxpayer is single and has a capital loss of $8,000 long-term for the tax year and a short-term

A: Capital gain - The money one makes when they sell a valuable asset, such as stocks, bonds, or real…

Q: Apple Ltd makes and sells a single product, for which variable costs are follows: Direct materials…

A: Sales is the amount of revenue earned by an entity by selling the goods. It is the total revenue…

Q: A. A company issued bonds with a par value of $250,000 and a maturity of 25 years. The bonds pay…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: , based on the financial performance of their divisions. The South Division normally sells to…

A: Variable cost refers to those expense a company born whole manufacturing a lot of product that…

Q: 0 to my cousin Vinny who has extensive medical issues. $4,000 to Grave Robbers, a nonprofit cemetery…

A: Charitable deductions refers to the concept that helps the taxpayers to subtract certain donations…

Q: year: rent of premises paid in advance and outstanding subscriptions from members. Where will these…

A: Lets understand the basics. Current asset is a asset that are expected to be realized within short…

Q: Assuming that the taxpayer is a resident citizen, the taxable income (subject to ordinary income…

A: Taxable incomes which are chargeable at the rates of the ordinary income taxes is the income only…

Q: Wilson Beckett buys a share of common stock directly from Anston Corporation for $13 in cash.…

A: Common stock is a type of security that represents ownership in an organization. After creditors,…

Q: January 1, 2016, F Corp. issued 2,000 of its 10%, $1,000 bonds for $2,080,000. These bonds were to…

A: Bond Payable Bonds payable is a debt that holds the sum that the issuer owes bondholders. Since…

Q: TRUE OR FALSE Basic earnings per share is required to be reported for all publicly-traded…

A: The answer is True. All publicly traded corporations are required to report basic earning per share…

Q: Do not use dollar signs in your answers. It your answer is a negative number, put a minus sign in…

A: COST OF GOODS SOLD Cost of goods sold (COGS) is the cost of acquiring or manufacturing the…

Q: 2019, Al gave his son a Mercedes worth $115,000 and his daughter a Lexus worth $85,000. He also gave…

A: Some gifts given are taxable but some are exempted and there is limit to the gift given during the…

Q: On May 20, Montero Company paid $240,000 to acquire 105 shares (5%) of ORD Corporation as a…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: Assume that you purchase a property for $2,000,000 and it generates $15,000 per month of rental…

A: The income that is collected from an investment is then divided by the amount of time that the…

Q: Bellingham Company produced 2,700 units of product that required 3.5 standard direct labor hours per…

A: Variance is something which shows the difference between the estimated cost and the actual cost. It…

Q: Comparative figures for Apple and Google follow. $ millions Apple Google Current Year One Year…

A: Accounts receivable turnover ratio counts the number of times receivables are converted to cash…

Q: Wynter Company manufactures and sells a single product. Its budgeted production stands at 25 000…

A: Fixed Cost: Fixed cost is a cost that remains same irrespective of the increase or decrease in the…

Q: (compounded annually)?

A: Present value refers to values of the sum of money in contrast to some future value. The idea of…

Q: Mary Alexander is a sole trader who operates a small wholesale business in Kingston, Jamaica. On…

A: Answer:- Gross profit meaning:- The profit a company makes after deducting all of the expenses…

Q: AB Ltd.'s gross purchases were $8,000, net purchases account for an average 10% discount on all…

A: Net purchases are defined as the part of total purchases that have remained with the company after…

Q: Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The…

A: Corporate Bonds - Corporate bonds are obligations that corporations issue to both public and private…

Q: If the Lumber Division sells to the Construction Division, $0.35 per board foot can be saved in…

A: Introduction:- Transfer pricing measures to the prices of goods and services that are exchanged…

Q: Can I get the income statement, a statement of retained earnings, and a classified balance sheet…

A: Balance Sheet A financial statement that lists a corporate resources, debts, and shareholders ’…

Q: EX 5: Transfers of investment property A company acquired a building for CU 100 000 in 20X1 and…

A: Introduction: Carrying amount: Generally Carrying amount is the amount at which an asset is…

Q: On the schedule of collection from sales what are the percentage calculations for cash collected…

A: Cash sales: It implies to the revenue that is earned by a business from the sale of it's services…

Q: Your company has decided to offer company-sponsored, outsourced retirement planning to employees as…

A: Retirement benefits are the monetary benefits to be paid at the time retirement to employees by…

Q: Factory Overhead Volume Variance Bellingham Company produced 4,600 units of product that required 4…

A: Introduction: The difference between the fixed overhead that was budgeted to be applied to produced…

Q: invited two friends to join him in a business venture. He is willing to invest his business and…

A: Contribution ratio refers to the concept of determine the gap between the company accounted sales…

Q: I. 1 2 w 4 5 6 7 00 8 9 10 Classify the ff.a is to: Direct Material (DM), Direct Labor (DL),…

A: Lets understand the basics. Material - It is a basics thing used in the business for manufacturing…

Q: iable costs change in direct proportion to a change in the activity level. True or False?

A: There are two types of one is fixed cost and other is variable cost and both are part of the total…

Q: product-costing systems are structured on multiple volume-based cost drivers. True or False?

A: Traditional Product-costing system refers to the concept of cost allocation under which the the…

Q: 2019 2020 Cash $ 138 $ 97 Sales 10,204 11,317 Inventory 5,209 5,138…

A: The financial cash flow to creditors formula is used to calculate cash flow to creditors, which…

Q: Schedule of Cash Receipts Rosita Flores owns Rosita's Mexican Restaurant in Tempe, Arizona. Rosita's…

A: SCHEDULE OF CASH RECEIPT Schedule of Cash Receipt represents the amount received from the…

Q: Forester Company has five products in its inventory. Information about the December 31, 2021,…

A: Workings :- 1) Calculation of NRV :- Product (i) Unit Selling price (ii) Sales commission (unit…

Q: Journalize the entries to record the following selected transactions of Oliver Co: a. purchased…

A: Golden Rules of Accounting: Account Debit Credit Personal Accounts The Receiver The…

Q: (2) Jack has deposited P1,000 into a savings account. He wants to withdraw it when it has grown to P…

A: Future value = Present Value* (1+Rate of Interest)t Here t is the time period or we can also say…

Q: Assume that B R Toys store purchased and sold a line of dolls during December as follows: (Click the…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: TFP Electric is a profitable utility company that has increased its dividend to common stockholders…

A: Common stockholders are the stockholders, who don't have any fixed right. Common stockholders get a…

Q: Smith-Kline Company maintains inventory records at selling prices as well as at cost. For 2021, the…

A: Inventory refers to all the items, goods, merchandise, and materials held by a business for selling…

Q: Chapters 3.2 to 3.5 discuss four data analytics approaches…

A: Introduction: Diagnostic analytics: It is a branch of analytics that focus to answer the question,…

Q: Manufacturing costs are classified into 4 categories. True or False?

A: Costs incurred while manufacturing a product are manufacturing costs. These costs are both direct…

Q: Job Costs Using a Plantwide Overhead Rate Perrin Company designs industrial prototypes for outside…

A: Since you have posted a question with multiple sub-parts, we will do the first three sub-parts for…

Q: These salespeople are paid a minimum monthly salary or commission, whichever is greater. Find the…

A: Gross pay is the amount an employee receives for their work that has not had any deductions for…

Q: Marvin Company has a beginning inventory of 14 sets of paints at a cost of $1.60 each. During the…

A: Calculation of no. of ending inventory: Opening stock 14 sets Add: purchase (6+8+8+12) 34 sets…

Q: In 2022, Zach is single with no dependents. He is not claimed as a dependent on another's return.…

A: This problem shall be solved using the below table: a. EITC = $5,200 x 7.65% = $397.8 = $398…

Q: Marie Corporation hast the following transactions: 1. Purchased raw materials from supplier…

A: The cost of goods sold includes the total cost of goods that are sold during the period. The gross…

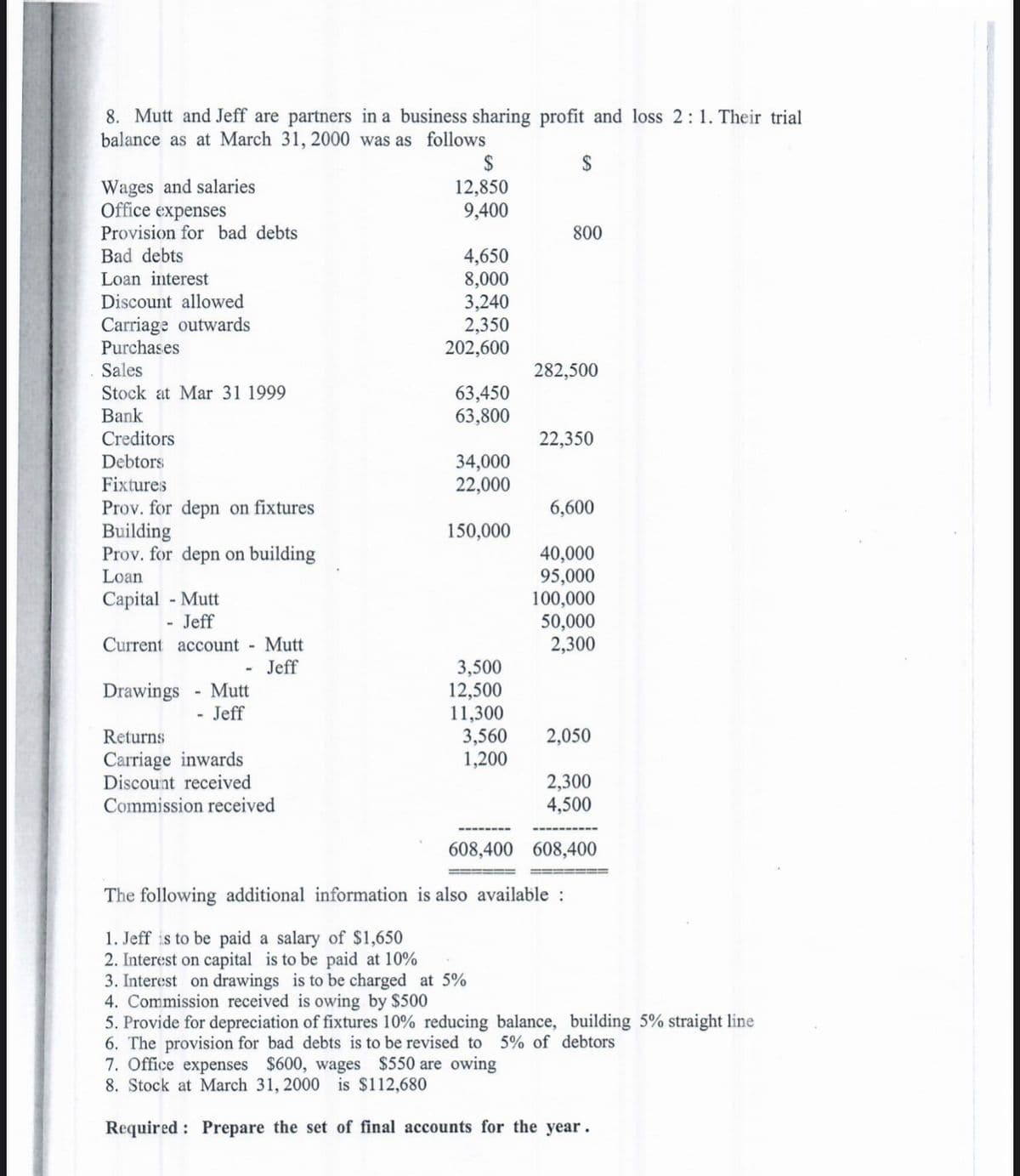

Please solve the below and provide explanation thank you

Step by step

Solved in 4 steps

- The following is the statement of financial position of PQR sharing profits and losses in the ratio of 3:2:1 as on 31st Dec 2010 Liabilities RO Assets RO Creditors Outstanding Expenses Bills Payable Capitals: P 28,000 Q 20,000 R 30,000 25,800 200 6,000 78,000 110,000 Cash Debtor and Stock Furniture Computer Building Patents 8,000 42,000 15,000 10,000 30,000 5,000 110,000 They admit S into the partnership on the following terms: - 1. The value of computer reduced by 10% 2. A part of value of Patents for RO 1000 became useless and it has to be reduced. 3. Buildings to be revalued at RO 55,000 4. Furniture was depreciated by 10% 5. S shall bring RO 25,000 as capital for ¼ share of future profits a) Calculate New Profit Sharing Ratio and Sacrificing Ratio b) Prepare Revaluation Account, Partner’s Capital Account and redraft the Statement of financial position after the admission. Answer: Revaluation Account…You are considering two possible companies for investment purposes. The following data is available for each company. Additional Information: Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet method is 10%. The $230,000 in Other Expenses includes all company expenses except Bad Debt Expense. Company B: Bad debt estimation percentage using the income statement method is 6.5%, and the balance sheet method is 8%. The $140,000 in Other Expenses includes all company expenses except Bad Debt Expense. A. Compute the number of days sales in receivables ratio for each company for 2019 and interpret the results (round answers to nearest whole number). B. If Company A changed from the income statement method to the balance sheet method for recognizing bad debt estimation, how would that change net income in 2019? Explain (show calculations). C. If Company B changed from the balance sheet method to the income statement method for recognizing bad debt estimation, how would that change net income in 2019? Explain (show calculations). D. What benefits do each company gain by changing their method of bad debt estimation? E. Which company would you invest in and why? Provide supporting details.The following is the balance sheet of P, Q and R who were sharing profits and losses in the proportion of 4:3:2 as on 31st March 2009 Liabilities RO Assets RO Capitals P Q R P’s Loan Provision for taxation Accounts Payables 80,000 45,000 35,000 7,000 3,000 56,000 226,000 Premises Fixtures and fittings Joint life policy Stock Accounts receivables Cash 85,000 20,000 10,000 68,000 40,000 3,000 226,000 Q decides to retire from the business due to her marriage. It is agreed that Commission accrued but not received RO 6,000 be brought into accounts Provision for taxation need not be maintained as there is no liability attached to it The surrender value of the joint life policy is RO 8,000 Premises is appreciated by RO 12,000 Fixtures and fitting and stock to be depreciated by 10% Goodwill of the entire firm be fixed at RO 21,600 and Q’s share if it be adjusted through the capital accounts of P and R…

- On May 1, 20x1, the statement of financial position of Juan and Pablo appear below:Juan PabloCash 22,000 44,708Accounts receivable 469,072 1,135,780Inventories 240,070 520,204Land 1,206,000Building 856,534Furniture and fixtures 100,690 69,578Other assets 4,000 7,200Total assets 2,041,832 2,634,004Accounts payable 357,880 487,300Notes payable 400,000 690,000Juan, Capital 1,283,952Pablo, Capital 1,456,704Total liabilities and equity 2,041,832 2,634,004Juan and Pablo agreed to form a partnership contributing their respective assets and equities subject to thefollowing adjustments:a. Accounts receivable of P40,000 in Juan’s books and P70,000 in Pablo’s books are uncollectible.b. Inventories of P11,000 and P13,400 are worthless in Juan’s and Pablo’s respective books.c. Other assets of P4,000 and P7,200 in Juan’s and Pablo’s respective books are to be written off. 3. Prepare journal entry to record Pedro’s admission. 4. During the first year of operations, the partnership earned P650,000.…On May 1, 20x1, the statement of financial position of Juan and Pablo appear below:Juan PabloCash 22,000 44,708Accounts receivable 469,072 1,135,780Inventories 240,070 520,204Land 1,206,000Building 856,534Furniture and fixtures 100,690 69,578Other assets 4,000 7,200Total assets 2,041,832 2,634,004Accounts payable 357,880 487,300Notes payable 400,000 690,000Juan, Capital 1,283,952Pablo, Capital 1,456,704Total liabilities and equity 2,041,832 2,634,004Juan and Pablo agreed to form a partnership contributing their respective assets and equities subject to thefollowing adjustments:a. Accounts receivable of P40,000 in Juan’s books and P70,000 in Pablo’s books are uncollectible.b. Inventories of P11,000 and P13,400 are worthless in Juan’s and Pablo’s respective books.c. Other assets of P4,000 and P7,200 in Juan’s and Pablo’s respective books are to be written off.Required:1. What are the adjusted capital balances of the partners after formation? 2. Pedro offered to join for a 20% interest in…The following are relevant information pertaining to the results of the business operations for Maisarah Islamic Window for the year 2020: Income from Operations2600000Expenses from Operations1180000Indirect Income (Fee Based)300000Indirect Expenses260000The above profit from operation is prior to the distribution of profit to mudharabah depositors. The agreed profit sharing ratio between the Bank and mudharabah depositors is 60:40 respectively.Required:Assuming that the Separate Investment Account Method SIAM is used, calculate the net profit/loss to the Islamic Bank (Before Tax and Zakat)

- 5. The followings ate the information about Rainbow National Bank:Report of Income Tk.Interest income 1,250Interest expense 500Total assets 40,000Securities losses or gains 1,000Earning assets 30,000Total liabilities 30,000Taxes paid 1,000Shares of common stock outstanding 3,000Noninterest income 8,000Noninterest expense 6,000Provision for loan losses 2,500Calculate ROE, ROA, Net interest margin, Earnings per share, Net noninterest marginand Net operating margin.Alternative Scenarios:Suppose interest income, interest expenses, noninterest income, and noninterestexpenses each decline by 5 percent while all other revenue and expense items shown inthe preceding table remain unchanged. What will be happen to Rainbow ROE, ROA,and earnings per share?S Man runs a small business, MANDLAS, from home. S Man does not keep proper accounting records. He needs to calculate the entity’s profit/loss and requests your assistance. You established the following: BALANCES AS AT 30 APRIL 2013 2012 R R Furniture at carrying value 22 950 25 500 Tools and equipment at carrying value 46 350 51 500 Inventory: Trading 10 500 15 200 Investment in shares - Solution Pty (Ltd) 25 000 - Bank (favourable) - 12 480 Bank (overdraft) 8 500 - Long-term loan 15 500 19 000 Creditors 9 520 9 520 Credit card 5 380 - 32 Days Notice Deposit 21 000 - Prepaid expenses 1 850 - Accrued income 2 430 - Income received in advance 3 800 5 000 Accrued expenses 1 600 - 1300 Additional information a) S Man withdrew R20 000 during the 2013 year for own use. b) During the 2013 financial year S Man deposited R30 000 from his personal bank account into the business bank account. c) The interest on the long-term loan for the 2013 financial…1. The following information is available from the records of X, Corporation: Year 1Income(loss)before bad debts write off and recovery P100,000Bad debts write off P25,000 Year 2 Income(loss)before bad debts write off and recovery (P20,000)Bad debts write off P10,000Previous year’s write off, recover this year P30,000 Year 3Income(loss)before bad debts write off and recovery P50,000Bad debts write off P5,000Previous year’s write off, recover this year P8,000 For year 3 the total taxable income should be?

- Please help me to understand this by writing your solution in good accounting form, thank you! PROBLEM: The following data were taken from the statement of affairs of ROBINSONS Corp.: Assets pledged for fully secured liabilities (current fairvalue, $75,000) $90,000 Assets pledged for partially secured liabilities (currentfair value $52,000) $74,000 Free assets (current fair value, $40,000) $70,000 Unsecured liabilities with priority $7,000 Fully secured liabilities $30,000 Partially secured liabilities $60,000 Unsecured liabilities without priority $112,000 *The amount that will be paid to creditors with priority is:a. 7,000 b. 6,000 c. 7,500 d. 6,200 *The amount to be paid fully secured creditors is:a. 30,000 b. 32,000 c. 20,000 d. 35,000 *The amount to be paid to partially secured creditors is:a. 52,700 b. 57,200 c. 56,200 d. 57,000 *The amount to be paid to unsecured creditors:a. 78,200 b. 70,800 c. 72,000 d. 72,800Compute for the Income Tax for the below data: MRS. MR. Gross Sales of the Business P4,000,000 Cost of Sales and expenses of the business 1,900,000 Gross Receipts from profession P300,000 Cost and Expenses in the practice of profession 120,000On 12/31/X4, Zoom, LLC, reported a $49,500 loss on its books. The items included in the loss computation were $23,000 in sales revenue, $8,000 in qualified dividends, $15,000 in cost of goods sold, $43,000 in charitable contributions, $13,000 in employee wages, and $9,500 of rent expense. How much ordinary business income (loss) will Zoom report on its X4 return? Multiple Choice ($8,000) ($14,500) ($49,500) ($84,500)