Plot the above AD-AS curves on the (Y, T) diagram. Describe the slopes of both the AD curve and the AS curve. b. If the economy is currently at its long-run trend, what should be the equilibrium output? What is the equilibrium inflation rate in this economy? What should be the equilibrium expected inflation rate in this economy? c. Assume that expected inflation rate is constant at 5 percent. What happens when the oil price increases by 5 percent (v = 0.05)? What is the equilibrium level of output? What is the equilibrium level of inflation? d. Assume that expected inflation rate is constant at 5 percent. What happens for today and 1 period after when money supply increases by 1 (m = 1)? (current period and the long-run period) What is the equilibrium level of output today and 1 period after? What is the equilibrium level of inflation today and 1 period after?

Plot the above AD-AS curves on the (Y, T) diagram. Describe the slopes of both the AD curve and the AS curve. b. If the economy is currently at its long-run trend, what should be the equilibrium output? What is the equilibrium inflation rate in this economy? What should be the equilibrium expected inflation rate in this economy? c. Assume that expected inflation rate is constant at 5 percent. What happens when the oil price increases by 5 percent (v = 0.05)? What is the equilibrium level of output? What is the equilibrium level of inflation? d. Assume that expected inflation rate is constant at 5 percent. What happens for today and 1 period after when money supply increases by 1 (m = 1)? (current period and the long-run period) What is the equilibrium level of output today and 1 period after? What is the equilibrium level of inflation today and 1 period after?

Chapter20: Monetary Policy

Section20.A: Policy Disputes Using The Self Correcting Aggregate Demand And Supply Model

Problem 2SQP

Related questions

Question

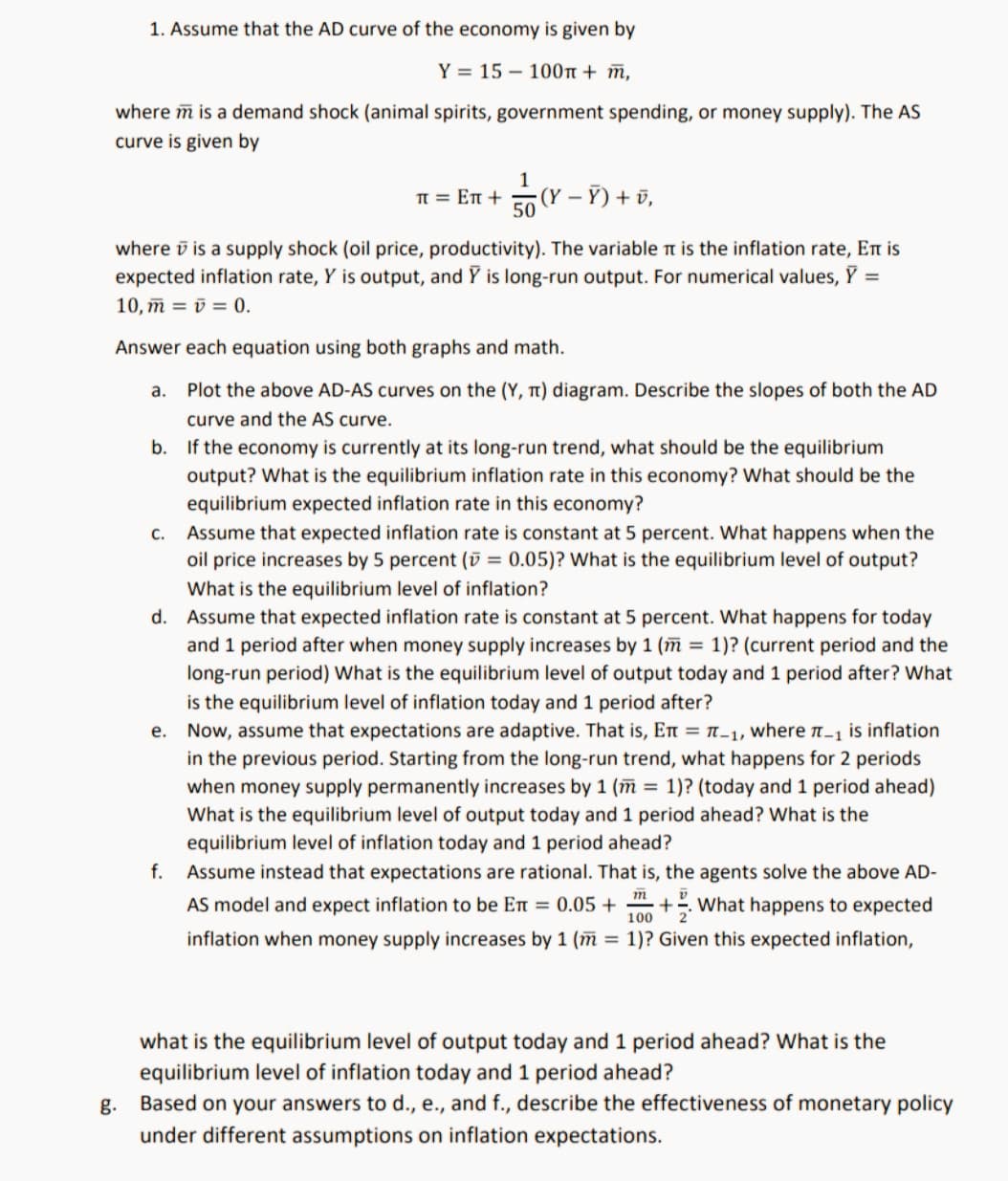

Transcribed Image Text:1. Assume that the AD curve of the economy is given by

Y = 15 – 100t + ñ,

where m is a demand shock (animal spirits, government spending, or money supply). The AS

curve is given by

1

TT = En +

(Y – Ỹ) + ū,

50

where v is a supply shock (oil price, productivity). The variable n is the inflation rate, En is

expected inflation rate, Y is output, and Y is long-run output. For numerical values, Y =

10, ñ = ū = 0.

Answer each equation using both graphs and math.

a.

Plot the above AD-AS curves on the (Y, t) diagram. Describe the slopes of both the AD

curve and the AS curve.

b. If the economy is currently at its long-run trend, what should be the equilibrium

output? What is the equilibrium inflation rate in this economy? What should be the

equilibrium expected inflation rate in this economy?

Assume that expected inflation rate is constant at 5 percent. What happens when the

oil price increases by 5 percent (ū = 0.05)? What is the equilibrium level of output?

C.

What is the equilibrium level of inflation?

d. Assume that expected inflation rate is constant at 5 percent. What happens for today

and 1 period after when money supply increases by 1 (m = 1)? (current period and the

long-run period) What is the equilibrium level of output today and 1 period after? What

is the equilibrium level of inflation today and 1 period after?

e. Now, assume that expectations are adaptive. That is, En = n-1, where n-1 is inflation

in the previous period. Starting from the long-run trend, what happens for 2 periods

when money supply permanently increases by 1 (m = 1)? (today and 1 period ahead)

What is the equilibrium level of output today and 1 period ahead? What is the

equilibrium level of inflation today and 1 period ahead?

f. Assume instead that expectations are rational. That is, the agents solve the above AD-

т

AS model and expect inflation to be En = 0.05 +

100

+What happens to expected

inflation when money supply increases by 1 (m = 1)? Given this expected inflation,

what is the equilibrium level of output today and 1 period ahead? What is the

equilibrium level of inflation today and 1 period ahead?

g. Based on your answers to d., e., and f., describe the effectiveness of monetary policy

under different assumptions on inflation expectations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you