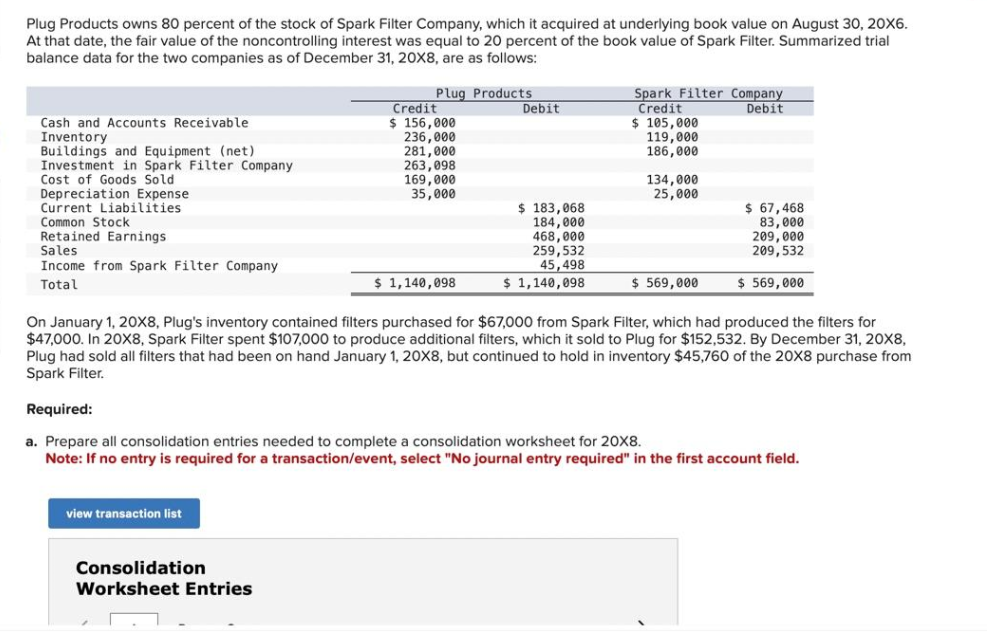

Plug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book value on August 30, 20X6. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Spark Filter. Summarized trial balance data for the two companies as of December 31, 20X8, are as follows: Plug Products Cash and Accounts Receivable Inventory Buildings and Equipment (net) Investment in Spark Filter Company Cost of Goods Sold Depreciation Expense Current Liabilities Common Stock Retained Earnings Sales Income from Spark Filter Company Total Credit $ 156,000 236,000 281,000 263,098 169,000 35,000 $ 1,140,098 Debit $ 183,068 184,000 468,000 259,532 45,498 $ 1,140,098 Spark Filter Company Credit Debit $ 105,000 119,000 186,000 134,000 25,000 $ 569,000 $ 67,468 83,000 209,000 209,532 $ 569,000 On January 1, 20X8, Plug's inventory contained filters purchased for $67,000 from Spark Filter, which had produced the filters for $47,000. In 20X8, Spark Filter spent $107,000 to produce additional filters, which it sold to Plug for $152,532. By December 31, 20X8, Plug had sold all filters that had been on hand January 1, 20X8, but continued to hold in inventory $45,760 of the 20X8 purchase from Spark Filter. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet for 20X8. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Plug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book value on August 30, 20X6. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Spark Filter. Summarized trial balance data for the two companies as of December 31, 20X8, are as follows: Plug Products Cash and Accounts Receivable Inventory Buildings and Equipment (net) Investment in Spark Filter Company Cost of Goods Sold Depreciation Expense Current Liabilities Common Stock Retained Earnings Sales Income from Spark Filter Company Total Credit $ 156,000 236,000 281,000 263,098 169,000 35,000 $ 1,140,098 Debit $ 183,068 184,000 468,000 259,532 45,498 $ 1,140,098 Spark Filter Company Credit Debit $ 105,000 119,000 186,000 134,000 25,000 $ 569,000 $ 67,468 83,000 209,000 209,532 $ 569,000 On January 1, 20X8, Plug's inventory contained filters purchased for $67,000 from Spark Filter, which had produced the filters for $47,000. In 20X8, Spark Filter spent $107,000 to produce additional filters, which it sold to Plug for $152,532. By December 31, 20X8, Plug had sold all filters that had been on hand January 1, 20X8, but continued to hold in inventory $45,760 of the 20X8 purchase from Spark Filter. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet for 20X8. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

answer

Transcribed Image Text:Plug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book value on August 30, 20X6.

At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Spark Filter. Summarized trial

balance data for the two companies as of December 31, 20X8, are as follows:

Plug Products

Cash and Accounts Receivable

Inventory

Buildings and Equipment (net)

Investment in Spark Filter Company

Cost of Goods Sold

Depreciation Expense

Current Liabilities

Common Stock

Retained Earnings

Sales.

Income from Spark Filter Company

Total

Credit

$ 156,000

236,000

view transaction list

281,000

263,098

Consolidation

Worksheet Entries

169,000

35,000

$ 1,140,098

Debit

$ 183,068

184,000

468,000

259,532

45,498

$ 1,140,098

Spark Filter Company

Credit

Debit

$ 105,000

119,000

186,000

134,000

25,000

$ 569,000

On January 1, 20X8, Plug's inventory contained filters purchased for $67,000 from Spark Filter, which had produced the filters for

$47,000. In 20X8, Spark Filter spent $107,000 to produce additional filters, which it sold to Plug for $152,532. By December 31, 20X8,

Plug had sold all filters that had been on hand January 1, 20X8, but continued to hold in inventory $45,760 of the 20X8 purchase from

Spark Filter.

$ 67,468

83,000

209,000

209,532

$ 569,000

Required:

a. Prepare all consolidation entries needed to complete a consolidation worksheet for 20x8.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

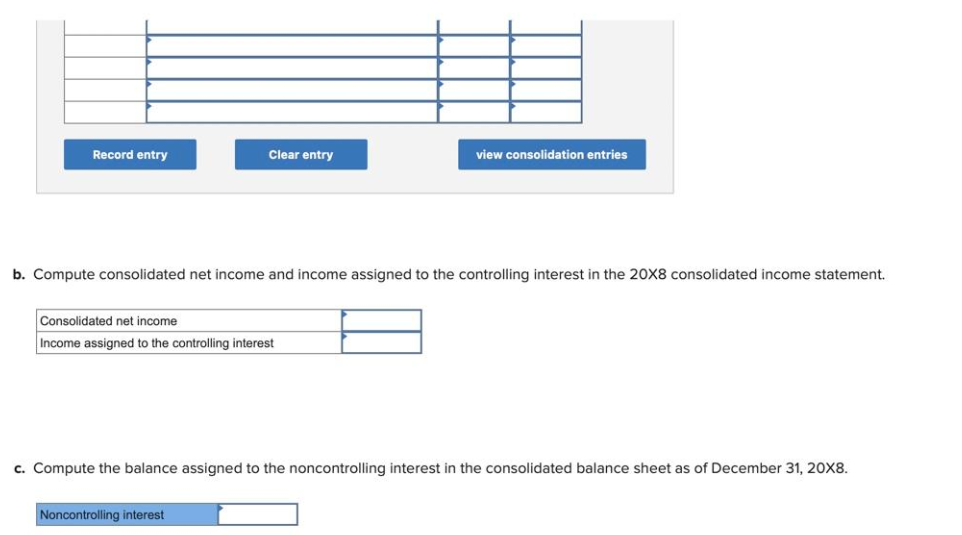

Transcribed Image Text:Record entry

Clear entry

b. Compute consolidated net income and income assigned to the controlling interest in the 20X8 consolidated income statement.

Consolidated net income

Income assigned to the controlling interest

view consolidation entries

Noncontrolling interest

c. Compute the balance assigned to the noncontrolling interest in the consolidated balance sheet as of December 31, 20X8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning