factor(s) from the tables provided.) Required: 1. Assume the note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal entry for Arctic to record the sale on January 1, 2021. 2. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on December 31, 2021. 3. Assume instead that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2022. Prepare the journal entry for Arctic to record the sale on January 1, 2021. 4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant, and that the note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal entry for Arctic to record the sale on January 1, 2021. (If no entry is required for a transaction/event, select "No inurnal entnu

factor(s) from the tables provided.) Required: 1. Assume the note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal entry for Arctic to record the sale on January 1, 2021. 2. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on December 31, 2021. 3. Assume instead that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2022. Prepare the journal entry for Arctic to record the sale on January 1, 2021. 4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant, and that the note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal entry for Arctic to record the sale on January 1, 2021. (If no entry is required for a transaction/event, select "No inurnal entnu

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 17E: Interest-Bearing and Non-Interest-Bearing Notes On December 11, 2019, Hooper Inc. made a credit sale...

Related questions

Question

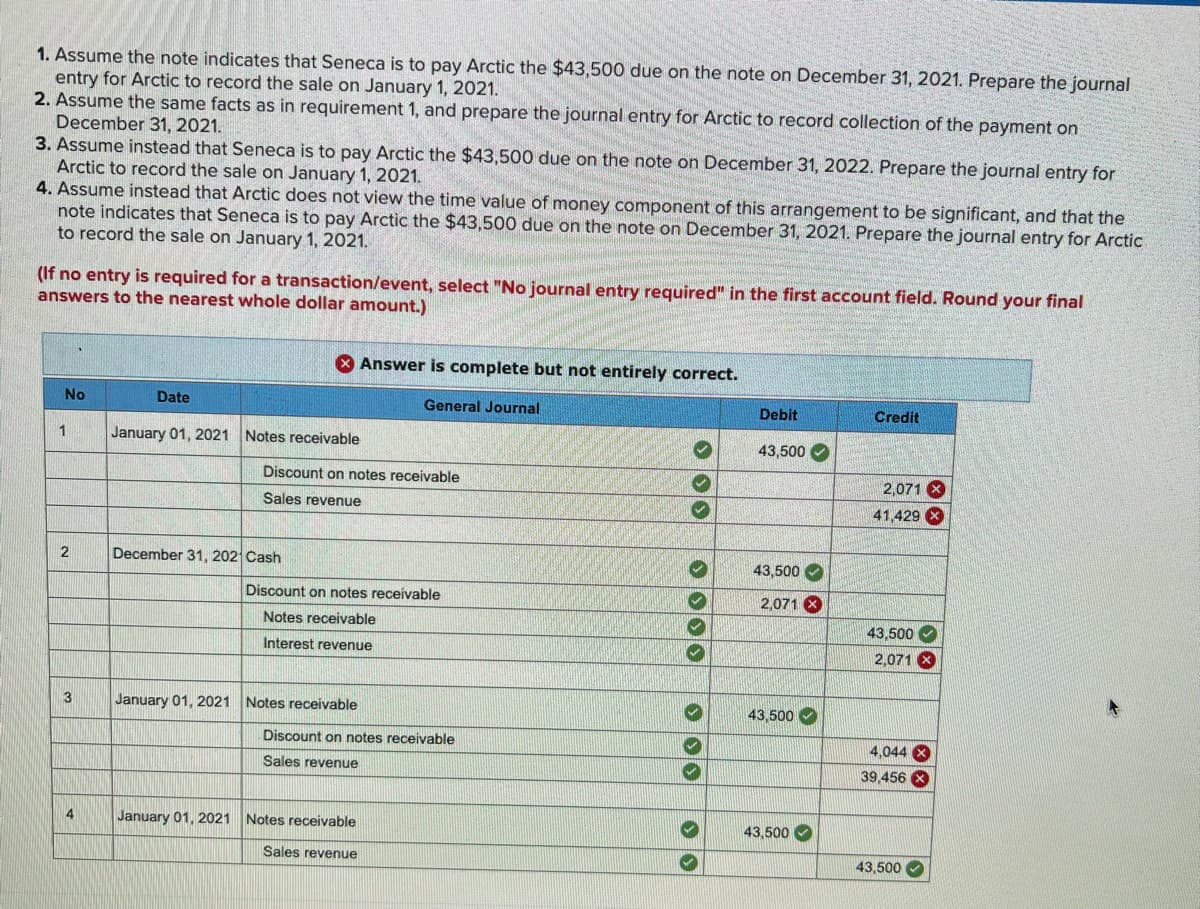

![Exercise 6-12 (Algo) Time value of money for accounts receivable [LO6-6]

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic

received a note from Seneca indicating that Seneca will pay Arctic $43,500 on a future date. Unless informed otherwise, assume that

Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. (FV of

$1, PV of $1, FVA of $1, PVA of $1, EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Assume the note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal

entry for Arctic to record the sale on January 1, 2021.

2. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on

December 31, 2021.

3. Assume instead that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2022. Prepare the journal entry for

Arctic to record the sale on January 1, 2021.

4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant, and that the

note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal entry for Arctic

to record the sale on January 1, 2021.

(If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final

answers to the nearest whole dollar amount.)

Answer is complete but not entirely correct.

No

Date

General Journal

Debit

Credit

1

January 01, 2021 Notes receivable

43,500

Discount on notes receivable

2,071 8

41,429 X

Sales revenue

December 31, 202 Cash

43,500

Discount on notes receivable

2,071

Notes receivable

43,500

Interest revenue

2,071 X

3

January 01, 2021 Notes receivable

43,500

000 0

O 00](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F3e1bfd6a-3cb6-4031-858f-4ba8da8545b1%2F593fd11c-074c-4530-a1d4-07f8d2ddc7a1%2Fusdc5km_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Exercise 6-12 (Algo) Time value of money for accounts receivable [LO6-6]

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2021, and Arctic

received a note from Seneca indicating that Seneca will pay Arctic $43,500 on a future date. Unless informed otherwise, assume that

Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. (FV of

$1, PV of $1, FVA of $1, PVA of $1, EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Assume the note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal

entry for Arctic to record the sale on January 1, 2021.

2. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on

December 31, 2021.

3. Assume instead that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2022. Prepare the journal entry for

Arctic to record the sale on January 1, 2021.

4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant, and that the

note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal entry for Arctic

to record the sale on January 1, 2021.

(If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final

answers to the nearest whole dollar amount.)

Answer is complete but not entirely correct.

No

Date

General Journal

Debit

Credit

1

January 01, 2021 Notes receivable

43,500

Discount on notes receivable

2,071 8

41,429 X

Sales revenue

December 31, 202 Cash

43,500

Discount on notes receivable

2,071

Notes receivable

43,500

Interest revenue

2,071 X

3

January 01, 2021 Notes receivable

43,500

000 0

O 00

Transcribed Image Text:1. Assume the note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal

entry for Arctic to record the sale on January 1, 2021.

2. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on

December 31, 2021.

3. Assume instead that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2022. Prepare the journal entry for

Arctic to record the sale on January 1, 2021.

4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant, and that the

note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2021. Prepare the journal entry for Arctic

to record the sale on January 1, 2021.

(If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final

answers to the nearest whole dollar amount.)

X Answer is complete but not entirely correct.

No

Date

General Journal

Debit

Credit

1

January 01, 2021 Notes receivable

43,500 O

Discount on notes receivable

2,071 X

Sales revenue

41,429 X

December 31, 202 Cash

43,500

Discount on notes receivable

2,071 X

Notes receivable

43,500

Interest revenue

2,071 X

3

January 01, 2021 Notes receivable

43,500 O

Discount on notes receivable

4,044 X

Sales revenue

39,456 X

4

January 01, 2021 Notes receivable

43,500 O

Sales revenue

43,500

O O0

O O0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning