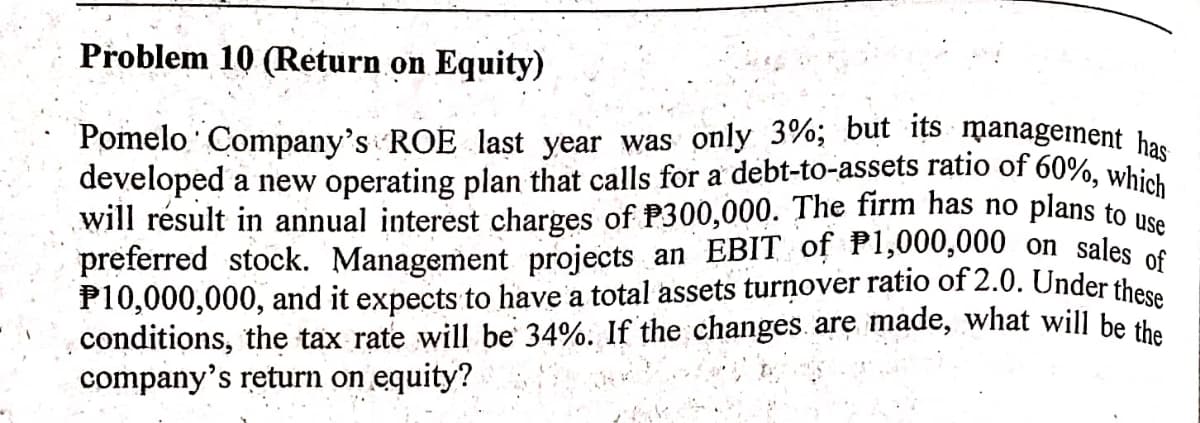

Pomelo Company's ROE last year was only 3%; but its management has developed a new operating plan that calls for a debt-to-assets ratio of 60%, which a plans to use will résult in annual interest charges of P300,000. The firm has no preferred stock. Management projects an EBIT of P1,000,000 on sales os P10,000,000, and it expects to have a total assets turņover ratio of 2.0. Under thee conditions, the tax rate will be 34%. If the changes. are made, what will be the company's return on equity?

Pomelo Company's ROE last year was only 3%; but its management has developed a new operating plan that calls for a debt-to-assets ratio of 60%, which a plans to use will résult in annual interest charges of P300,000. The firm has no preferred stock. Management projects an EBIT of P1,000,000 on sales os P10,000,000, and it expects to have a total assets turņover ratio of 2.0. Under thee conditions, the tax rate will be 34%. If the changes. are made, what will be the company's return on equity?

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 15P

Related questions

Question

Help me answer this ty

Transcribed Image Text:developed a new operating plan that calls for a debt-to-assets ratio of 60%, which

Pomelo Company's ROE last year was only 3%; but its management has

Problem 10 (Return on Equity)

plans to use

will résult in annual interest charges of P300,000. The firm has no

preferred stock. Management projects an EBIT of P1,000,000 on sales os

P10,000,000, and it expects to have a total assets turņover ratio of 2.0. Under these

conditions, the tax rate will be 34%. If the changes. are made, what will be the

company's return on equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning