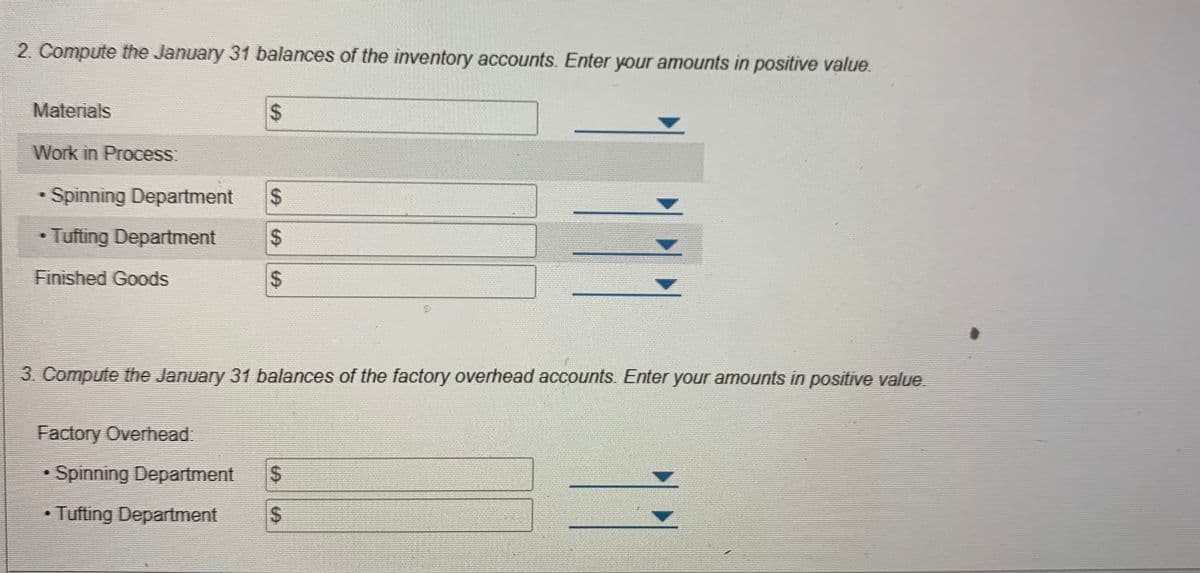

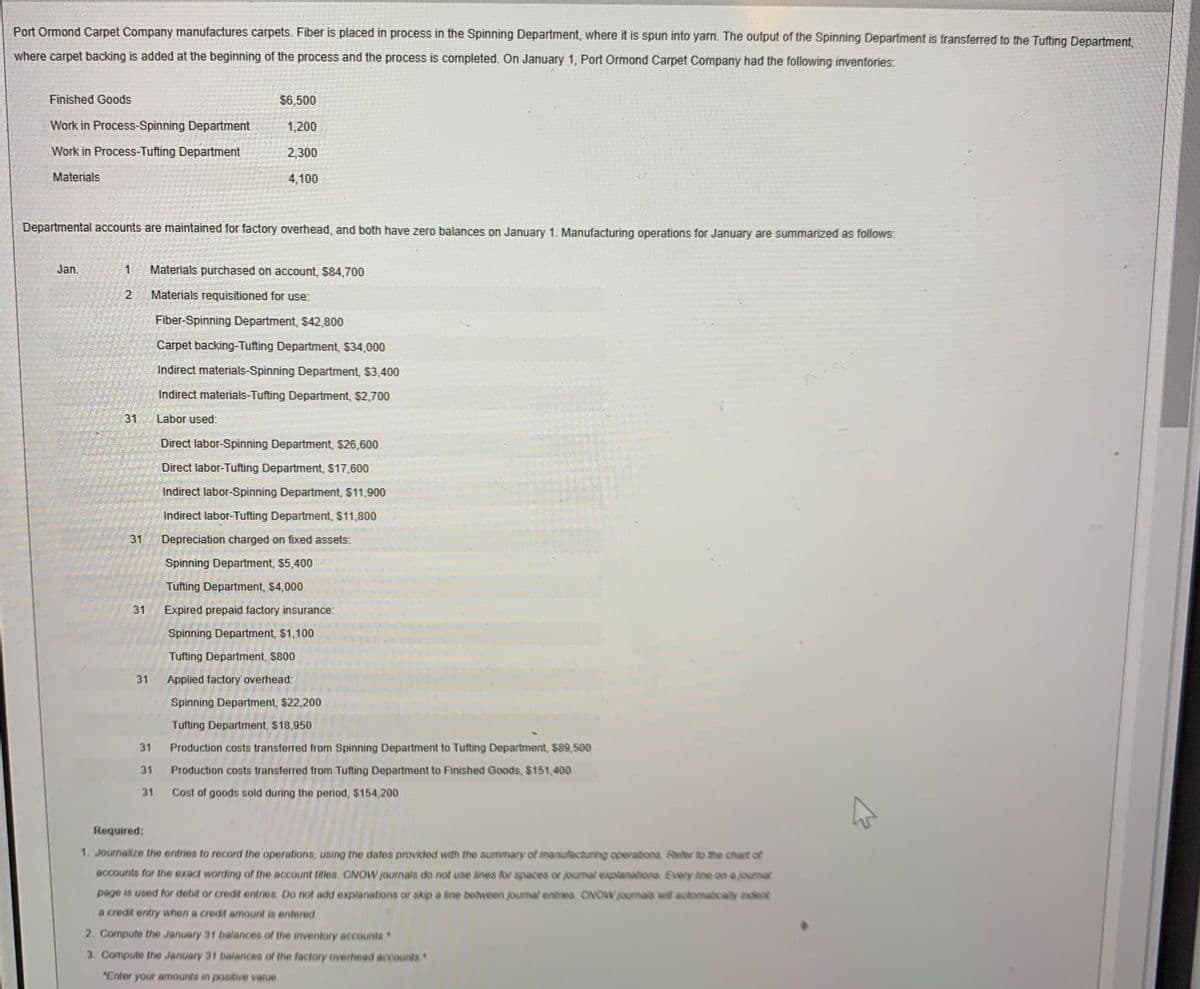

Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting Department. where carpet backing is added at the beginning of the process and the process is completed. On January 1, Port Ormond Carpet Company had the following inventories: Finished Goods $6,500 Work in Process-Spinning Department 1,200 Work in Process-Tufting Department 2,300 Materials 4,100 Departmental accounts are maintained for factory overhead, and both have zero balances on January 1. Manufacturing operations for January are summarized as follows: Jan. Materials purchased on account, $84,700 Materials requisitioned for use: Fiber-Spinning Department, $42,800 Carpet backing-Tufting Department, $34,000 Indirect materials-Spinning Department, $3,400 Indirect materials-Tufting Department, $2,700 31 Labor used: Direct labor-Spinning Department, $26,600 Direct labor-Tufting Department, $17,600 Indirect labor-Spinning Department, $11,900 Indirect labor-Tufting Department, $11,800 31 Depreciation charged on fixed assets. Spinning Department, $5,400 Tufting Department, $4,000 31 Expired prepaid factory insurance: Spinning Department, $1,100 Tufting Department, $800 31 Applied factory overhead: Spinning Department, $22,200 Tufting Department, $18,950 31 Production costs transferred from Spinning Department to Tufting Department, $89,500 31 Production costs transferred trom Tufting Department to Finished Goods, $151,400 31 Cost of goods sold during the period, $154,200 Required: 1. Journalize the entries to record the operations, using the dates provided with the summary of manufacturng operations Reer to he chart of accounts for the exact wording of the account titles CNOW journala do not use lines tv apaces or joumal explanationa Every ine on a jouma page is used for debit or credit entries Do not add explanations or akp a ne belween ournal ent CNOW oumals will automacaly ndent a credit entry when a credit amount is entered 2. Compute the January 31 balances of the inventory accounts 3. Compute the January 31 balances of the fadory overhead accounts "Enter your amounts in positive value

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images